ARTICLE AD BOX

That reflects expectations Indian refiners will take more Middle Eastern and medium-density grades as they pivot away from Russia’s Urals.

12 Aug 2025, 06:17 PM IST i 12 Aug 2025, 06:17 PM IST 12 Aug 2025, 06:17 PM IST

That reflects expectations Indian refiners will take more Middle Eastern.

(image source: Bloomberg)

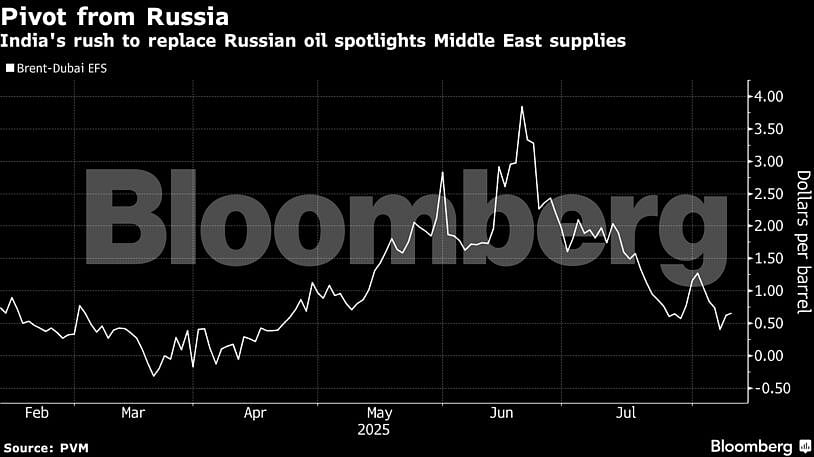

A closely-monitored oil market metric that tracks the strength of Middle Eastern crude versus global benchmark Brent underlines the fallout from President Donald Trump’s push against India’s buying of Russian flows.

The differential — known as Brent-Dubai EFS, or exchange of futures for swaps — shows the European grade has a premium of just 60 cents a barrel, down from $3.90 in late-June, data from PVM Oil Associates show. That reflects expectations Indian refiners will take more Middle Eastern and medium-density grades as they pivot away from Russia’s Urals, traders said.

Washington’s threat of punishing tariffs follows a tougher stance from the EU against India, a push that also contributed to a narrower EFS.

(image source: Bloomberg)

The oil market is focused on shifting flows after the US ramped up pressure against India over imports of Russian energy to try to force an end to the Ukraine war. Washington’s threat of punishing tariffs follows a tougher stance from the EU against India, a push that also contributed to a narrower EFS.

The latest shift has opened up a so-called arbitrage window for crudes from the Atlantic Basin, which are typically priced against Brent and US’ West Texas Intermediate, to flow into Asia, said the traders, who asked not to be identified.

In recent weeks, Indian state refiners have pulled back from Russian crude, affecting October-loading Urals flows, and turned to the spot market for cargoes from Abu Dhabi, Libya, Nigeria, and even the US. At the same time, there have been signs Moscow has been offering more Urals to China, another major buyer.

.png)

.png)

.png)

14 hours ago

5

14 hours ago

5

English (US) ·

English (US) ·