ARTICLE AD BOX

US President Donald Trump’s latest tariff threat did not emerge from a trade dispute or a factory town. It arrived via Greenland.Driving the newsTrump on Saturday escalated his push to acquire Greenland, vowing to slap a new wave of tariffs on European allies until the United States is allowed to buy the Danish autonomous territory.In a post on Truth Social, Trump said an additional 10% import tariff would take effect on February 1 on goods from Denmark, Norway, Sweden, France, Germany, the Netherlands, Finland and Great Britain - with the rate set to rise to 25% on June 1 and remain in place “until such time as a Deal is reached for the Complete and Total purchase of Greenland,” adding that he was “immediately open to negotiation with Denmark and/or any of these Countries.

”Trump accused the targeted nations of “playing this very dangerous game,” warning that “These Countries… have put a level of risk in play that is not tenable or sustainable,” and argued “it is imperative that… strong measures be taken so that this potentially perilous situation end quickly, and without question.”Trump’s threat to impose steep new tariffs on eight European allies over Greenland has reignited a broader debate in Washington and global markets: whether tariffs-now Trump’s primary economic and diplomatic weapon-are doing more harm than good for the United States.

Trump said on Truth Social that a new 10% tariff on goods from Denmark, Norway, Sweden, France, Germany, the Netherlands, Finland and Great Britain would begin February 1, rising to 25% by June 1 unless the US is allowed to purchase Greenland.European leaders rejected the demand outright, warning that tariffs over a sovereignty dispute threaten Nato unity and transatlantic trade. But the Greenland episode is increasingly seen as a symptom of a larger issue: a tariff strategy that is weighing on US jobs, keeping inflation high, straining alliances and failing to slow China’s export machine.

Why it matters

Tariffs now touch nearly every major US trading relationship. Trump has imposed levies of 10–50% on most imports, layered new duties on allies and rivals alike, and tied trade penalties to issues ranging from Iran to Greenland.The result is a US economy that is still growing but more slowly than it would have otherwise alongside mounting evidence that tariffs are undercutting the very goals they were meant to achieve: stronger manufacturing, lower deficits and economic leverage over China.

Foreign Policy’s Keith Johnson writes that tariffs have acted “as an anchor, not an engine” for the US economy. Oxford Economics estimates they cut real GDP by 1.1% in 2025 and will drag another 1.4% off growth in 2026.

The big picture

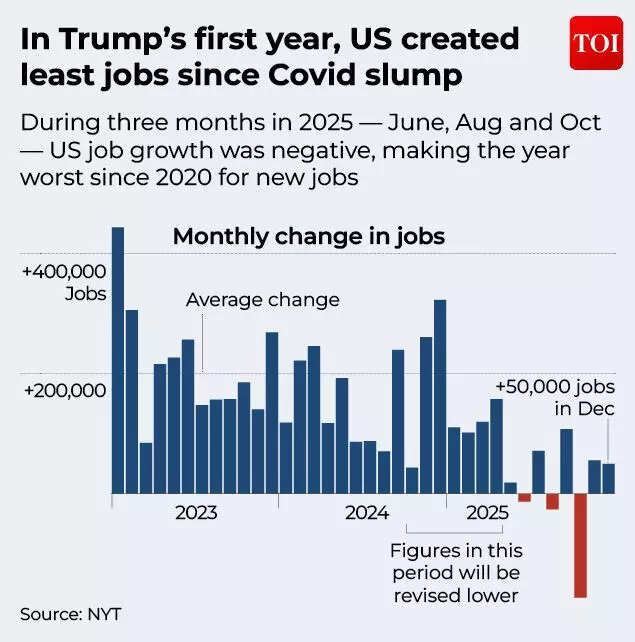

Trump argues tariffs raise revenue, protect jobs, and force rivals to bend. But five trends suggest the opposite is happening.1) Tariffs are coinciding with weaker US job growth - not a revivalThe US labor market is losing momentum, particularly in sectors most exposed to trade.In 2025, job creation was the weakest since the Covid slump, with multiple months of negative employment growth. Manufacturing jobs, which Trump has repeatedly vowed to restore, have begun declining again in his first year back in office, after modest gains during the Biden administration.

Foreign Policy reports that real private fixed investment in manufacturing facilities, which had been rising for four years, declined steadily throughout 2025.

