ARTICLE AD BOX

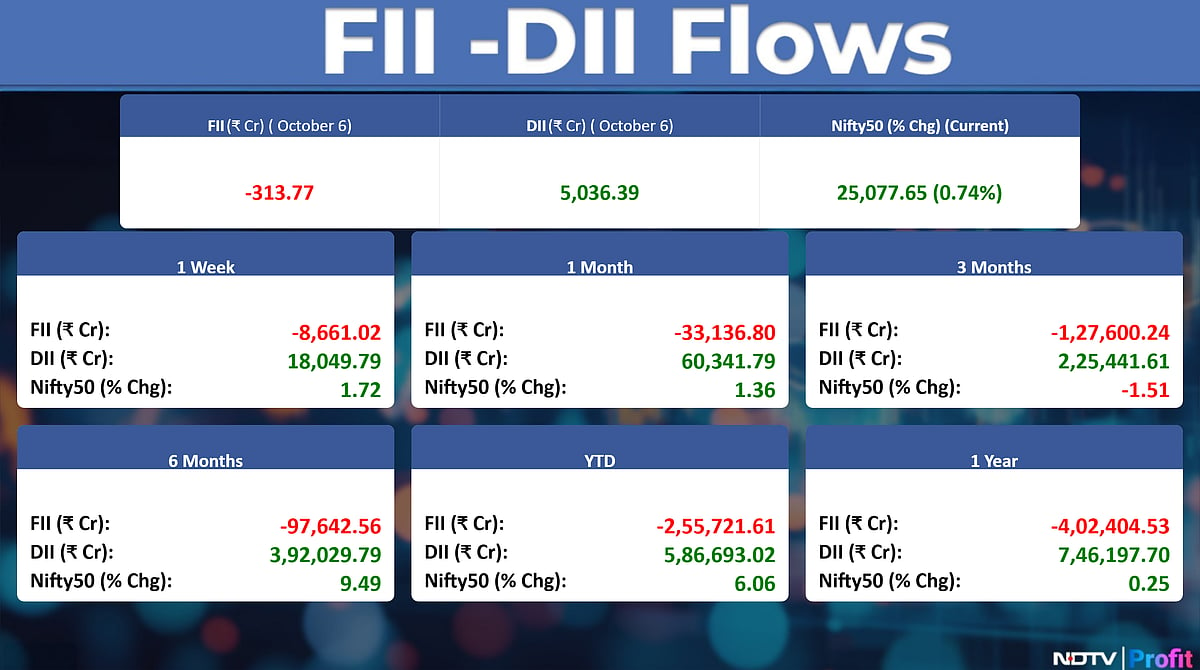

The Nifty 50 closed 0.74% higher at 25,077.65 while Sensex closed 0.72% higher at 81,790.12 on Monday.

07 Oct 2025, 06:00 AM IST i 07 Oct 2025, 06:00 AM IST 07 Oct 2025, 06:00 AM IST

Stock Market Today: All You Need To Know Going Into Trade On Oct. 7 (Photo source: Freepik)

Summary is AI Generated. Newsroom Reviewed

The benchmark indices on Monday extended their winning streak for the third consecutive session, closing in the green. The Nifty 50 closed 0.74% higher at 25,077.65 while Sensex closed 0.72% higher at 81,790.12.

The foreign portfolio investors on Monday stayed net sellers of Indian shares for the 10th consecutive session. The FPIs sold stocks worth approximately Rs 313.77 crore, according to provisional data from the National Stock Exchange. The DIIs stayed net buyers for the 29th session and bought stake worth Rs 5,036.39 crore.

Bank of India (YoY)

Domestic Deposits as on Sept 30 is up 8.5% at Rs 7.3 lakh crore

Global Gross Advances as on Sept 30 is up 13.9% at Rs 7.1 lakh crore

Global Deposits as on Sept 30 up 10% at Rs 8.5 lakh crore

Global Business as on Sept 30 up 11.8% at Rs 15.6 lakh crore

Metropolis Health (YoY)

Q2 Consolidated Revenue is up 23%

Core diagnostics at high single digit margin in Q2

On consolidated basis, company is debt free & has net cash surplus of Rs 55 crore

Tata Motors (YoY)

Domestic Sales of Curvv down 35.8% at 5,274 units

Production Volume of Curvv dow 39.8% at 5,289 units

Wipro: The company is scheduled to report its Q2 results on October 16.

