ARTICLE AD BOX

This is an AI-generated image, used for representational purposes only.

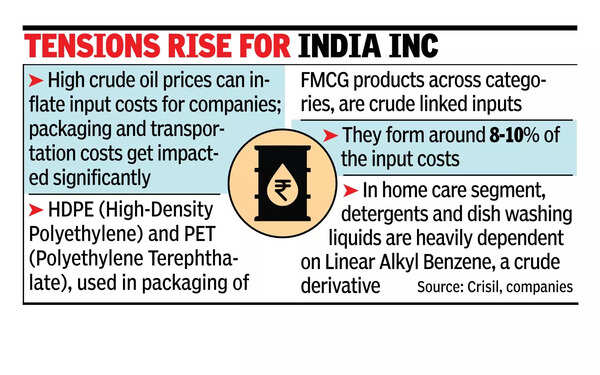

MUMBAI: From packaged goods makers to retailers and paint companies, firms are keeping a close tab on crude oil prices, which have been volatile since the start of the escalating conflict between Israel and Iran.Higher crude oil prices tend to inflate input costs for companies-crude-linked derivatives, for instance, are used in the packaging of FMCG products across categories such as food and beverages and personal care, while certain segments like detergents and dishwashing liquids are heavily dependent on Linear Alkyl Benzene (a crude derivative) as a key raw material. Beauty products like lotions, creams, and lip balms also use crude derivatives like petroleum jelly, said Anuj Sethi, senior director at Crisil Ratings.The development comes at a time when broader consumption had started seeing some green shoots after several sluggish quarters, helped by tax sops, easing food inflation, and rate cuts. Further escalation of the conflict in West Asia could impact demand recovery in the near term. For companies, the challenge will be on two fronts- protecting margins if input costs spike and getting consumers to spend more; high oil prices typically impact overall household spending, nudging consumers to cut budgets on their discretionary purchases.

"Crude plays a major role in two cost centres- freight and packaging. This can impact the bottom line of companies. We are monitoring the situation and hope things do not escalate," Mayank Shah, vice-president at Parle Products, told TOI, not ruling out risk to demand recovery in the short term. Geopolitical tensions in West Asia could pose short-term headwinds by driving up crude oil prices. "This may drive up prices of the overall purchase basket and pinch consumers," said Krishna Khatwani, head of sales (India) at Godrej Consumer Products.

Oil prices settled 7% higher on Friday, rising more than 13% during the session to their highest levels since Jan. On Monday, prices edged down after opening higher as the attacks so far didn't hit critical export infrastructure, international media reported. But oil markets remain tense, and the future trajectory is uncertain. "Israel-Iran tensions and Brent Crude climbing into the high $70s per barrel pose cost pressures. If sustained, these may translate into pricing adjustments for some businesses and temper consumer sentiment," said Tarun Arora, CEO at Zydus Wellness.

.png)

.png)

.png)

5 hours ago

7

5 hours ago

7

English (US) ·

English (US) ·