ARTICLE AD BOX

NEW DELHI: The GST Council, headed by Union finance minister Nirmala Sitharaman, on Wednesday agreed to the biggest ever revamp of the eight-year-old indirect tax regime by rolling out a two-rate structure of 5% and 18%, along with a 40% slab for a handful of sin goods and services.The new rates, barring the incidence on tobacco products, will come into effect from Sept 22, the first day of Navratri, which also usually marks the onset of the heavy buying season.

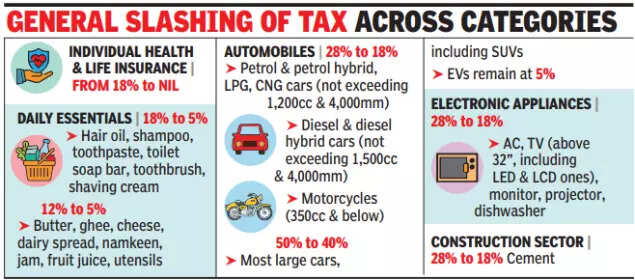

The sweeping changes, which were catalysed by the Centre, have brought the curtains down on the 12% and 28% rates, and are aimed at simplification of the tax system and ending classification disputes. In other words, no more 'roti versus paratha' skirmishes.

Now, all Indian breads will face zero GST, while all life health insurance plans purchased by individuals will be exempt from the levy.Several critical medicines are also being moved into the nil rate segment.Besides, the compensation cess is being done away with along with the implementation of the new tax rates. Existing rates on tobacco products will continue until loans and interests are repaid.Cars will get cheaper as small cars will attract 18% tax, instead of 29% (28% tax and 1% cess), while the larger ones, including SUVs, will face 40% GST instead of 50% (28% tax and 22% cess).

Electric vehicles will remain at 5%."The reforms have been carried out with a focus on the common man. Every tax levied on common man's daily use items have undergone a rigorous look, and in most cases, the rates have come down drastically. Labour intensive industries have been given good support," Sitharaman said after a marathon 12-hour meeting, which saw a few states being cajoled into signing off on the reforms.Most commonly used food items, such as paneer, ghee and namkeen, will now be in the 5% or nil brackets while several everyday consumer items, such as hair oil, shampoos and toothbrushes will move into the 5% bracket. Similarly, all white goods - from refrigerators to ACs, dishwashers and TVs sets - have been put into the 18% slab, from 28%, along with cement.Sitharaman complimented all states for helping thrash out a package largely put together by the Centre, and said states and the Centre sit together in the GST Council.Many common food items now in 5% or nil brackets Sitharaman said, "Every tax levied on common man's daily use items have undergone a rigorous look, and in most cases, the rates have come down drastically. Labour intensive industries have been given good support."Most commonly used food items, such as paneer, ghee and namkeen, will now be in the 5% or nil brackets while several everyday consumer items, such as hair oil, shampoos and toothbrushes will move into the 5% bracket.

Similarly, all white goods - from refrigerators to ACs, dishwashers and TVs sets - have been put into the 18% slab, from 28%, along with cement. Sitharaman complimented all states for helping thrash out a package largely put together by the Centre, and said states and the Centre sit together in the GST Council.While some opposition-led states had raised the issue of a hit to their revenue, the finance minister said the rate rationalisation will result in higher consumption and greater buoyancy.

"Nobody is a donor and nobody is a donee," she said, emphasising that reforms were motivated by the concern for the consumer and "we were all into it".Asked about revenue impact, revenue secretary Arvind Shrivastava said that based on the 2023-24 consumption base, the overall net fiscal implication was estimated at Rs 48,000 crore. He, however, added that the entire economy would benefit from the decisions of the council and the exercise is expected to generate buoyancy and will impact consumer behaviour.

Besides, Shrivastava said, the decisions are expected to result in higher compliance and rate changes also have a bearing on the cash refunds and input tax credit.

A key element of the GST Council's decision was on ending inverted duty structure in sectors such as textiles and fertilisers, Sitharaman said.She also dismissed suggestions that the exercise was the result of the US's decision to impose stiff tariffs on Indian exports, pointing out that the process had started a year-and-a-half ago. "For almost eight to nine months PM Narendra Modi has been asking for relief for the public," she said. In his Independence Day speech, the PM had announced the changes, aimed at lowering prices and ushering in ease of living for small businesses and taxpayers.

.png)

.png)

.png)

1 day ago

7

1 day ago

7

English (US) ·

English (US) ·