PNC Infratech: The company has received the appointed date for two of its projects from the National Highways Authority of India.

Kotak Mahindra Bank: The company will declare its Q2 results on October 25.

HCL Technologies: The company has joined the MIT Media Lab in the US to collaborate on artificial intelligence research.

SPML Infra: The company has approved the allotment of 5.6 lakh shares upon exercise of rights attached to 5.6 lakh convertible warrants.

Garden Reach Shipbuilders & Engineers: The government has appointed Niranjan Mukund Bhalereo as Director (Finance) and Chief Financial Officer.

Zydus Lifesciences: The company has received approval from Health Canada for Liothyronine tablets, used in the treatment of hypothyroidism.

Astral: The company has commissioned commercial production at its Kanpur plant.

Aster DM Healthcare: The company has received no-objection letters from BSE and NSE regarding its proposed scheme of merger with Quality Care India.

Brigade Enterprises: The company has signed a joint development agreement for premium residential projects in Chennai, with an estimated gross development value of Rs 1,000 crore.

LTIMindtree: The company has signed a multi-year deal with a global entertainment company.

KRN Heat Exchanger: The company's subsidiary, KRN HVAC Products, will acquire the bus air-conditioning business of Sphere Refrigeration Systems.

Nibe: The company has received purchase orders worth Rs 20.57 crore from a leading infrastructure and defence company.

Capri Global Capital: The company has approved the early closure of its public issue of up to 40 lakh non-convertible debentures worth Rs 400 crore.

Havells India: The company's subsidiary, Havells International, will acquire a 20% stake in Salesmark Ventures. Post-acquisition, Havells HVAC will become a wholly-owned subsidiary of Havells International.

Tourism Finance Corp: The company has entered into an exclusive term sheet with Cosmea Investment Holdco to acquire 100% stake in Cosmea Investment.

ISGEC Heavy Engineering: The company will acquire a 26% stake in FPEL HR1 Energy for Rs 2.2 crore.

Medico Remedies: The company has received an order worth $1,781,000 from the Ministry of Health and Medical Inquiry of Turkmenistan to supply tablets and dry syrups.

Landmark Cars: The company will acquire a 17% stake in Landmark Cars (East) from Autocity Services for Rs 12.5 crore.

Solarworld Energy Solutions: The company has entered into an agreement with Pioneer Facor IT Infradevelopers to borrow funds worth Rs 50 crore.

Coal India: The company has signed a pact with Chhattisgarh Mineral Development Corporation for exploration of critical minerals.

Fabtech Technologies International: The company has received a letter of intent worth Rs 68 crore for the supply and installation of modular cleanroom partition systems and doors.

Dilip Buildcon: The company has received a letter of acceptance to develop a 100 megawatt grid-connected ground-mounted solar photovoltaic power project.

Suraj Estate Developers: The company has announced the resignation of Palak Dani as Chief Marketing Officer.

Crest Ventures: The company has provided an update on its joint venture, Crest Residency, which has entered a development agreement with Saidale Co-operative Society for a property in Mumbai.

Gallantt Ispat: The company's board will meet on October 9 to consider the incorporation of subsidiaries and setting up of a solar power plant.

Oil India: The company has signed an agreement with Mahanagar Gas to explore opportunities in the liquefied natural gas value chain.

Karur Vysya Bank: The company has received an interim stay from the Madras High Court on tax demand matters for Assessment Years 2020–21, 2021–22, and 2022–23.

Prestige Estates Projects: The company's subsidiary has received a show-cause notice for a goods and services tax demand of Rs 307.2 crore, including penalties, from the Mumbai tax authority.

