ARTICLE AD BOX

IPOs such as LG's, which is the third-largest this year in the Indian markets, have positioned India as one of the world’s most active IPO destinations. (AI image)

India’s IPO (Initial Public Offerings) market is booming, even though the secondary market has seen timid returns this year. Sample this: In a time span of just 6.5 hours, the LG Electronics India IPO of $1.3 billion was oversubscribed! LG Electronics India IPO saw the quickest oversubscription in over 17 years among major IPOs in the Indian market.Today, Lenskart Solutions Ltd IPO garnered strong response during its first day of subscription, primarily supported by institutional and individual investors. According to NSE figures, the IPO, valued at Rs 7,278-crore, attracted bids for 11,22,94,482 shares compared to the available 9,97,61,257 shares, achieving a subscription rate of 1.13 times.LG, the home appliances manufacturer, saw remarkable IPO success with subscriptions reaching $200 million per hour! The three-day subscription period saw domestic participants, including institutions and individual investors, accounting for 60% of total bids, apart from the anchor book allocation.

The company's shares rose by 48% upon market debut.

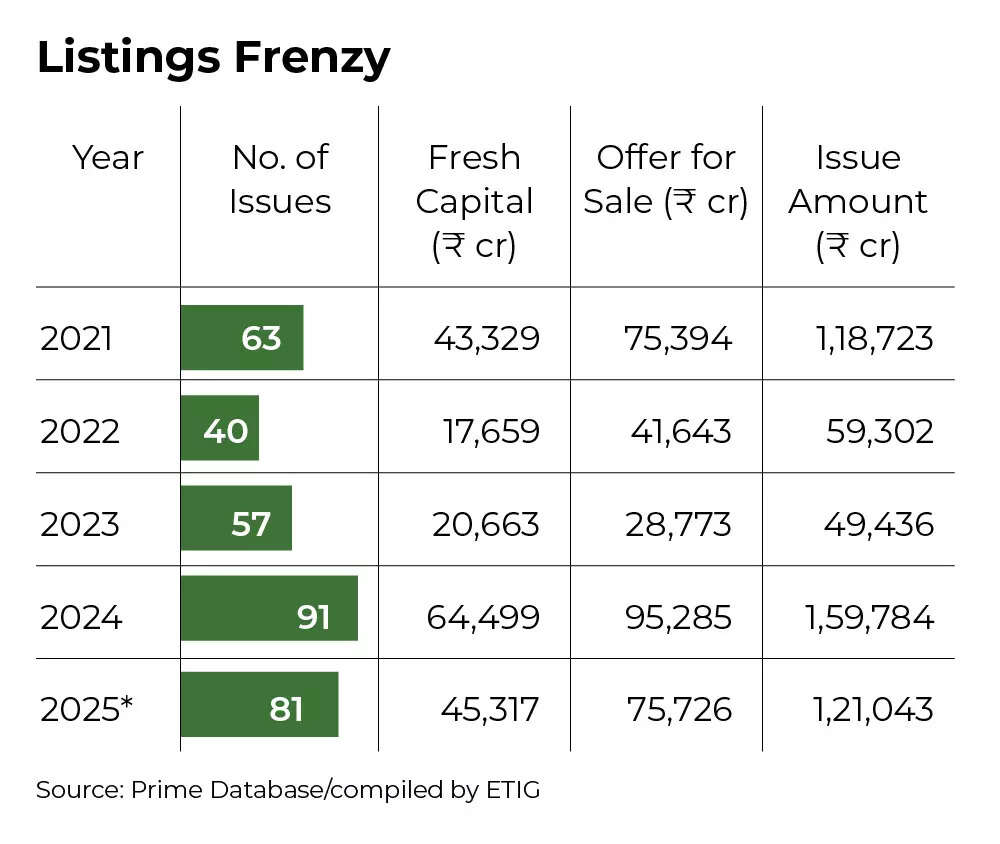

IPO Listing Frenzy

In the context of Indian IPOs with minimum fundraising of Rs 100 billion, LG's subscription rate was unmatched since January 2008, when Reliance Power Ltd. completed its record-breaking offering in under a minute.So, what’s driving the frenzy? The interesting fact is that domestic investors are betting big on the new offers.

India’s IPO frenzy: The fundamental shift

IPOs such as LG's, which is the third-largest this year in the Indian markets, have positioned India as one of the world’s most active IPO destinations, with total proceeds advancing towards last year's unprecedented $21 billion mark, according to a Bloomberg report.

