ARTICLE AD BOX

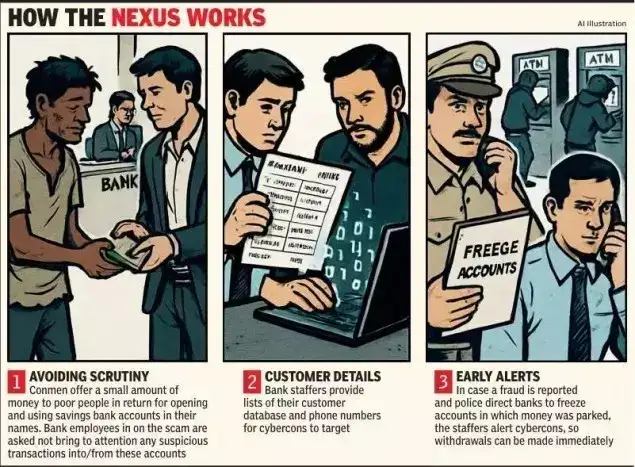

GURGAON: The arrests of 42 bank employees in cybercrime cases over the past year have helped the city cops map out the multiple ways in which fraudsters find their targets and manage to evade scrutiny.Police said bank staffers involved in the scam often leaked data of their customers, alerted fraudsters if cops came looking, and let suspicious transactions go through without flagging it to their colleagues or the authorities. The frauds were orchestrated at a wide level — the arrested bankers were anything from clerks to assistant managers. They were from both govt and private banks. In a recent case on Aug 23, the city police busted a bogus call centre, where they arrested six persons.

The team — led by ACP Priyanshu Dewan — seized mobile phones of the accused. One of the devices contained screenshots with details of credit card holders from a prominent private bank in the country. The screenshots also had customers' names, credit card numbers and contact numbers."The accused had information about 1,000 credit account holders. They only targeted credit card holders, and not the debit card holders, in this case.

However, we are yet to ascertain the cause for this," an officer said. The accused told interrogators that their "handlers" shared lists of bank customers for the fraudsters to target. "They were even given a script for calling a target," ACP Dewan told TOI."It is shocking how financial institutes are helping cyber fraudsters by sharing private details of their customers. Customers have a lot of trust in these banks that their money would be safe and their privacy would be maintained.

These criminals need data to commit fraud, which — unfortunately — is easily available to them because of few staffers," he added.Another senior police officer said it was ironic that customers who approach banks to report a fraud and freeze any transactions are often redirected to the cybercrime helpline or to police.In another case of a retired IAS officer losing Rs 53 lakh after being "digitally arrested" for two days last month, three suspects were arrested from Vadodara in Gujarat.One of the accused was a bank staffer — Sangram Singh (33) — who allegedly assured cyber fraudsters of help in withdrawing money from a mule account without any complications."Sangram allegedly told another accused that he was aware of a nexus operating from Dubai and that he knew how to tackle such cases," an officer said.In return for helping the fraudsters, he allegedly took a share of Rs 7 lakh, which he said was to pay back a loan.A third police officer said that in some cases, they found that bank officials did not freeze accounts immediately despite being told to. Cops suspect the employees alerted fraudsters to withdraw the money before the accounts were blocked."After noticing such a trend, we emphasised and asked banks to deploy a team of two persons who will be responsible for freezing the suspected accounts within two minutes of being informed by police.

This has increased the freezing of accounts by 26% in Gurgaon," the officer said.Last Thursday, ACP Dewan agreed that bank staffers working in cahoots with cyber fraudsters was "a major threat". "We will soon interrogate bank officers in this regard, and issue notices," he said.The city's cyber police cell has registered around 16,000 complaints in the first half of this year.The ACP said they arrested 1,300 suspects in connection with these cases, up from around 700 in the same period last year. "Increased public awareness has helped reduce total financial fraud losses from Rs 155 crore in 2024 to Rs 80 crore in the current year," he said.

.png)

.png)

.png)

1 day ago

2

1 day ago

2

English (US) ·

English (US) ·