Buy, Sell Or Hold: Polymed, MOIL, Motherson Sumi, Zydus Wellness — Ask Profit

WeWork India Management: The company is a flexible workspace operator in India. The public issue was subscribed to 13% on day two. The bids were led by Qualified institutional investors (9% ), non-institutional investors (6%), retail investors (37%).

Tata Capital: The company is in diversified financial services and a subsidiary of Tata Sons. The public issue was subscribed to 39% on day one. The bids were led by Qualified institutional investors (52%), non-institutional investors (29%), retail investors (35%).

More Bullish On Aditya Birla Capital Than Tata Capital, Says Vikas Khemani

Glottis: The company's shares will debut on the stock exchange on Tuesday at an issue price of Rs 129 apiece. The public issue was subscribed to 2.05 times on day three. The bids were led by Qualified institutional investors (1.87 times ), non-institutional investors (2.97 times), retail investors (1.42 times).

Fabtech Technologies: The company's shares will debut on the stock exchange on Tuesday at an issue price of Rs 191 apiece. The public issue was subscribed to 2.03 times on day three. The bids were led by Qualified institutional investors (2.02 times ), non-institutional investors (1.97 times), retail investors (2.08 times).

Glottis IPO GMP And Allotment In Spotlight; Check Status, GMP, Listing Date

LG Electronics: The company is the second-largest player in India in home appliances and consumer electronics after Samsung. The company will offer shares for bidding on Tuesday. The price band is set from Rs 1,080 to Rs 1,140 per share. The Rs 11,607.01 crore IPO is entirely an offer for sale.

Anantam Highways Trust: The company is an Indian infrastructure investment trust (InvIT) focused on investing in road infrastructure. The company will offer shares for bidding on Tuesday. The price band is set from Rs 98 to Rs 100 per share. The Rs 400 crore IPO is entirely an fresh issue of shares.

LG Electronics Raises Rs 3,475 Crore From Anchor Investors Ahead Of Rs 11,607-Crore IPO

Optiemus Infracom: BOFA Securities Europe Sa bought & Dymon Asia Multi-Strategy Investment sold 3.54 lakh shares at Rs 672.1 apiece.

Eternal: BofA Securities Europe SA bought, Goldman Sachs Bank Europe SE sold 81 lakh shares at Rs 328.45 apiece.

Aditya Birla Lifestyle Brands: Aditya Birla Sun Life Mutual Fund bought 36.6 lakh shares, Amansa Holdings bought 70.2 lakh shares, ICICI Prudential Mutual Fund bought 1.9 crore shares, Nippon India Mutual Fund bought 1.76 crore shares, SBI Life Insurance bought 1.73 crore shares, and Flipkart Investments sold 7.3 crore shares at Rs 136.45 apiece.

Embassy Office Parks REIT: Kotak Performing Re Credit Strategy sold 90 lakh shares at Rs 421 a piece.

Pace Digitek: Morgan Stanley Asia Singapore Pte bought 12 lakh shares at Rs 220.95 apiece. Necta Bloom Vcc - Necta Bloom One sold 21.02 lakh shares at Rs 224.9 apiece.

SBI MF, Goldman Sachs, Others Buy As Flipkart Exits Aditya Birla Lifestyle Via Rs 998-Crore Block Deal

Price Band change from 10% to 5%: V2 Retail

Price Band change from 20% to 10%: KIOCL and Orient Technologies

Nifty Sep futures is up 0.70% to 25,181.1 at a premium of 104 points.

Nifty Sep futures open interest up by 1.56%.

Nifty Options 7th Oct Expiry: Maximum Call open interest at 25,200 and Maximum Put open interest at 25,000.

Securities in ban period: RBL Bank

FPIs Remain Net Sellers Even As Nifty Closes Above 25,000

The rupee closed flat at 88.79 (provisional) against the US dollar on Monday, near its all-time low level. The yield on the 10-year bond ended one point higher at 6.52%.

Trade Setup For Oct. 7: Nifty Reaffirms Bullish Sentiment; Resistance At 25,100-25,150

1 week ago

14

1 week ago

14

English (US) ·

English (US) ·