ARTICLE AD BOX

The relationship status has significantly evolved from being a "good friend" to becoming a "bad trading partner”, it says. (AI image)

Barclays has flagged ‘serious threat’ to around 70% of India’s exports to the US with the Donald Trump administration's 50% tariffs coming into effect today. “The risks to growth for the Indian economy have become more real,” says Barclays in its latest report.The relationship status has significantly evolved from being a "good friend" to becoming a "bad trading partner”, it says.Barclays notes that the 50% US import duty significantly disadvantages India compared to other emerging market nations. Apart from Brazil, where the 50% tariffs were imposed for reasons beyond trade imbalances, other developing economies face considerably lower duties. However, India's exposure relative to GDP remains modest due to its predominantly domestic-focused economy.

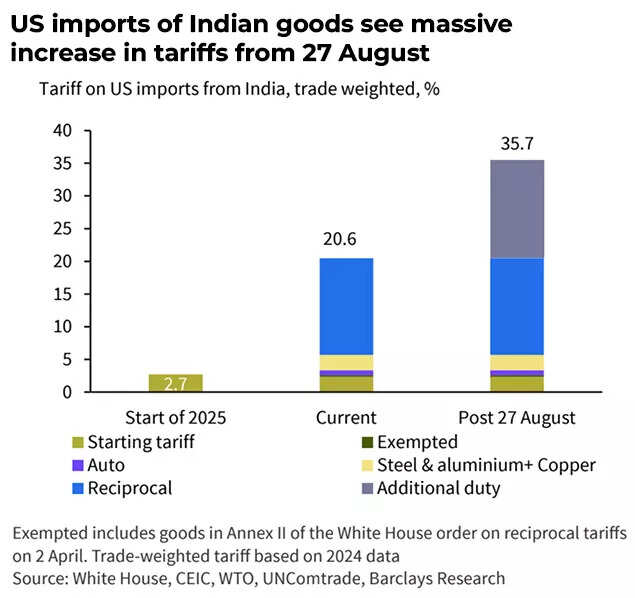

US imports of Indian good see massive tariff increase

- The United States, being India's primary trading partner, receives 18% of India's total merchandise exports in 2024.

- The $80 billion merchandise exports to America (CY2024 figures) span across India's major export sectors. Currently, with exclusions granted to smartphones, petroleum products, and pharmaceuticals, approximately $55bn of exports (representing 70% of US-bound exports and 13% of India's total merchandise exports) remain susceptible to the heightened 50% tariff, says Barclays.

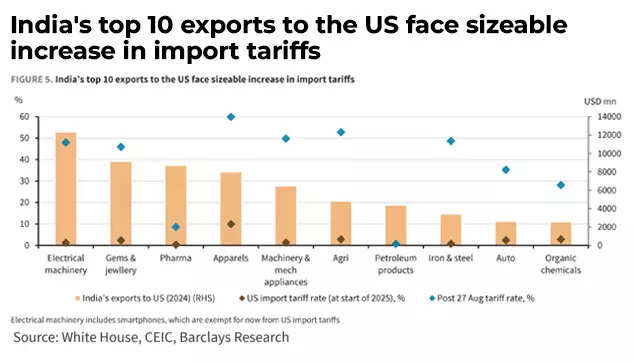

- The sectors most affected by increased US tariffs, compared to rates at the year's beginning, are electrical machinery and gems and jewellery.

- While certain electronic items, primarily semiconductors, receive exemptions, these do not significantly benefit India's primary export categories. The smartphone exemption provides substantial relief, particularly considering its success within India's PLI scheme.The pharmaceutical sector, India's third-largest export to the US ($8.7 billion in 2024), currently enjoys exemption. However, President Trump has indicated plans for separate tariffs up to 200% with a grace period of 12-18 months for all trading partners. This substantial increase would impact India's pharmaceutical industry significantly, as the US purchases 38% of India's pharmaceutical exports.

