Hailing the Goods and Services Tax (GST) rate rationalisation announced last week as a landmark step towards a simpler and more inclusive tax regime, the Federation of Telangana Chambers of Commerce and Industry (FTCCI) has underscored the significance of bringing petrol and diesel under the ambit of GST.

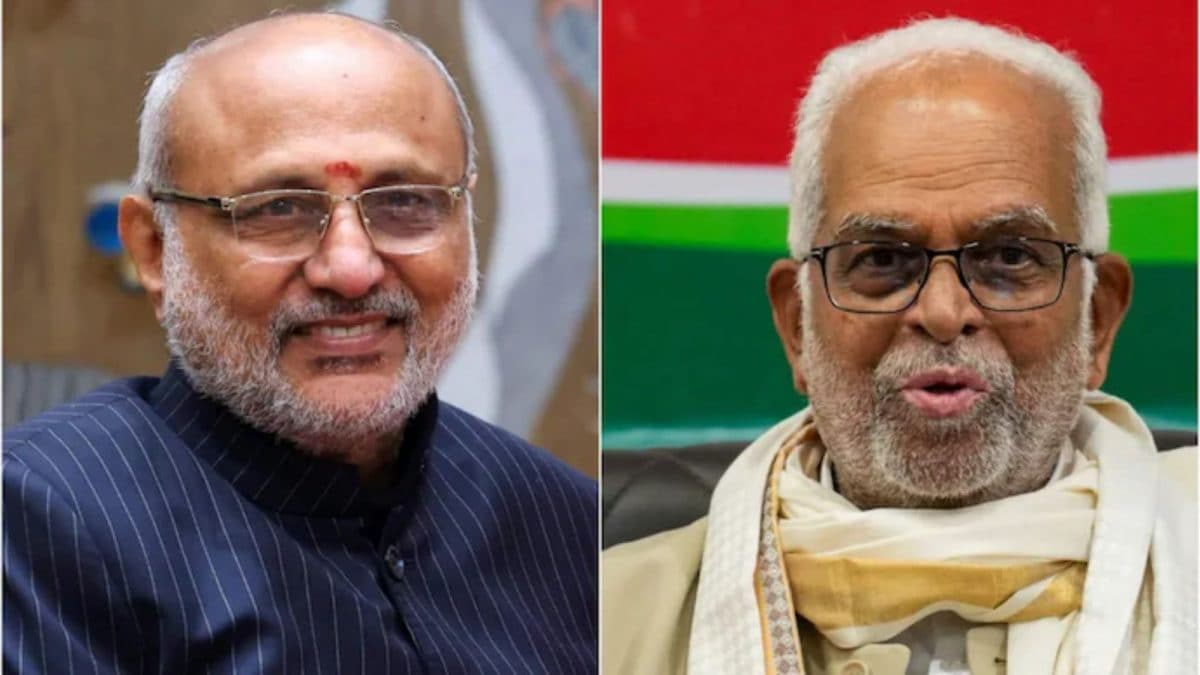

Seeking a clear timeline for inclusion of petrol, diesel, aviation turbine fuel (ATF) and natural gas under the GST framework, FTCCI leaders led by its president R.Ravi Kumar said this remains a long-standing demand of the industry as a measure to eliminate cascading taxes. At present, the products are levied VAT/sales tax by State governments and the rates vary.

Other aspects that the 108-year old trade and industry body leaders sought to highlight, while welcoming the recent GST announcements, include introduction of an optional higher GST rates on which input tax credit (ITC) can be availed for B2B transactions, especially in hospitality. Such a move will help maintain seamless credit chain and prevent input tax leakage.

Review and rationalisation of the compensation cess on coal, in light of the sharp hike in GST to 18%, to avoid excessive tax burden on energy-intensive and core manufacturing sectors and timely issue of clarifications and circulars on the classification of goods and services under the revised GST rate slabs (5%, 18% and the new 40% slab) to reduce litigation and for ensure uniform implementation across States were other aspects FTCCI has sought.

Keeping petroleum outside GST is still a stumbling block, Chair of FTCCI’s GST and Customs Committee Mohd Irshad Ahmed said, while Mr.Ravi Kumar said the continued exclusion leads to cascading tax and hampers competitiveness, particularly of energy-intensive industries and logistics sector firms.

On the move to reduce GST on hotel accommodation (up to ₹7,500/day) to 5% without ITC, senior vice-president KK Maheshwari said this was a concern and FTCCI recommended dual-rate options that allow businesses to claim input tax credit, preserving the seamless credit flow that GST was designed to enable.

