ARTICLE AD BOX

MUMBAI: Days after govt announced the 'export promotion mission' and easier loan flow, RBI has eased repayment rules for exporters by giving them more time to bring in the proceeds and allowing banks to offer temporary relief on trade-related loans.

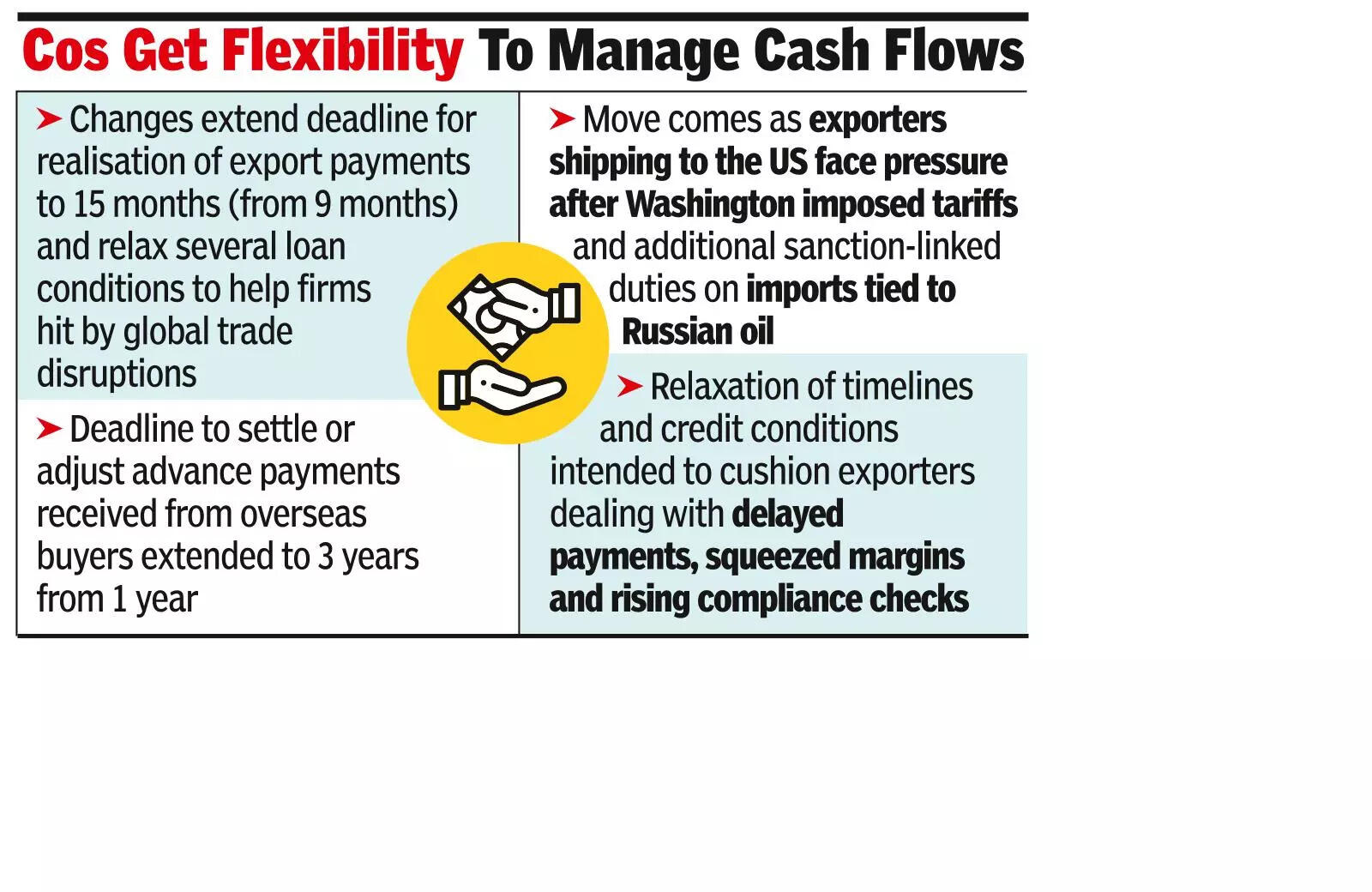

The changes, issued through a Gazette notification on Nov 13 amending Fema rules and a circular to lenders, extend the deadline for realisation of export payments to 15 months (from 9 months) and relax several loan conditions to help firms hit by global trade disruptions.The move comes as exporters shipping to the US face pressure after Washington imposed tariffs and additional sanction-linked duties on imports tied to Russian oil.

RBI's relaxation of timelines and credit conditions is intended to cushion exporters dealing with delayed payments, squeezed margins and rising compliance checks in their key markets.

Under the amended Fema regulations, exporters have 15 months instead of nine to bring back their export earnings. The deadline to settle or adjust advance payments received from overseas buyers has been extended to three years from one year.

RBI said the longer timelines are meant to ease pressure on exporters struggling with delays in shipments and payments.A separate circular to banks, cooperatives and NBFCs outlines how lenders should support affected exporters. Firms in specified sectors that held standard export credit as of Aug 31 may be offered a four-month moratorium on loan installments and interest from Sept 1 to Dec 31. Interest will continue to accrue, but only as simple interest.

Lenders may convert this into a separate loan, which can be repaid between April and Sept 2026.Banks have also been allowed to ease working-capital rules by reducing margins and recalculating drawing power. They may give exporters up to 450 days to repay pre-shipment and post-shipment credit. Exporters who have produced goods but cannot ship them may repay packing credit using domestic sales or proceeds from other export orders.

RBI said these relaxations will not be treated as restructuring, and lenders must ensure borrowers' credit histories are not affected. Banks will, however, need to create a 5% general provision against such accounts as a prudential buffer.The central bank said the measures are intended to prevent short-term trade disruptions from turning into defaults, give exporters flexibility to manage cash flows and allow lenders to support viable firms without weakening credit discipline.

1 hour ago

4

1 hour ago

4

English (US) ·

English (US) ·