ARTICLE AD BOX

Bhavye Khetan, an Indian-origin UC Berkeley graduate, sparked online debate after claiming he faked a founder persona—using buzzwords like “Stanford,” “Palantir,” and “AI”—to attract 27 responses from 34 venture capitalists. (Image: X/@bhavye_khetan)

An

Indian-origin graduate

from the prestigious University of California, Berkeley recently conducted an experiment which initiated a debate across the startup world. As part of the experiment the Indian-origin student named Bhavye Khetan posed as a fake startup founder and sent some cold emails to 34

venture capitalists

. In his proposal he used some buzzwords like "

Stanford

," "

AI

," and "ex-Palantir”. To his surprise 27 investors responded to his proposal and out of them four also asked for a call. Khetan shared his experience on a post on X (formerly known as Twitter) and called the

startup funding

as a ‘rigged game’.

Read Indian-origin Berkeley graduate Bhavye Khetan’s viral post here

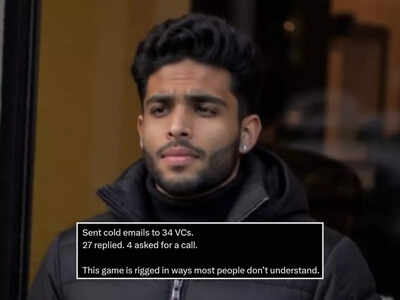

Khetan shared the details of his experiment on X, highlighting how superficial markers of credibility—such as prestigious university affiliations and trendy tech terms—can generate investor interest, even without a product, pitch, or business plan.“I made a fake founder persona. No product. No pitch. No deck.Just:

- Stanford CS- Ex-Palantir- Used the word “AI” 3 timesSent cold emails to 34 VCs.27 replied. 4 asked for a call.This game is rigged in ways most people don’t understand,” wrote Khetan in the viral post.

Khetan's findings suggest that VCs may be heavily influenced by signals of perceived credibility and alignment with current investment trends, sometimes even over the substantive details of a business idea. The inclusion of "AI" taps into the current technological zeitgeist, while "Stanford" and "ex-Palantir" (referring to the data analytics company co-founded by Peter Thiel, a prominent VC) signal an elite educational background and experience at a high-profile, data-driven firm.His post, which has garnered over 1.2 million views, critiques the venture capital ecosystem, suggesting that flashy credentials often outweigh substance in early-stage funding decisions.

.png)

.png)

.png)

1 day ago

2

1 day ago

2

English (US) ·

English (US) ·