A swiftly growing pool of capital from domestic mutual funds, insurance companies and countless retail investors now commands the IPO landscape - a fact that demonstrates beyond doubt the enhanced capability to accommodate huge share offerings. Importantly, this trend highlights the reducing dependence of India's equity capital markets on foreign inflows, indicating a fundamental transformation that experts believe will foster a self-sufficient IPO ecosystem.

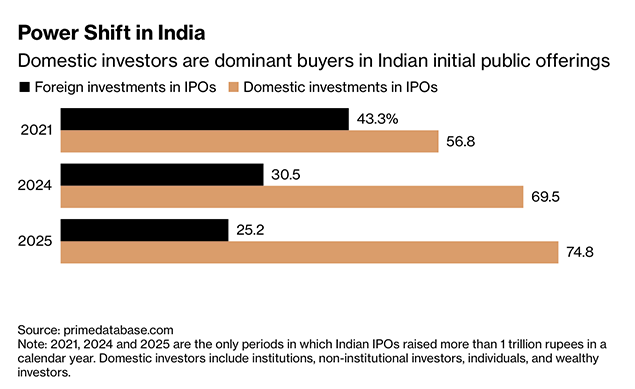

Power shift in India

While the market enthusiasm brings potential risks, particularly with some companies showing inflated valuations and small IPOs seeing subscription rates of over 100 times, there are concerns about possible market adjustments that could negatively impact retail investors, the Bloomberg report said.Data from Prime Database reveals that domestic investors have invested Rs 979 billion rupees in IPOs since 2024 beginning, compared to foreign funds' contribution of Rs 790 billion.

Domestic investment participation in IPOs has grown consistently, reaching approximately 75% for 2025, marking the highest proportion for any year where proceeds surpassed 1 trillion rupees ($11.3 billion)."The market is going through a sea change," Abhinav Bharti, head of India equity capital markets at JPMorgan Chase & Co told Bloomberg. "Households are deploying more and more of their savings into equities through mutual funds and that capital is getting channeled into capital markets."

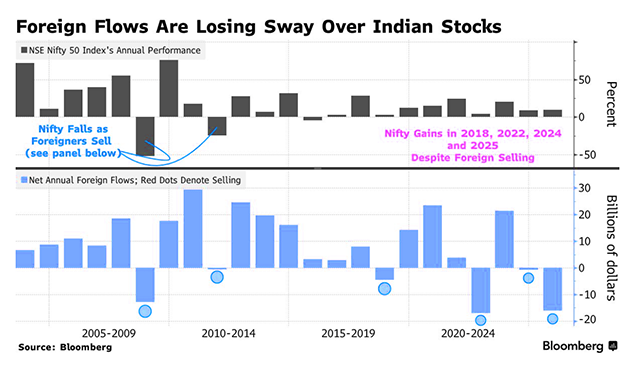

Foreign flows are losing sway over Indian stocks

Assuming no significant disruptions occur, this substantial pool of investment capital could provide sustained market support in the forthcoming years, he noted.India's IPO landscape is undergoing transformation, mirroring changes in its $5.3 trillion equity market during recent years, driven by substantial retail investment growth following the pandemic.Divya Agrawal, Research Analyst & Advisory (Fundamental), Wealth Management at Motilal Oswal Financial Services Ltd is of the view that this surge reflects deep local liquidity, with both retail and institutional investors anchoring demand. “Retail enthusiasm continues to drive oversubscriptions across recent offerings, supported by expanding demat penetration and seamless digital access. On the institutional side, domestic mutual funds and insurers have become dominant anchors, often leading QIB books even as foreign flows remain selective,” she told TOI.The accessibility of trading applications, simplified account creation processes, and widespread investment education content on social platforms have attracted many first-time market participants.Conservative investors are contributing billions through monthly systematic investment plans into domestic mutual funds, participating in a market where the benchmark index is heading towards its tenth consecutive yearly gain.Domestic institutional investors have increased their ownership in over 2,000 NSE-listed companies to 19.2% as of June, reaching a 25-year peak, according to exchange data. Meanwhile, foreign portfolio investors' holdings have declined to 17.3%, marking their lowest level in over ten years.Indian IPOs have proven particularly profitable for investors, delivering a weighted average return of 18% this year, surpassing the NSE Nifty 50 Index's 9.7% increase. The benchmark's growth is particularly significant given the foreign outflows of approximately $16 billion from the market, approaching the second-largest withdrawal on record. Domestic investors, primarily mutual funds and insurance companies, have compensated by investing more than $70 billion, according to the Bloomberg report.The strong participation from domestic investors has made the equity market an attractive platform for companies seeking to raise capital, particularly as they aim to exploit opportunities in India's rapidly expanding economy."Everyday there is a roadshow," said Vivek Toshniwal, chief executive officer of Mumbai-based family office Plutus Wealth Management LLP, which invests in IPOs. "A euphoria like this is unprecedented."Narendra Solanki, Head Fundamental Research - Investment Services, Anand Rathi Share and Stock Brokers Limited says that with two months still left for the year and looking at the pending lineup, 2025 may surpass the previous year in both number and amount raised in primary markets.“Enthusiasm in investors is currently very high as they look forward to investing in new companies and businesses for long term wealth generation,” he told TOI.Amongst the anticipated significant offerings expected within the next 24 months are Reliance Jio Infocomm Ltd., National Stock Exchange of India Ltd., and Flipkart India Pvt., backed by Walmart. Additional listings include PhonePe Ltd. (Walmart-supported), Hindustan Coca-Cola Beverages Pvt., SBI Funds Management Ltd., Manipal Hospitals Pvt. and Avaada Electro Pvt., supported by Brookfield.