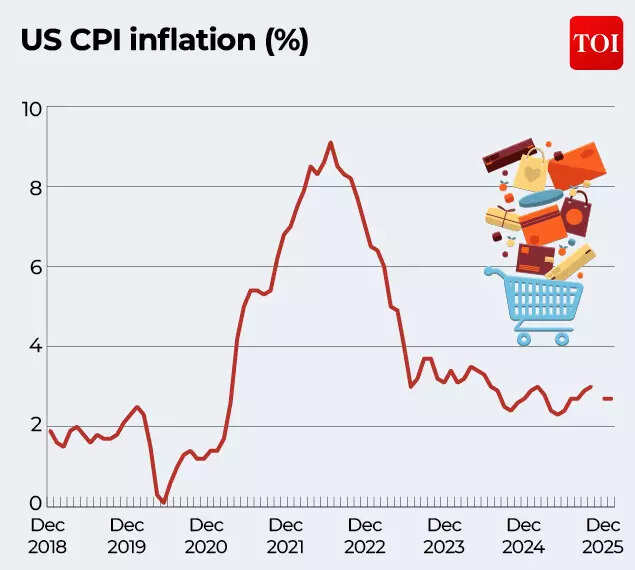

Economic activity in the manufacturing sector contracted for the 10th straight month in December, with companies citing higher input costs from tariffs and weaker demand.Construction, another employment anchor, is also faltering. Tariffs on steel, copper and lumber have pushed costs higher, contributing to the first sustained decline in construction spending since the early months of the pandemic.The irony: Tariffs meant to protect US jobs are increasingly squeezing the sectors that employ them.2) Inflation remains stubborn, and tariffs are part of the reasonTrump has repeatedly argued tariffs don’t cause inflation. But price data suggests otherwise.US CPI inflation has hovered close to 3% for more than a year, refusing to cool meaningfully. Producer prices rose 2.7% through September, driven by higher food and energy costs, both indirectly affected by trade wars, according to Foreign Policy.

Tariffs raise the cost of imported inputs for US businesses, from machinery and steel to food and energy components.

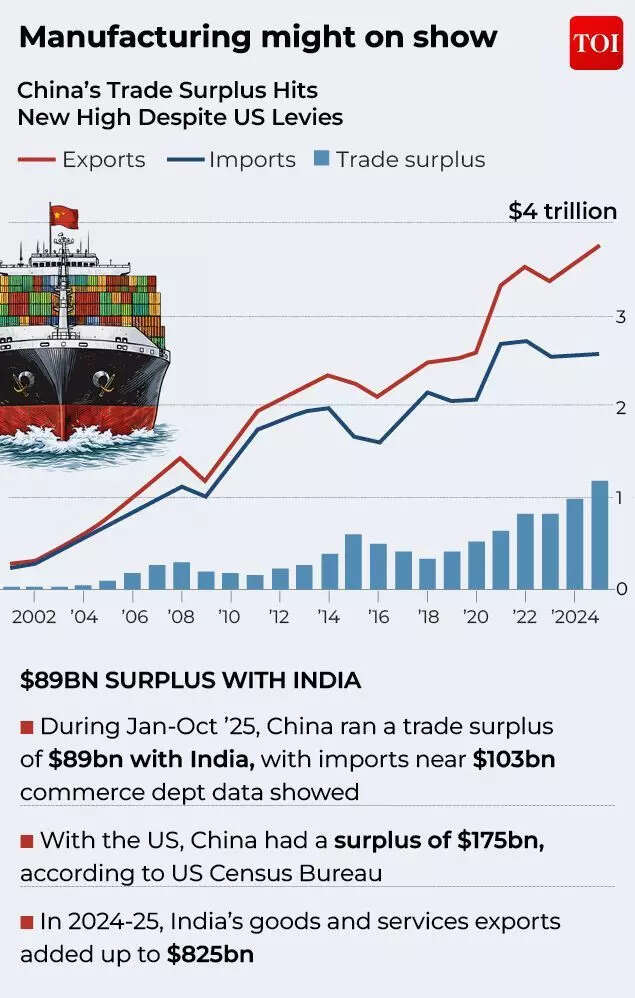

Many companies initially absorbed those costs in 2025 to protect market share. That buffer is eroding.As inventories normalize in 2026, economists expect more of the tariff burden to be passed directly to consumers, keeping inflation elevated just as the Federal Reserve hopes to declare victory.The Greenland tariffs would hit European industrial goods, machinery and consumer products-precisely the categories most likely to ripple through supply chains and prices.3) China’s trade surplus keeps hitting records - despite US tariffsIf the goal of tariffs was to curb China’s export dominance, the results are starkly disappointing.China closed 2025 with a record $1.19 trillion trade surplus - the largest ever recorded, even adjusted for inflation.To be sure, exports to the US fell sharply under Trump’s tariffs. But Chinese manufacturers responded by scaling up sales to other markets.

