ARTICLE AD BOX

MUMBAI: Startup IPOs are taking the sheen off large private funding deals (beyond $100 million). Venture capital (VC) investors are actively raising funds, the funding winter is over, but it is the small and mid-sized deal counters (a few million dollars to $50 million or so) where there's a rush of activity.

There have been some big deals too, but some of them, such as Zepto's $450-million funding and Infra.Market's near $200 million-fundraise in tranches were pre-IPO rounds. A booming IPO market is now nudging many startups to look at a public listing rather than chasing private investors for large cheques. Public market investors in India have matured and a wider mix of new age IPOs are now finding takers. "Several startups, which were earlier looking to raise $100 million or bigger funding, are now assessing how far they are from an IPO.

If they find that there's investor interest to participate in pre-IPO rounds, then they take that or else they directly hit the public market. Tech IPOs today are not restricted to billion-dollar issues. Companies are going for IPO with sub-unicorn valuations as well," said Amit Nawka, partner at PwC.

Urban Company's $215-million IPO, for instance, was among the blockbuster listings of this year. IPOs have allowed companies to get growth capital and generate liquidity for shareholders, said Padmaja Ruparel, co-founder at IAN Group, which makes early-stage investments.

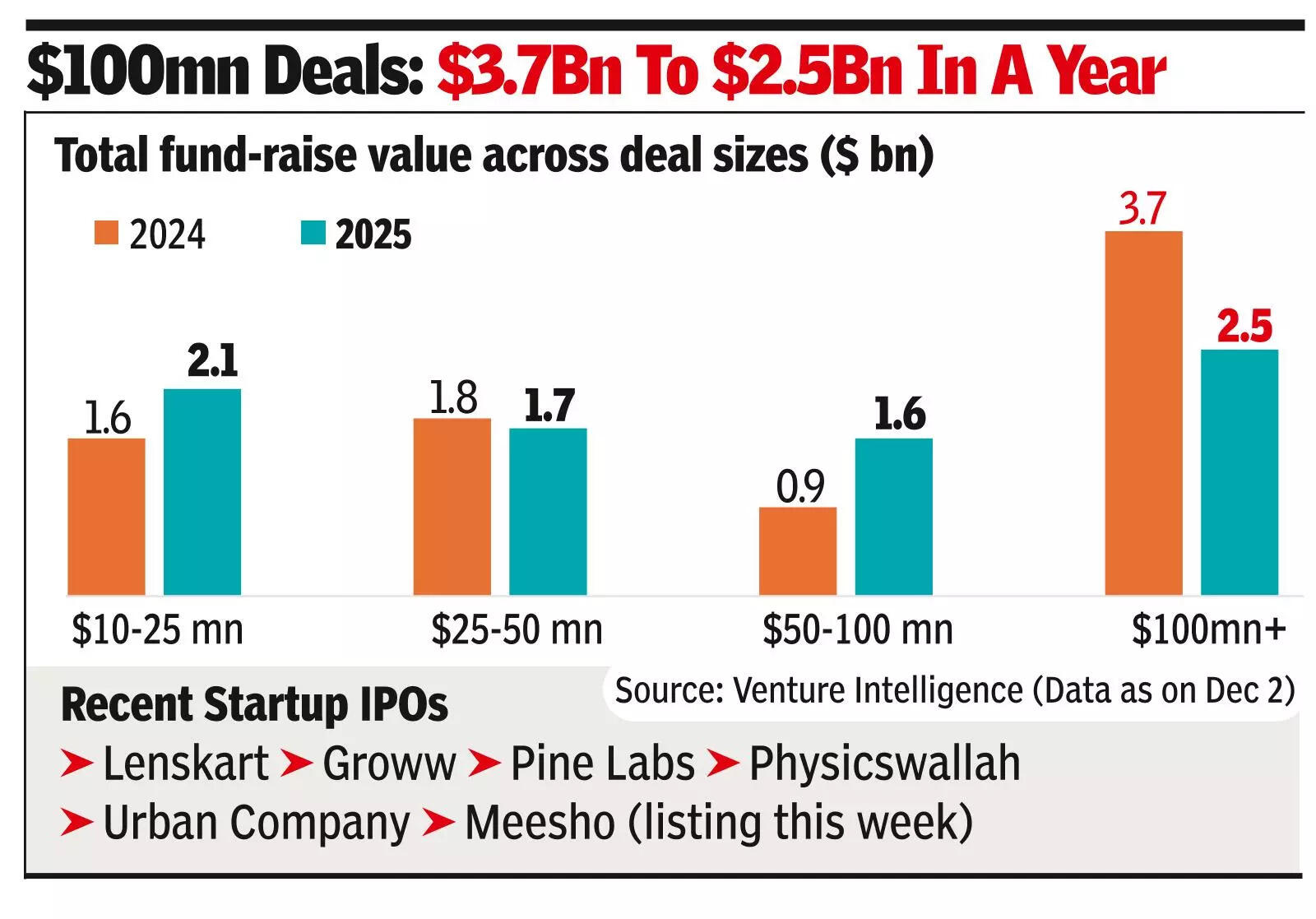

Data sourced from market research firm Venture Intelligence showed that startups raised $2.5 billion through big deals ($100 million plus) this year, lower than last year's count of $3.7 billion. The tally of deals in the range of $10-50 million went up, collectively touching $3.8 billion this year over $3.5 billion last year. In terms of number of deals, there will always typically be more small and mid-sized transactions over larger deals, which tend to be selective, but given that a bunch of early-stage investors including Fireside Ventures, Blume Ventures and Accel have raised funds, smaller deals got a boost. "There is enough money available, and $40-50 million cheques are moving around. A lot of deals in the range of $5-25 million in the consumer space are in the works," said Nawka. Fireside Ventures, which recently closed a $253-million fund, will make 30-32 new early-investments through the fund, said co-founder and partner Vinay Singh. Deal volumes in the seed to series A stages have gone up and the time taken for such deals to close have shrunk, said Singh. "There is no question of funding winter. We are entering a bubble territory. Valuations are also creeping up but they are nowhere as high as 2020-21," Singh said. Besides IPOs, there's also a pick-up in M&A activity giving legacy companies an opportunity to acquire startups to expand their market share. Also, debt funding is picking up, partly explaining the trend of declining volumes of bigger cheques.

4 hours ago

3

4 hours ago

3

English (US) ·

English (US) ·