ARTICLE AD BOX

India has increased its oil refining capacity by only 5% over the past seven years, falling far short of the 69% growth that had been targeted for 2025. Factors such as uncertainty around future demand due to climate considerations, limited land availability, and disruptions from the COVID-19 pandemic have significantly slowed expansion efforts.

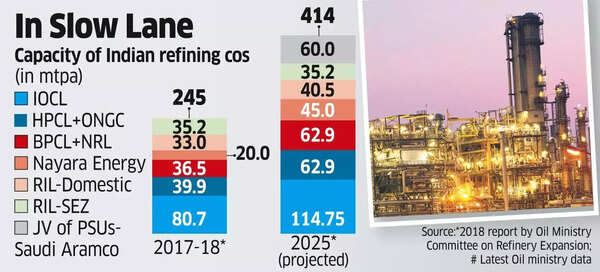

This shortfall has further heightened India’s reliance on imported energy.A 2018 report by an oil ministry panel, which included government officials and industry leaders, had projected that refining capacity would grow from 245 million tonnes per annum (mtpa) in 2017-18 to 414 mtpa by 2025 and 439 mtpa by 2030, based on what were then considered "firm plans" by refiners, according to ET. However, the current capacity stands at just 258 mtpa, according to the figures put out by the oil ministry.

Key projects that have fallen behind include the proposed 60 mtpa India-Saudi greenfield joint venture, Nayara Energy’s 25 mtpa expansion backed by Rosneft, Reliance Industries’ planned 7.5 mtpa addition, and Indian Oil’s 34 mtpa capacity goal.The combined refining capacity of BPCL and NRL has increased by just 2 million tonnes per annum (mtpa), falling significantly short of the planned 26.4 mtpa expansion by 2025.

Meanwhile, the HPCL-ONGC group registered the largest capacity addition among all players, with an 11 mtpa increase - but still below its target of 23 mtpa. Several projects led by Indian Oil and HPCL are currently under construction and are expected to be completed in the coming years.Major refiners, including Indian Oil, HPCL, BPCL, Reliance Industries, and Nayara Energy, haven't commented on the delays or revised timelines.The sluggish pace of expansion, combined with rising domestic fuel demand, has led to a 43% increase in India’s petroleum product imports over the past seven years (up to 2024 - 25), while export volumes have slipped by 3% during the same period.

B Ashok, former chairman of Indian Oil, says the uncertainty over the impact of energy transition policies, both in India and globally, has “made decision-makers more circumspect”.

He acknowledged that refineries are “high capex and high gestation projects” but stressed that India urgently needs fast-executed greenfield refinery projects to support its rapidly growing economy. According to him, such projects must integrate new technologies to address environmental concerns and be supported by new risk-sharing models, reported ET.B Anand, former CEO of Nayara Energy and of the TCG Group’s petrochemical business, also agrees that the shadow of transition looms over refinery growth.

“Globally, the refining growth story is diminishing. Access to new-age capital for hydrocarbons due to net zero concerns has reduced,” he said.Ashok added that climate-focused initiatives are creating competing demands for capital within energy companies. “With emphasis on transition and climate impact mitigation efforts, the capital requirements within the organisations are varied and stretched. These are also impacting the view of future refining projects,” said Ashok, who also headed the India-Saudi joint venture refinery project, which ultimately stalled due to land acquisition issues.Anand believes India should shift its focus toward petrochemicals, given the anticipated rise in demand driven by rapid urbanisation and the growth of e-commerce. “For India, building new refineries with so much crude import dependence is not a good idea. We should instead focus on investing in petrochemicals, which has a promising future,” he added.

.png)

.png)

.png)

5 hours ago

5

5 hours ago

5

English (US) ·

English (US) ·