Reuters reports exports to Africa jumped 25.8%, shipments to Southeast Asia rose 13.4%, and exports to the EU grew 8.4%.

Bloomberg noted that Chinese exporters “aggressively sought out customers in other markets when shipments to the US plunged,” while the New York Times reported that firms increasingly bypass US tariffs by routing goods through Southeast Asia and other intermediaries.HSBC’s Fred Neumann said China’s diversification strategy has “significantly enhanced” its ability to withstand trade shocks.The net effect: US tariffs are reshaping global trade, but not in Washington’s favor. 4) Tariffs are straining alliances and isolating the USThe Greenland episode underscores how tariffs are increasingly colliding with diplomacy and security.European leaders warned Trump’s move risks a “dangerous downward spiral.” British Prime Minister Keir Starmer said “applying tariffs on allies for pursuing the collective security of Nato allies is completely wrong.”

EU leaders said they stand in “full solidarity” with Denmark and Greenland.An emergency meeting of EU ambassadors has been called to coordinate a response.Trade experts warn that treating EU countries differently, as Trump proposes, could derail existing trade deals and push Europe closer to alternative partners, including China.William Reinsch of the Center for Strategic and International Studies told Reuters that Trump’s approach may convince the European Parliament it is “pointless” to approve any trade agreement with the US. Tariffs are becoming a wedge between the US and its closest allies, creating openings for Beijing to expand economic and political influence.

5) Tariff revenue is real - but economically misleadingTrump frequently points to tariff revenue as proof of success. The numbers are striking but incomplete.Politico reports the US has collected $261.6 billion in tariff revenue so far this year, up 186% from last year. But that figure remains dwarfed by the $2.4 trillion raised annually through income taxes.Economists warn tariff revenue often spikes early, then levels off as companies shift supply chains, cut volumes, or find workarounds. High tariffs also reduce overall trade, shrinking the base on which those revenues are collected.There’s also a major legal overhang. The US Supreme Court is considering challenges to Trump’s tariff authority. A decision against Trump could trigger more than $130 billion in refunds to US importers.Trump himself warned the US would be “screwed” if the court overturns the tariffs, saying the fallout could reach “Trillions of Dollars!”.

Between the lines

Many of the reasons the US economy avoided a sharper slowdown in 2025 are temporary.Foreign Policy notes companies front-loaded inventories, absorbed costs and delayed investment decisions while waiting for clarity on tariffs. Those cushions are fading in 2026, even as new investigations could bring fresh duties on sectors like solar power, aircraft engines and robotics.Uncertainty itself is becoming a tax, discouraging investment, hiring and long-term planning.

What's next

Trump says he is “open to negotiation” on Greenland, but European leaders insist the territory is not for sale and warn that backing down under tariff pressure would set a dangerous precedent.Markets are watching three fault lines closely:

- Jobs: Manufacturing and construction employment are already weakening.

- Inflation: New tariffs risk keeping prices elevated.

- China: Each new trade shock accelerates Beijing’s pivot toward non-US markets.

The Supreme Court’s looming decision could either reinforce Trump’s strategy or dramatically weaken it.

The bottom line

In Trump’s first term, tariffs were pitched as shock therapy. In his second, they have hardened into habit.They are used to punish Iran, pressure China, threaten Europe, and now demand the sale of territory from an ally. Legal authority is often vague. Economic consequences are treated as secondary.What has changed is where the damage is landing. Manufacturing investment is down. Job growth has slowed. Prices remain sticky.

Allies are alienated. China’s export machine rolls on.Ironically, the presidency with the tariff was meant to project strength abroad. Increasingly, it is being felt at home quietly, steadily, and with effects that are harder to undo than to announce.The policy has reshaped global trade, just not in America’s favor.

1 hour ago

5

1 hour ago

5

English (US) ·

English (US) ·