ARTICLE AD BOX

NEW DELHI: Eight years after the launch of goods and services tax, the Centre has circulated the blueprint for GST 2.0, with two main slabs of 5% for common use items and 18% for other goods as it seeks to make life simpler and less taxing for citizens and businesses.

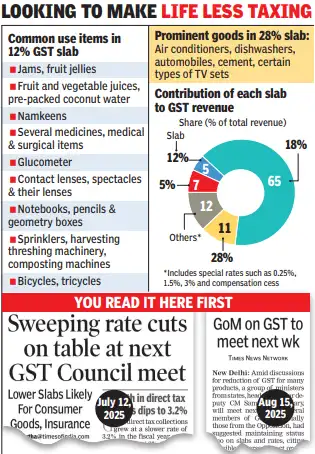

The comprehensive revamp plan - which will be discussed by a group of state finance ministers on Thursday - proposes to bring the curtains down on the 12% and 28% slabs, while ending compensation cess ahead of the March deadline, and tax sin goods at 40%.Food, medicines and medical devices, stationary and educational products and everyday essentials, such as hair oil and toothbrush, will be in the nil or 5% slabs, officials said.

Items used by the middle class, such as ACs, TV sets and refrigerators will move into the 18% slab, although there was no clarity on how govt intended to tax automobiles and cement, which currently attract a 28% levy.

GST 2.0

Besides, there will be a major cut in GST on health and term insurance, which has been on the table for several months. Apart from insurance, automobiles, health, handicrafts, farm goods, textiles, fertilisers and renewable energy have been flagged among sectors with special emphasis.

Reduction in slabs will end classification disputes over namkeens, parathas, buns and cakes and several other products due to varying rates on ingredients. Special rates of 0.25% on diamonds and precious stones and 3% on jewellery will be retained to promote specific industries, govt sources said while unveiling the plan."We have suggested a very simple, well reformed, next generation GST... Broadly, tax incidence will come down because rates on bulk of the items in 12% and 28% slabs will come down," a senior govt official said. The plan is to move 99% of the mass-use items in 12% slab to 5% bracket, with a small set moving to 18%. The proposed changes, which need to be endorsed by the GST Council, will end the patchwork that has been going on since 2017 , with every meeting of ministers resorting to small tweaks.

As a result, the weighted average tax rate, which had come down to 11.6%, will drop further.Officials explained, apart from the common man, special emphasis has been given to equipment used by farmers.

.png)

.png)

.png)

11 hours ago

6

11 hours ago

6

English (US) ·

English (US) ·