ARTICLE AD BOX

NEW DELHI: Govt and the Insolvency & Bankruptcy Board of India have discussed a proposal for a sharp increase in the number of benches of the National Company Law Tribunal from 63 to 80-85.

They are also considering adding 150-200 "special benches" for four to five years to deal with the backlog in insolvency cases.The law provides for deciding cases within 180 days, which can be extended by another 90 days. In contrast, more than three-fourths of the cases are now taking longer than 270 days, with another 9% taking between 180 and 270 days. At the end of March, only 13% of the 1,194 cases were decided within six months, according to IBBI data.

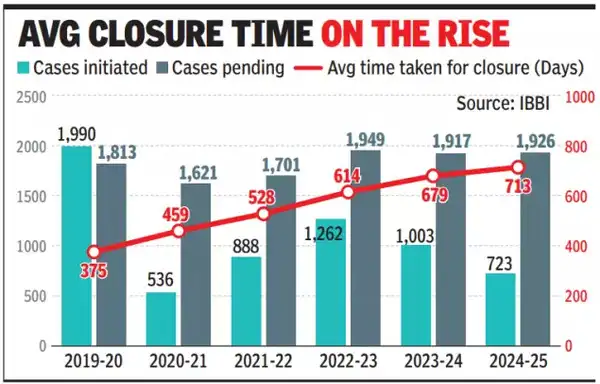

The data also showed that the average time taken has been on an upward trajectory for the last few years.

The last financial year saw 259 cases decided, following 263 approvals in the previous year. At this rate, it will take around seven years to clear the pending over 1,900 cases. Last year also saw 723 cases being admitted, which means the number of pending cases will only increase."We saw that a large part of the year had all the members in NCLT to decide on cases, and approvals are now stabilising around 260-270 annually.

But we need to speed up decisions so that the asset quality is preserved for resolution and creditors can also realise more value," a source told TOI. One of the reasons for fewer cases coming under the IBC fold last year was healthier bank balance sheets.The proposed "special benches" can see members only for a specified period of around five years, and once the case backlog is reduced, the window can be closed, added sources. In any case, the appointment of NCLT members, who also deal with other Companies Act cases, is for a fixed tenure, and the proposal will involve govt adding several more members.Finding such a large number of members in one go can, however, be a challenge, as will be creating infrastructure.

.png)

.png)

.png)

2 hours ago

5

2 hours ago

5

English (US) ·

English (US) ·