ARTICLE AD BOX

Discover unclaimed money in your family's name through the RBI's UDGAM portal. Simply use basic details like name and date of birth to search across numerous banks. If a match surfaces, reclaim your funds by visiting the bank with necessary documents. This initiative helps reunite individuals with forgotten deposits, ensuring rightful owners can access their money.

'The Times of India' brings you 'Hack of the Day' — a new weekday-series of quick, practical solutions to everyday hassles. Each hack is designed to save you time, money or stress, using tools and features within your reach — from government websites to everyday apps. In simple words it is: Simple fixes for smarter living.

You can find unclaimed money in your family using RBI’s UDGAM portal by searching old bank accounts with basic details like name and date of birth. If a match is found, you can claim the funds by visiting the bank with valid documents.

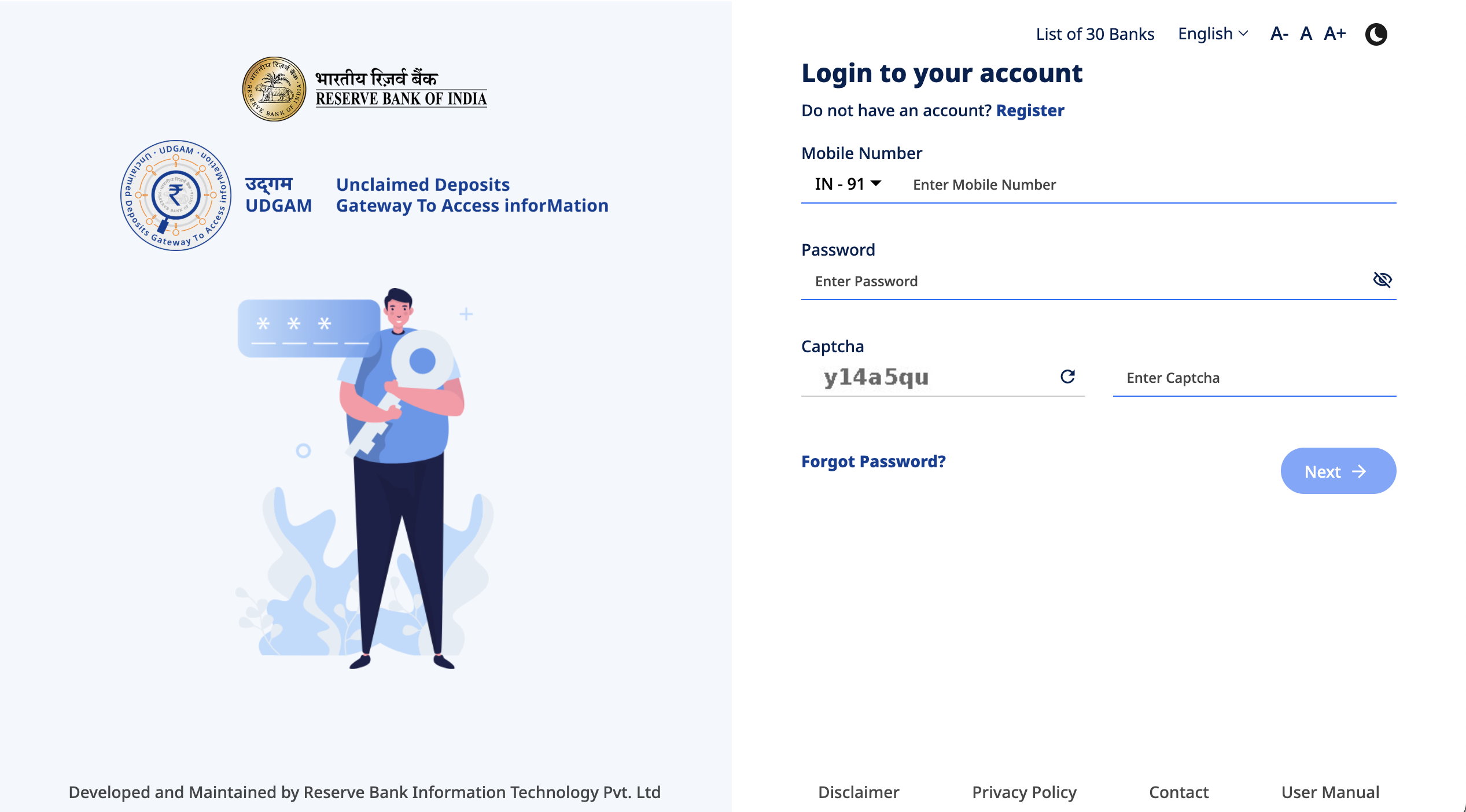

The UDGAM portal (Unclaimed Deposits – Gateway to Access Information) is an initiative by the Reserve Bank of India to help individuals locate and reclaim unclaimed deposits across multiple banks. These deposits often come from inactive or dormant accounts, fixed deposits, or savings accounts that haven’t been operated for over 10 years.Banks transfer such funds to the Depositor Education and Awareness (DEA) Fund, but the money still belongs to the original account holder or their legal heirs and can be claimed anytimeAlso Read: Hack of the day: UPI Autopay: Automate recurring monthly payments

How to search for unclaimed money

To check if your family has unclaimed deposits:

- Visit the UDGAM portal: https://udgam.rbi.org.in/unclaimed-deposits

- Enter basic details:

- Name of the account holder

- Date of birth

- PAN (optional but helpful)

- Select banks to search: You can choose from over 30 major Indian banks.

- Review results: If a match is found, the portal will show the bank and branch details.

How to claim the money

If you find an unclaimed deposit:

- Visit the respective bank branch listed in the search result.

- Carry valid KYC documents (such as Aadhaar, PAN, voter ID).

- If claiming on behalf of a deceased family member, bring legal heir documents like a death certificate, succession certificate, or will.

The bank will verify your claim and initiate the process to release the funds

1 hour ago

6

1 hour ago

6

English (US) ·

English (US) ·