India’s IPO market boom: The concerns

Pratik Loonker, who leads equity capital markets at Axis Capital Ltd.,

indicates that recent years have shown unprecedented activity throughout his professional experience of more than twenty years."It's a virtuous cycle" with mutual funds' participation, said Loonker. "They make alpha, which means they make reasonable returns for individual shareholders who are contributors to these mutual funds. And if that happens, more and more individuals come to the market to give money to these asset managers to manage, which means they have more capital to deploy again."

Alpha signifies returns that exceed market benchmarks.The current IPO landscape exhibits greater variety compared to the 2021 surge, which was primarily concentrated in technology-based startups. Previous offerings included companies like Eternal Ltd. (formerly Zomato), One 97 Communications Ltd. (Paytm's parent company), and FSN E-Commerce Ventures Pvt, the organisation behind Nykaa.Although these earlier offerings initially received enthusiastic responses, their share prices subsequently declined due to valuation concerns and worldwide interest rate increases.

Among these, only Eternal's shares have recovered to surpass their initial offering price.According to Loonker of Axis Capital, this situation presents an ongoing concern. He indicates that inappropriate valuation of IPOs could potentially affect the currently stable market conditions."If five or six large IPOs have poor listings, that can quickly spoil the party," he said.Vinod Nair, Head of Research at Geojit Investments Limited told TOI, “Domestic investors are actively investing in IPOs with the same enthusiasm witnessed in CY24, which recorded the highest number of public placements historically.

This trend persists despite the underperformance of the secondary market over the past 12-13 months. Additionally, the listing gains from CY25 IPOs have been significantly lower than those seen in CY24 and CY23, which averaged gains of 25-30%.

We attribute this poor performance to the lack of quality companies being offered and high valuation requirements. However, these factors have not dampened the spirits of domestic investors, who remain buoyant, bolstered by high liquidity and the historical gains made in the past 2-3 years."Despite the overall positive performance of Indian IPOs this year, Bloomberg data reveals that approximately half of the listings across primary and secondary boards have fallen below their issue price. The underperformers primarily consist of companies with fundraising below $100 million, although significant offerings like HDB Financial Services Ltd.'s $1.5 billion IPO have also declined.Recent data indicates diminishing quick returns from main board IPOs.

A Bloomberg analysis shows the median one-month post-listing return has decreased to 2.9% in the current year, compared to 22% in the previous year.

India’s IPO market sees ‘China-like’ boom

Following over 300 listings that have generated nearly $16 billion in 2025, India ranks as the fourth most active IPO destination globally, as Bloomberg data indicates. Within Asia, only Hong Kong and mainland China have surpassed India's proceeds.Saurabh Dinakar, who heads Morgan Stanley's Asia-Pacific global capital markets, anticipates 2026 will see record-breaking IPO proceeds.He compares India's current IPO surge to China's situation from 10-15 years ago, noting that India's present economic conditions, including an expanding middle class and increased internet accessibility, mirror the factors that facilitated the growth of Chinese tech companies into prominent public entities.Recent regulatory changes have created a supportive environment. The securities market regulator implemented modifications in September to streamline large private companies' public listing process, whilst the central bank recently eased restrictions on IPO-related lending.Rita Tahilramani, investment director at Aberdeen Investments in Singapore, notes that IPOs are introducing novel sectors such as fintech and renewables, alongside emerging industries currently unavailable in secondary markets.She observes that market expansion is occurring through these new company listings, supported by substantial available liquidity.According to Tracxn Technologies Ltd., India ranks third globally in unicorn companies, hosting over 90 private organisations valued above $1 billion, following the US and China.

6 hours ago

4

6 hours ago

4

English (US) ·

English (US) ·