Vice-president Srinivas Garimella said the sharp GST hike on coal is worrisome. The increase from 5% to 18% poses serious challenges for sectors like steel, cement, and aluminium, increasing energy costs and risking inflationary pressures. FTCCI urged the Centre to rationalise the existing compensation cess on coal to offset the impact.

In a release, FTCCI said the leaders made these observations while welcoming the benefits and relief on account of the measures announced, including moving cement from 28% slab to 18% and correction of the inverted duty structure on man-made textiles, reduction in GST on critical fertiliser, steps aimed at enhancing ease of doing business, including provision of 90% provisional refunds for exports as well as reducing GST on a number of daily use products.

Set to spur growth

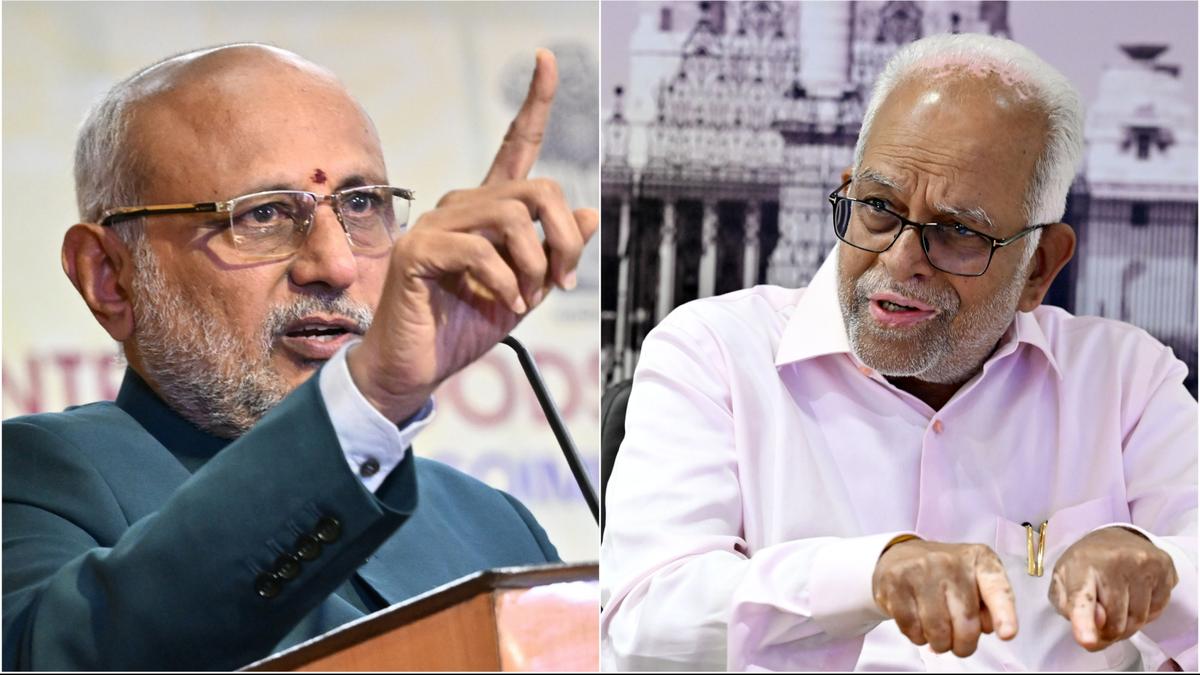

CII Telangana chairman R.S. Reddy and vice-chairman M.Goutham Reddy said the rollout of GST 2.0 reforms is a landmark move that is bound to benefit micro, small and medium enterprises (MSMEs), food and agriculture sector among many others. The changes are expected to spur economic growth. The MSME sector, which forms the backbone of the economy, is set to gain immensely from the simplified compliance structure. Faster refund cycles and seamless input tax credit mechanisms will help the enterprises maintain healthy cash flows. The reforms are expected to increase formalisation, reduce compliance costs and empower small businesses to scale operations across State borders without facing bureaucratic hurdles.

By enhancing compliance without increasing tax burden, GST 2.0 is expected to ensure that honest taxpayers, especially the salaried middle class, are not penalised due to system inefficiencies, they said in a statement.

.png)

.png)

.png)

6 hours ago

5

6 hours ago

5

English (US) ·

English (US) ·