ARTICLE AD BOX

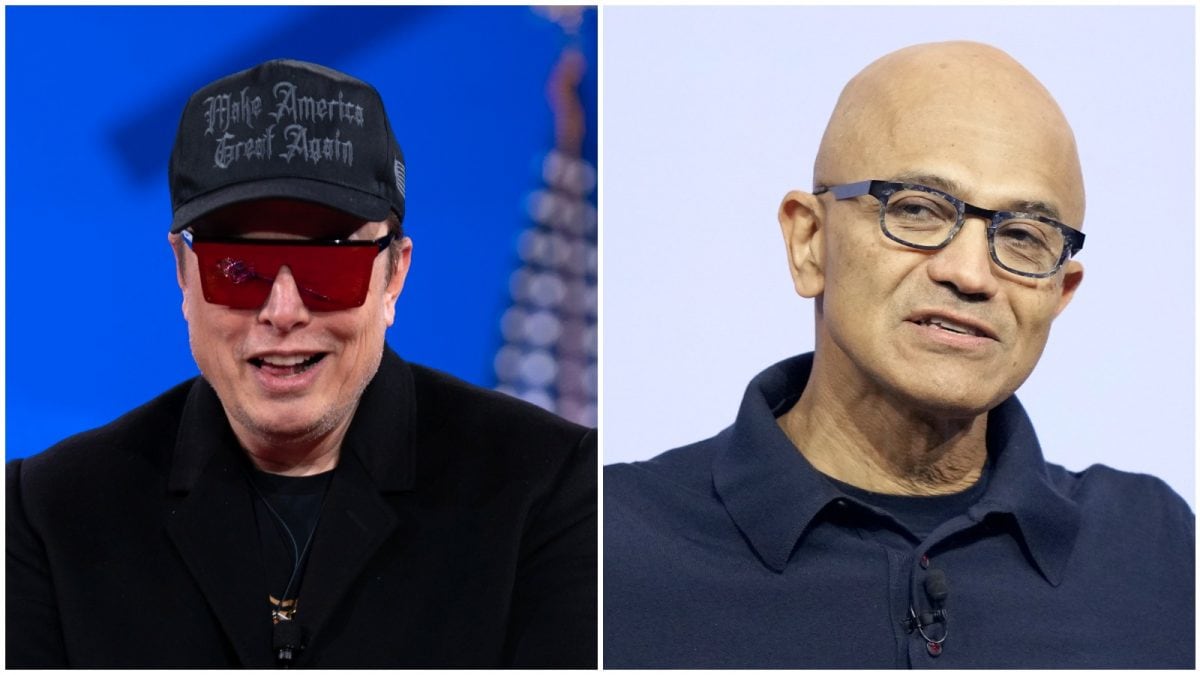

Compounding is the key to earning over Rs 1 crore, according to CA Nitin Kaushik, who recently shared an investment roadmap on X.

08 Aug 2025, 10:44 AM IST i 08 Aug 2025, 10:44 AM IST 08 Aug 2025, 10:44 AM IST

Skill-based income compounds faster than market returns, says CA and tax expert Nitin Kaushik.(SIP. Image: Envato)

You hail from a modest background and dream of becoming a crorepati. It's possible. With the right mindset, skills and enough time to reap the benefits of compounding, you can turn your dreams into reality.

In an X thread, Chartered Accountant (CA) and tax expert Nitin Kaushik has laid out an investment roadmap to achieve a corpus of Rs 1 crore and more, starting from zero.

“It’s not about luck. It’s about systems and consistency,” Kaushik says.

💥 From ₹0 Savings to ₹1 Cr: A Financial Freedom Blueprint Most People Ignore

If you’re starting from scratch — no inheritance, no fancy job — this roadmap can still take you to ₹1 Cr and beyond.

It’s not about luck. It’s about systems and consistency.

Here’s a realistic… pic.twitter.com/4NW2XFvdoV

Here’s a breakdown of his proposal.

Phase 1: Create Emergency Fund

To be prepared for the worst, Kaushik advises saving Rs 1 lakh in a savings account or a fixed deposit. “This gives you a buffer for job loss, medical needs, or sudden expenses,” he outlined.

He also emphasised the importance of building a safety net before starting to invest.

You need to invest Rs 10,000 monthly via SIP in equity mutual funds. If you invest consistently and earn at least a 12% compound annual growth rate (CAGR), your investment will grow to Rs 1 crore in 20 years.

Phase 3: Start Side Hustle

Kaushik advises starting a side hustle, such as content creation and teaching, to earn at least Rs 30,000 monthly. “Use it only to invest or build assets. Over 10 years, this alone can add Rs 30–Rs 40 lakh to your net worth,” he suggests.

This should cover term life insurance amounting to 10 to 15 times your annual earnings, along with a health insurance offering a sum assured of Rs 10 lakh to Rs 20 lakh. You must avoid high-interest loans and EMIs, as these can quietly erode your financial well-being.

Phase 5: Build Your Freedom Fund

To identify your “financial independence number”, you need to multiply your annual expenses by 25. For example, if you spend Rs 6 lakh annually, you need a corpus of over Rs 1.5 crore.

Finally, the CA recommends acquiring remunerative skills such as coding, writing, marketing and finance. “Skill-based income compounds faster than market returns,” he says.

Gold Outshines Nifty — Will Silver Be The Next Star? CA Abhishek Mehta Explains Risks, Trajectory

.png)

.png)

.png)

1 week ago

8

1 week ago

8

English (US) ·

English (US) ·