ARTICLE AD BOX

NEW DELHI: Fearing challenges to working capital and potential losses, car dealers are knocking multiple doors for adjustment of the Rs 2,500 crore GST cess paid by them to govt and have written to finance minister Nirmala Sitharaman, auto companies and banks to help them tide over the issue.

The dealers - who are saddled with an inventory of around six lakh vehicles which was loaded up in anticipation of the festive rush - say with no avenue to adjust the cess which was removed after the GST Council meeting on Sept 3, they have no option but to seek relief, or else risk running into heavy losses and disruption in working capital."While GST 2.0 subsumes the earlier compensation cess regime for automobiles, dealers today hold significant, validly-availed compensation cess balances in their electronic credit ledgers.

Once no further cess liability arises, these balances cannot be utilised against CGST/SGST/IGST under the current law. Without a transitional pathway, credits risk lapsing, creating an unintended, permanent loss and a sharp working-capital shock for compliant MSME dealerships," CS Vigneshwar, president of Federation of Automobile Dealers Associations (FADA), said in a representation to the finance minister.

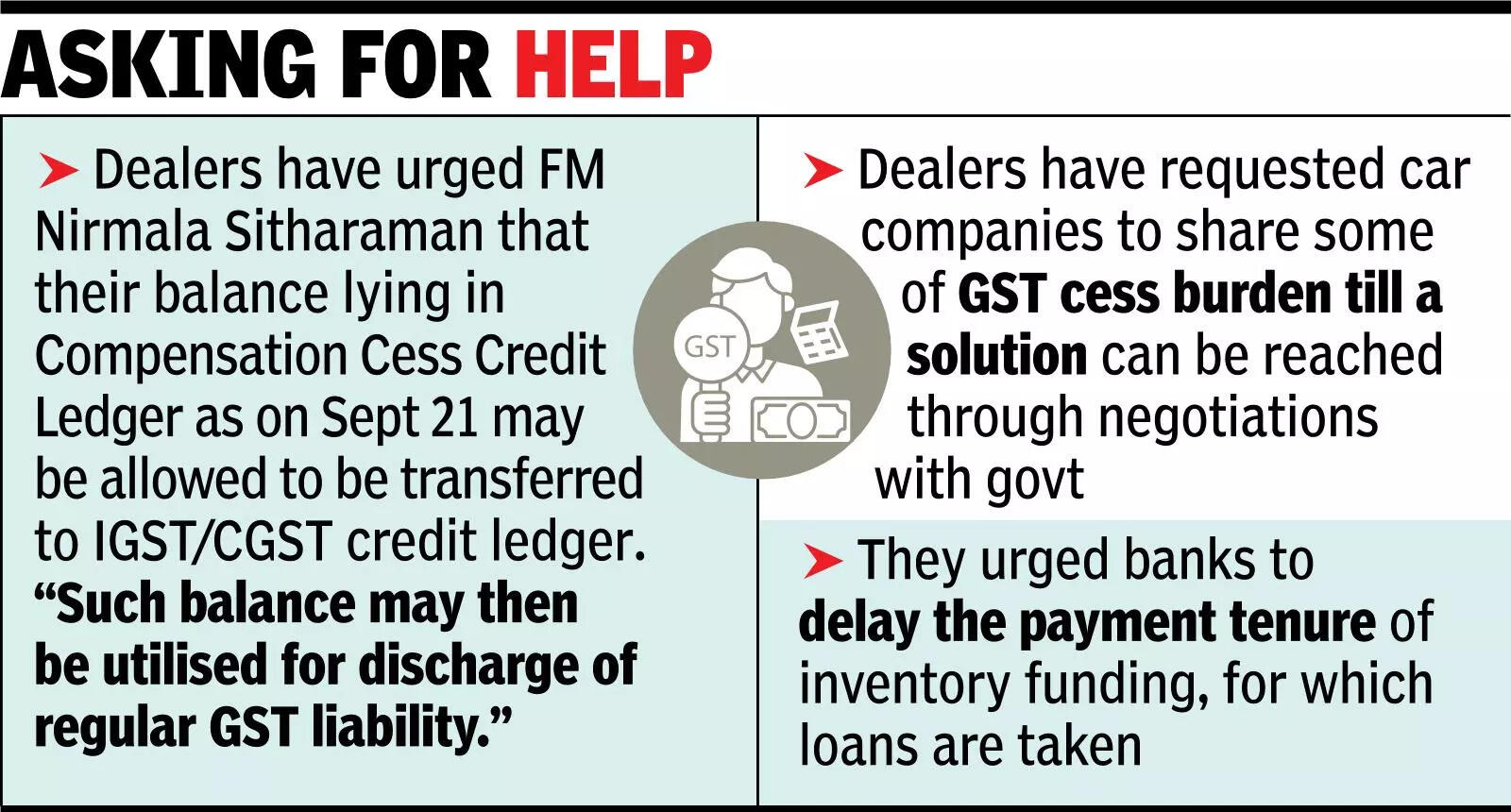

The dealers have petitioned Sitharaman that their balance lying in Compensation Cess Credit Ledger as on Sept 21 may be allowed to be transferred to IGST/ CGST credit ledger. "Such balance may then be utilised for discharge of regular GST liability," they said in their representation, which was also sent to revenue secretary Arvind Shrivastava and CBIC chairman Sanjay Kumar Agarwal.The dealers' body has also requested car companies to help them tide over the challenge.

"We have also asked automakers for help, which includes seeking credit in liquidating the stock faster by provision of consumer discounts. Also, we have requested them to share some of our GST cess burden till a solution can be arrived at through negotiations with the govt."Companies such as Mahindra & Mahindra and Skoda have already announced immediate discounts to clear the dealer inventory, instead of waiting till Sept 22 for the lower GST rates to come into play. Other companies such as Hyundai, Toyota, BMW, Classic Legends, Tata Motors, and Mercedes-Benz have also announced cuts in retail prices, but from the day when the new rates are effective. FADA has also requested banks to delay the payment tenure of the inventory funding, for which dealers take loan.

.png)

.png)

.png)

3 hours ago

5

3 hours ago

5

English (US) ·

English (US) ·