ARTICLE AD BOX

Mumbai: Billionaire Sajjan Jindal plans to take JSW Paints public through a reverse merger with the listed Akzo Nobel India after completing the acquisition of the Dulux paints manufacturer. The Jindal family will retain a controlling stake in the combined entity, which will also include private equity investors and public shareholders.

The private equity funds' involvement stems from their role in financing the Rs 13,336-crore Akzo Nobel India acquisition. Once listed, Jindal will have six publicly traded companies with a collective market capitalisation of Rs 4.5 lakh crore. Jindal also intends to take JSW Cement public (Shiva Cement, its subsidiary, is already listed on the stock exchanges).

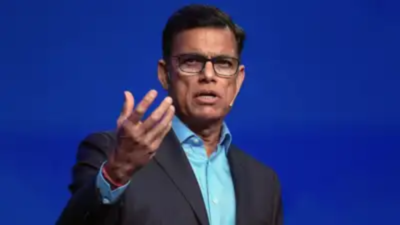

"It (Akzo Nobel India) is a structured transaction where, at the time of the reverse merger, and based on the performance of the merged entity, their (private equity investors') capital would get converted to a stake in the merged entity," Parth Jindal, JSW Paints MD, and son of Sajjan Jindal, told TOI. Apart from private equity funding, the acquisition will be financed by internal accruals of JSW Paints and contributions from the promoters, each in the proportion of one-third. Akzo will propel JSW, which entered the industry in 2019, to the fourth position in the decorative paints sector after Kansai Nerolac, Berger Paints, and Asian Paints. "Akzo Nobel India allows us to scale our business and come close to our ambition of being in the top three players in the Indian paint industry," said Parth, adding that "At JSW Group, we have always said that in whichever industry we enter, we would like to remain in the top three.

We have achieved that in our steel business, energy business, and infrastructure business. Now it's the time for the paint business to achieve that.

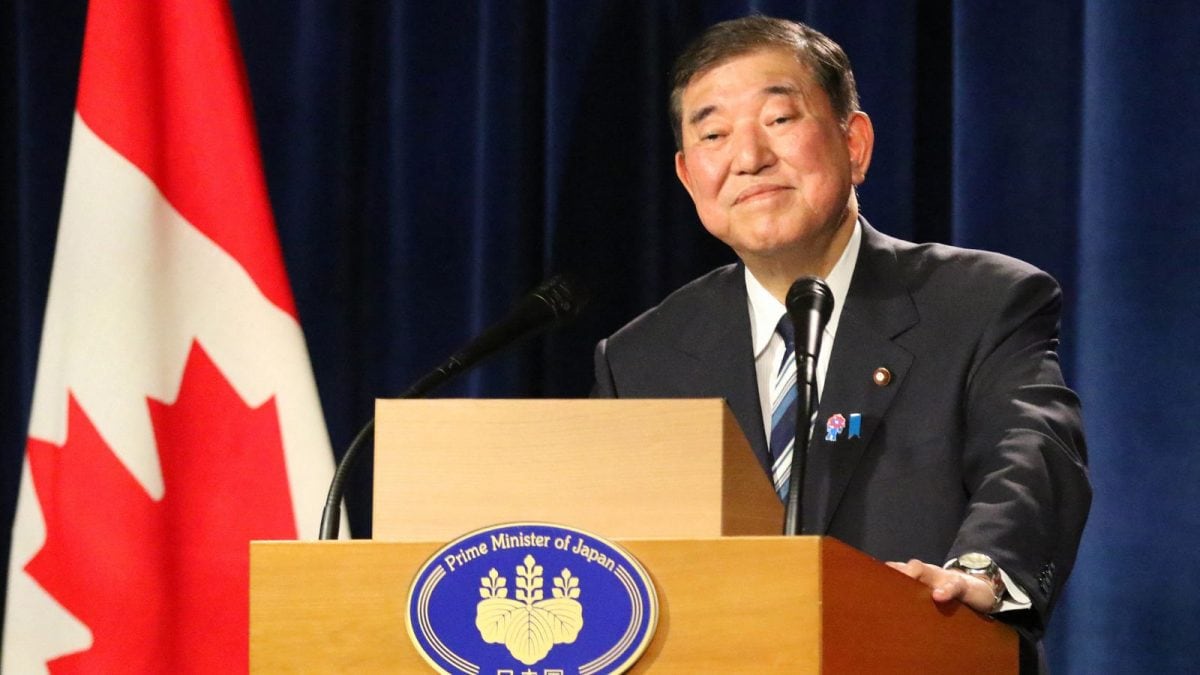

" JSW Paints will pay a 4.5% royalty on the sales of liquid coatings business to Akzo Nobel Netherlands, Parth said. While JSW through Akzo Nobel India has intellectual property rights for decorative paints (sold under Dulux brand), it has entered into a technological alliance with Akzo Nobel Netherlands for liquid coatings (sold under International and Sikkens brands). On the reasons to sell the India business, Akzo Nobel CEO Greg Poux-Guillaume said the Dutch MNC holds strong product quality and brand recognition, but lacked local firepower and distribution depth to fully capitalise on the market potential in the country. "As a multinational, we were at times distracted. We weren't capitalising enough on the value of the brands or the quality of our products. What we missed was the ability to take that promise and transform it into business and market share," he said.

The divestment reduces Akzo Nobel's play in India to powder coatings business, R&D centre, and global business services centre in Pune.

.png)

.png)

.png)

11 hours ago

3

11 hours ago

3

English (US) ·

English (US) ·