ARTICLE AD BOX

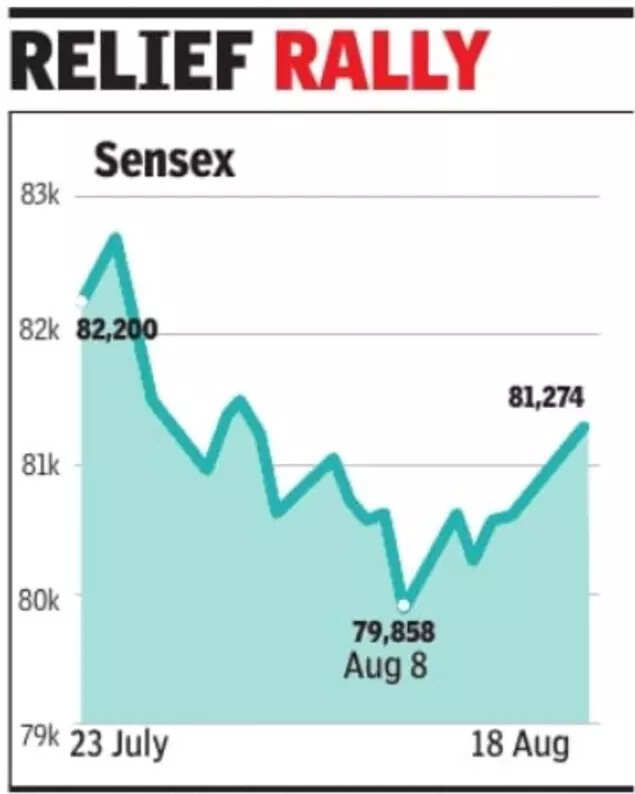

MUMBAI: Equity markets surged, the rupee recovered sharply against the dollar, but bonds erased most of Friday's gains on fears of higher govt borrowing. The shift came as investors weighed the Centre's proposed overhaul of the goods and services tax alongside a sovereign rating upgrade from S&P.The sensex closed 676 points, or 0.8%, higher at 81,274, while the Nifty gained 1% to end at 24,877 - the biggest single-day percentage gain since June 26, 2025. Intra-day, both indices rose even more sharply, buoyed by strong buying in autos and consumer durables. The rally lifted the BSE smallcap and midcap indices by about 1.4% and 1%, respectively.

Autos led the advance. The BSE auto index jumped 4.3%, with Maruti rising nearly 9%.

Bajaj Finance rose over 5% and UltraTech Cement 3.7%. Consumer durables, discretionary and metals also gained, while IT, power and technology stocks lagged. Of the BSE's listed companies, 2,560 advanced against 1,629 decliners."The positive sentiment was driven by GST reform proposals, easing concerns over crude oil prices, and a sovereign rating upgrade, which together lifted investor confidence," said Ajit Mishra, SVP, research, Religare Broking.

The rupee settled at 87.35 to the dollar, up 20 paise from 87.55 in the previous session, rising in tandem with local shares. In contrast, the 10-year bond yield rose to 6.49%, erasing Friday's rally, as dealers anticipated higher borrowing needs following lower tax collections.Govt revenues are expected to fall short this year as the Centre's proposed GST overhaul would replace the existing four-tier structure with just two main slabs - 5% and 18% - along with a 40% rate on a handful of goods. Globally, markets were mixed. Japan and China ended higher, with Chinese stocks hitting their strongest level since 2015. Taiwan reached a record high. South Korea and Hong Kong retreated, while European indices traded lower and Wall Street had closed mostly down on Friday. MSCI's emerging-market index climbed to its highest since late 2021, up 19% so far this year, helped by the rally in India.However, US trade tariffs on Russian oil imports continue to be an overhang. Dealers said signals were mixed and Tuesday's market opening would depend on developments on the Russia-Ukraine front.

.png)

.png)

.png)

1 hour ago

3

1 hour ago

3

English (US) ·

English (US) ·