ARTICLE AD BOX

AI image for representation only.

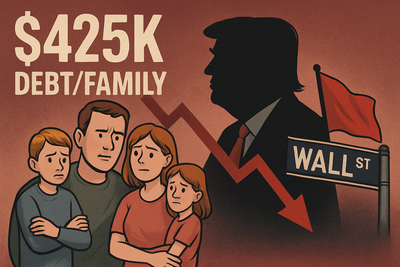

President Donald Trump’s newly passed $3.4 trillion tax and spending package - dubbed by supporters as “One Big Beautiful Bill” - is being denounced by Wall Street figures, economists, and bond market analysts as a fiscal time bomb.

Among the most vocal: Ray Dalio, founder of Bridgewater Associates, who says the bill will lead to “big, painful disruptions” for American families and the global financial system if not urgently reversed.Why it mattersThe legislation, passed with razor-thin margins in Congress, is expected to add $3.4 trillion to the national deficit over the next decade, according to the Congressional Budget Office. It comes at a time of relative economic stability - not a war, recession, or pandemic.

Critics argue that deficit spending without crisis justification marks a dangerous shift in American fiscal policy.Dalio breaks it down in stark terms: annual federal spending will balloon to around $7 trillion, while revenues will hover near $5 trillion. “The debt... is now about 6x of the money taken in, 100 percent of GDP, and about $230,000 per American family,” Dalio wrote. In ten years, those numbers could rise to “7.5x the money taken in, 130 percent of GDP, and $425,000 per family.”

The big pictureThis isn’t just theoretical. Rising federal debt will demand more borrowing, and that means higher interest and principal payments. Dalio estimates that those costs will soar from $10 trillion today to $18 trillion - with annual interest alone doubling to $2 trillion.What happens next, he warns, could be one of three scenarios:

- A politically unpopular slashing of spending.

- A massive increase in taxes.

- Or a monetary intervention involving printing more money and lowering interest rates - which would “devalue the dollar and hurt bondholders.”

Between the linesThe bond market - where the US borrows money - has already begun sending distress signals.

Yields on long-term Treasurys jumped in May, nearing their highest levels in two decades, reflecting unease over the government’s fiscal trajectory.Bill Gross, founder of Pimco and one of the bond market’s most respected voices, likened the US to “a teenager with a credit card that has no limits.” He warned that the payment is coming - not via default, but through “a weak dollar and higher interest rates.”Zoom inThe Wall Street Journal, in an in-depth analysis, highlighted the extraordinary nature of the moment: a historic deficit without a national emergency.

Typically, large-scale federal borrowing is reserved for times of crisis - like the 2008 financial collapse or the Covid pandemic.This time is different. “The market has been willing to tolerate spikes in borrowing during crises... What stands out now... is that America is bingeing on debt when there’s no such emergency requiring it,” the WSJ noted.Moody’s projects that the deficit, already at $1.8 trillion (6% of GDP), will climb to nearly 9% by 2035.

That would push the national debt from just under 100% of GDP today to more than 130% - surpassing even World War II-era highs.What they are saying

- Dalio sees systemic risk not just for America, but for the global economy: “The US Treasury market is the backbone of all capital markets, which are the backbones of our economic and social conditions.” If confidence in US debt erodes, the entire financial architecture could wobble.

- Ken Rogoff, former chief economist of the IMF, agrees: “It’s not clear markets will tolerate” further borrowing sprees when a real crisis hits. He warned that the US is leaving itself without fiscal headroom to respond to future emergencies.

- Even the dollar - long considered a safe haven - is starting to reflect these jitters. It just posted its worst first-half performance since 1973, a signal that foreign investors may be losing confidence in the US fiscal trajectory.

The Trump administration’s viewPresident Trump and Republican lawmakers say the bill’s $4.5 trillion in tax cuts will supercharge economic growth. They argue that cuts to Medicaid, food stamps, and green energy subsidies are essential to "rightsizing" government.“For all cost-cutting Republicans, of which I am one, REMEMBER, you still have to get reelected,” Trump posted online.

“We will make it all up, times 10, with GROWTH, more than ever before.”They also tout provisions such as new deductions for tips and overtime, a hike in the child tax credit, and business incentives to spur investment. Trump calls the bill “a phenomenal victory” and plans to sign it on July 4th.The math doesn’t add up - at least not for DalioDalio doesn’t buy the growth-will-save-us logic. He warns that the exploding interest burden will force the Fed to either crush the economy with higher rates or suppress rates artificially - triggering inflation and dollar devaluation.The scenario he paints is bleak: “Unless this path is soon rectified to bring the budget deficit from roughly 7% of GDP to about 3%... big, painful disruptions will likely occur.”That includes a potential bond market revolt, skyrocketing borrowing costs for households and businesses, and a shrinking safety net just as economic headwinds build.Catch up quick

- Congress passed the bill 218–214 after weeks of internal GOP wrangling.

- The Senate version was made law with Vice President JD Vance casting the tie-breaking vote.

- The CBO estimates 11.8 million Americans will lose health coverage and 3 million will lose food stamp eligibility by 2034.

- Some Republicans expressed discomfort with the deficits - then voted yes anyway.

What’s nextMarkets are watching closely. The Fed, already navigating post-pandemic economic turbulence, may have to intervene if long-term rates spike.

That could limit its ability to fight inflation or support growth.Foreign investors, who hold nearly one-third of US public debt, may start reallocating to other safer assets. As Harvard economist Jeremy Stein puts it, “I wouldn’t be surprised... if they start shifting that reinvestment more towards, say, Europe or German bonds.”The cost of Trump’s “big, beautiful” bill may not be fully visible today - but Dalio and Wall Street are betting we’ll all feel it tomorrow.(With inputs from agencies)

.png)

.png)

.png)

5 hours ago

3

5 hours ago

3

English (US) ·

English (US) ·