ARTICLE AD BOX

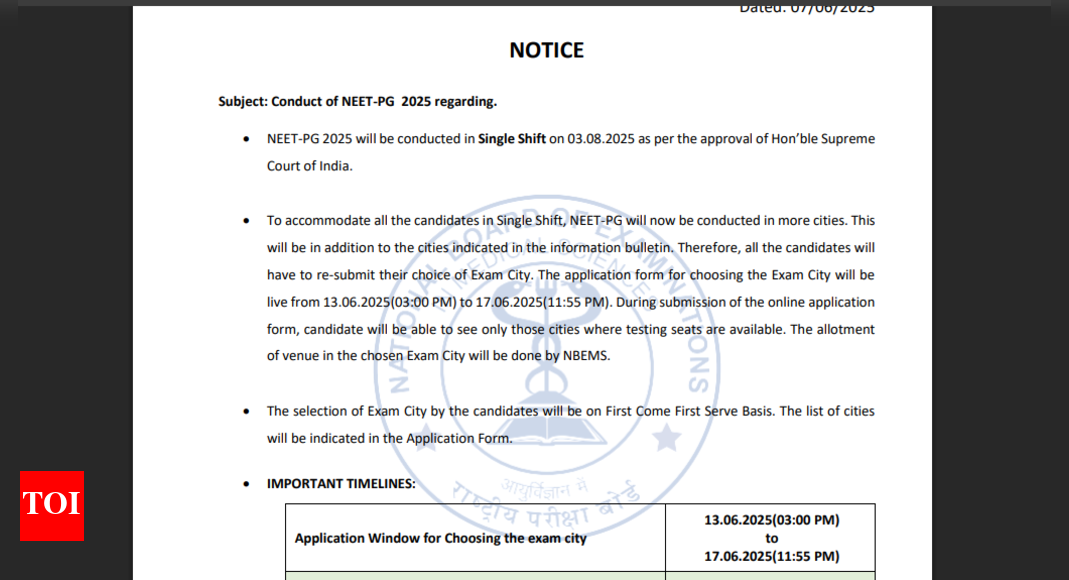

NEW DELHI: After the recent acquisitions of Yoga Bar and 24 Mantra Organic, ITC Foods is sharpening its focus on strategic takeovers to accelerate growth, gain rapid entry into high-potential categories, and align with consumer preferences for health, indulgence, convenience, and premium offerings.

This move aligns with the 'ITC Next' strategy, which prioritises value-accretive acquisitions as a core expansion driver, Hemant Malik, executive director, ITC, told TOI.

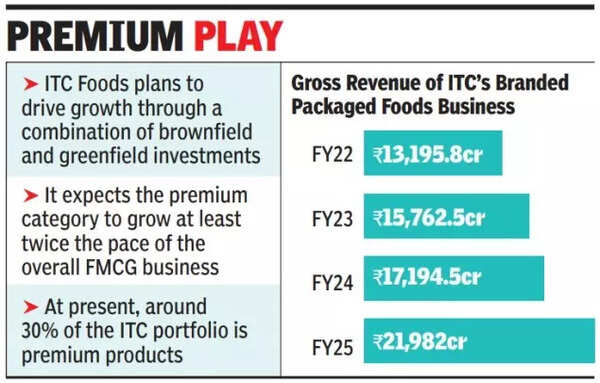

The company plans to drive growth through a combination of brownfield and greenfield investments, navigating challenges of subdued urban consumption amid weak household incomes and spiralling inflation.During the year, there was severe inflationary pressure in edible oil, wheat, maida, cocoa, and packaging inputs, which, the company said, was partially mitigated through cost management initiatives, calibrated pricing actions, and a strategic push towards premiumisation.Malik expects the premium category to grow at least twice the pace of the overall FMCG business. "We are creating offerings for the health-seeking new India, growing per capita India, Gen Z, as well as consumers seeking richer and new experiences. Many of them would have premium pricing. It's all about providing the right value to the consumers... Premium is not limited only to metros; there are premium customers across the country," he said.

At present, around 30% of the ITC portfolio is premium products. The strategy seems to be paying off. ITC's revenue from packaged foods increased nearly 28% to Rs 21,982 crore in FY24-25."Health is the fastest growing segment for us, growing at 400 times that of the remaining foods business. We're also keeping a close watch on emerging consumer needs - whether it's health, nutrition, convenience, or indulgence. These trends shape how we evolve our portfolio and explore new categories. We are creating a lot of new products based on evolving consumer needs, for every life stage or cohort," Malik said.The food category still has significant headroom for growth - especially since a large part of it remains unbranded, according to Malik.

.png)

.png)

.png)

4 hours ago

6

4 hours ago

6

English (US) ·

English (US) ·