ARTICLE AD BOX

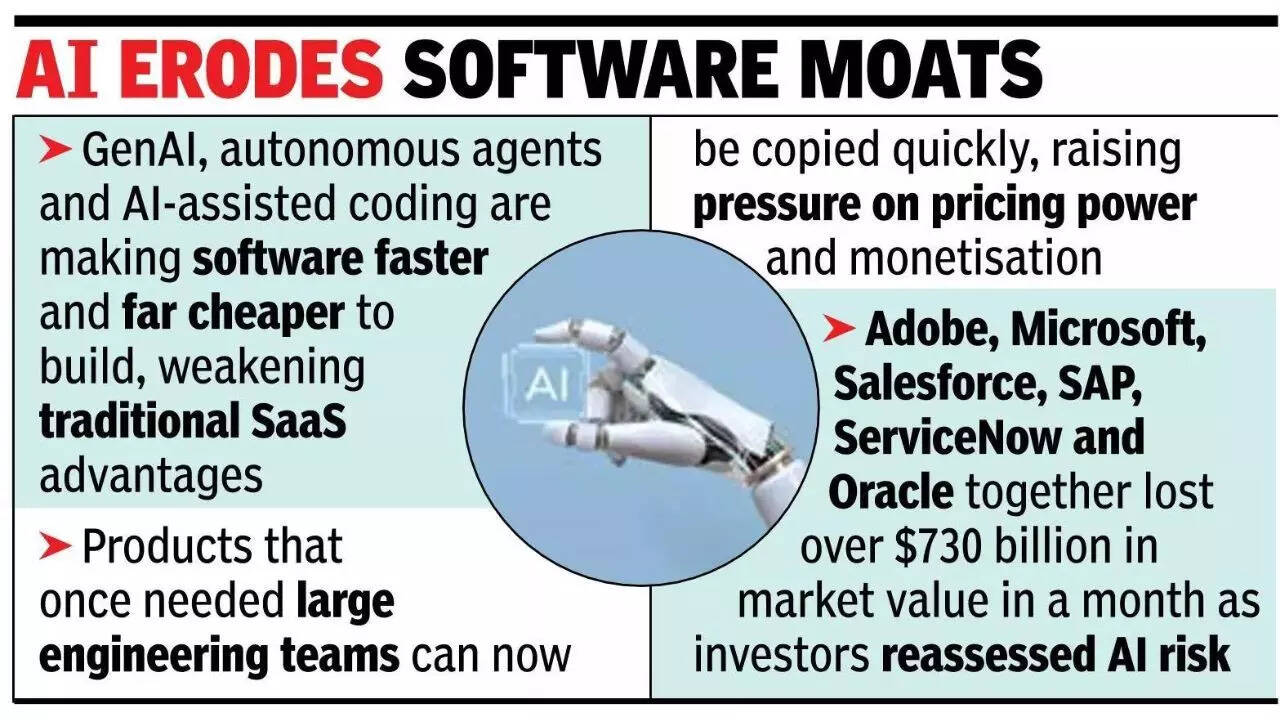

BENGALURU: A sharp selloff in global software stocks over the past month has reignited a basic question for founders, investors and customers alike: what happens to the economics of software-as-a-service when AI makes building and maintaining software dramatically cheaper?Advances in GenAI, autonomous agents and AI-assisted coding are forcing a rethink of long-held assumptions about SaaS defensibility, pricing power and growth.

Tasks that once required large engineering teams can now be executed faster and at far lower costs, raising concerns that many software products may become easier to replicate and much harder to monetise.

AI erodes software moats

The growing unease has spilled into public markets. According to tech publication The Register, Adobe, Microsoft, Salesforce, SAP, ServiceNow and Oracle have together shed more than $730 billion in market value over the past month as of Tuesday’s close, as investors reassess how AI could reshape the software profit pool.On Wall Street trading desks, the selloff has acquired a name. Jeffrey Favuzza of Jefferies described the rout as a “SaaSpocalypse” in comments to Bloomberg, saying, “We call it the ‘SaaSpocalypse,’ an apocalypse for software-as-a-service stocks.”Behind the market volatility lies a deeper industry debate. Zoho founder and CEO Sridhar Vembu has argued that SaaS was structurally vulnerable even before the current AI wave.

In a widely shared post, Vembu said the sector had leaned too heavily on sales-led growth and expanding budgets, calling AI “the pin that is popping this inflated balloon.”Others argue that the impact will be uneven rather than existential. Srikanth Velamakanni, co-founder and CEO of Fractal Analytics, said AI is compressing software value but not eliminating it. “It is vastly easier to build software today than ever before,” he said.“You can write 10,000 lines of code a day per person when the industry average used to be about 10. That means large parts of existing SaaS codebases can be abstracted away very quickly. What does not change overnight is distribution, trust and deep integration into enterprise workflows. Those factors give software companies durability, even as pricing pressure increases,” he added.Manav Garg, founder of Together Fund, said AI’s impact will differ for different categories of services.

5 hours ago

4

5 hours ago

4

English (US) ·

English (US) ·