ARTICLE AD BOX

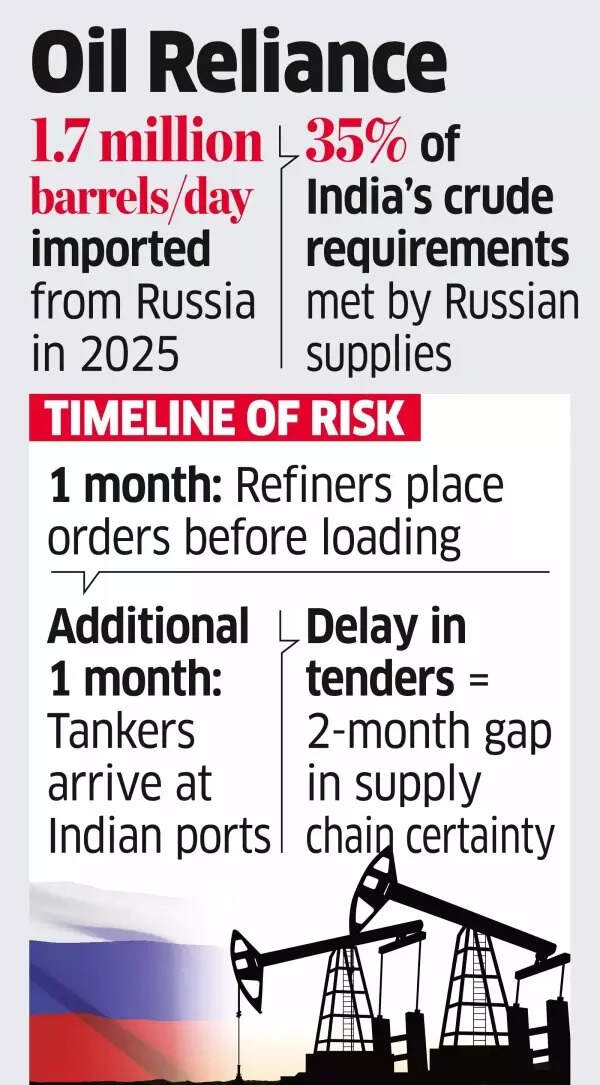

Indian refiners usually place orders a month before loading, and it generally takes an additional month for tankers to arrive at Indian ports. (AI image)

As US President Donald Trump’s 25% additional tariffs, effective month-end loom, some Indian refiners are adopting a cautious stance towards Russian oil tenders, postponing orders for September-loading shipments.

Refiners are awaiting clarity on the potential impact of Trump's proposed 25% penalty linked to oil purchases. Indian refiners usually place orders a month before loading, and it generally takes an additional month for tankers to arrive at Indian ports.Executives from these refineries noted that a rapid switch to other suppliers could tighten the market and potentially drive up global oil prices."We haven't awarded any tender for Russian oil for September loading yet," a refinery executive told ET, mentioning that the company might proceed with this in the coming days.Also Read | ‘Russia lost an oil client, which is India’: What Donald Trump said before meet with Putin; ‘secondary sanctions would be devastating…’Like many governments and businesses around the globe, refinery executives were closely observing the meeting in Alaska between US President Donald Trump and Russian President Vladimir Putin. The outcome of this meeting did little to clarify the uncertainties surrounding Moscow's oil trade.Before the Alaska meeting, Trump appeared to soften his position but remained uncertain about imposing secondary sanctions on purchasers of Russian oil.

He stated, "If I have to do it, I'll do it. Maybe I won't have to do it."

Oil reliance

Will 25% additional tariff be delayed?

Some Indian refinery executives are optimistic that the US will delay the 25% penalty, while others are concerned that if Trump decides to impose secondary sanctions—distinct from the penalty—it could significantly disrupt the oil trade between India and Russia.Last week, Indian Oil chairman AS Sahney said that the government has not provided any instructions to refiners regarding the purchase of Russian oil.

Other refinery executives agreed with Sahney, noting that refiners are making decisions based on their own market assessments.Also Read | Trump sees a ‘dead economy’ - but US-based S&P Global upgrades India’s credit rating - here’s whyAccording to energy cargo tracker Vortexa, India imported an average of 1.7 million barrels per day of crude oil from Russia in 2025, which represents about 35% of the country's total crude oil needs. An industry executive commented that quickly replacing such a significant amount of Russian oil would be challenging.

"If such a large supply disappears from the market, it will create tension and lead to price increases," he remarked.The global oil market is experiencing an oversupply, leading to prices averaging $66 per barrel this month. "India's abrupt change could tighten the market," a second executive noted. "While those volumes will eventually find buyers, it may take 2-3 months for global trade to rebalance, affecting prices in the meantime."There are only a handful of countries with a demand as significant as India's, so Russian oil would need to be redistributed among numerous buyers, including current ones like China and the EU.

.png)

.png)

.png)

2 hours ago

2

2 hours ago

2

English (US) ·

English (US) ·