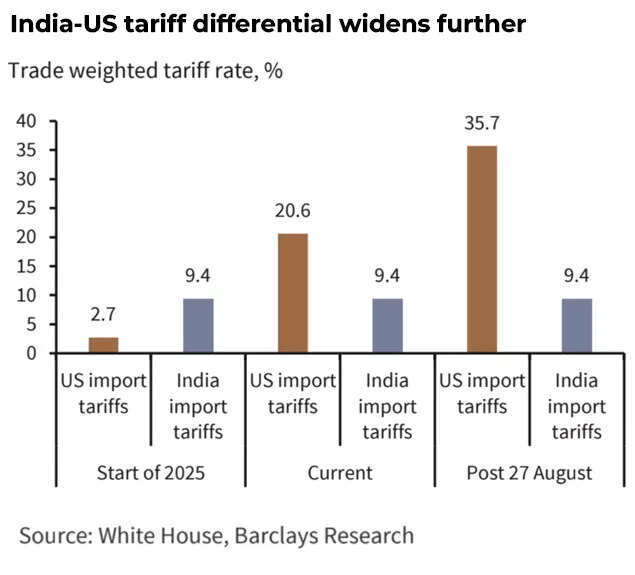

India-US tariff differential widens further

- The apparel sector faces considerable challenges in maintaining competitiveness, with a combined 60% tariff (50% plus existing rate) being notably higher than those imposed on regional competitors ("reciprocal" tariffs for Bangladesh and Sri Lanka remain at 20%).

- The implementation of higher tariffs (2 April) and the subsequent pause triggered a surge in Asian exports to the US. India's exports to the US initially showed remarkable growth (28.1% y/y in March compared to 6.5% average growth in CY2024), maintaining strong performance through July (20.1% y/y). Whilst US-bound shipments continue to register double-digit growth, exports to other destinations (except China) show declining trends. Following the robust first half, a slowdown is anticipated in H2.

India's top 10 exports to US face sizeable increase in tariffs

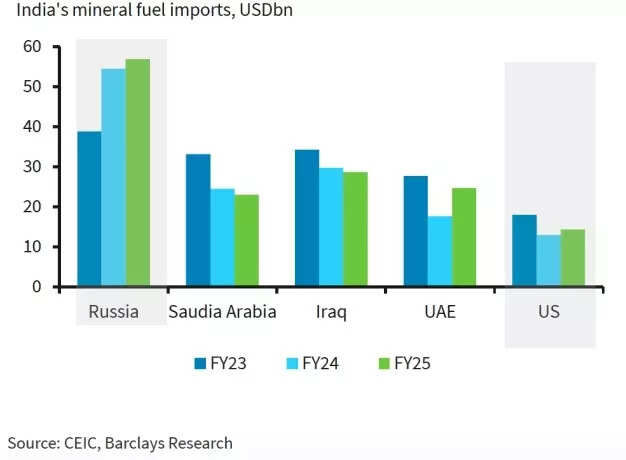

India-Russia crude oil trade

India's procurement of Russian oil faces a 25% secondary tariff, yet it continues its purchases. The economic advantage of Russian imports during 2022-24 remains India's primary justification.Russian contribution to India's total mineral fuel imports increased substantially from 2.7% in FY21-22 to 26% in FY24-25 (calculated in USD), overtaking traditional leaders Iraq and Saudi Arabia.

Russia has remained the top mineral fuel supplier for India

The discounted Russian crude generated estimated savings of $7-10bn against a total oil import expenditure of $186 billion in 2024.

Currently, Russian oil prices offer a modest advantage of $3-8/bbl compared to Middle Eastern varieties. While Indian refiners indicate plans to reduce Russian oil acquisitions in upcoming weeks, complete stopping is not anticipated, says Barclays.Also Read | ‘Country first, commerce later’: Indian refiners unlikely to stop Russia crude oil trade under US pressure; ‘message from government is…’Russia maintained its 26% share in India's mineral fuel imports during Q1 FY26 (April-June). Supply diversification shows increased US participation, reaching 9.8% of India's total imports, up from 6.6% in FY24-25 (showing 39% year-on-year growth). Should India shift towards traditional West Asian suppliers and emerging sources like Brazil to compensate for reduced Russian supplies, prices could rise by approximately $4-5/barrel.However, with 2025 global oil prices averaging $9/bbl below 2024 levels, such supply diversification is unlikely to significantly impact India's oil import expenses, the report says.

India prepares to deal with Trump’s tariffs

India is developing strategies to bolster its economy and support exporters in response to the standstill in trade negotiations with the United States and their imposed import tariffs.Prime Minister Narendra Modi’s August 15 announcement regarding GST rate reductions and tax slab restructuring, are aimed at boosting urban consumption. For exporters and MSMEs, the government is considering reactivating the Emergency Credit Line Guarantee Scheme (ECLGS), which offers government-backed collateral-free working capital, previously utilised during the COVID pandemic.Several sectors face significant challenges from the 50% US tariff, particularly labour-intensive industries like apparel, gems & jewellery, footwear, and leather, which rely heavily on US markets (comprising over 30% of their exports). Industry associations have requested enhanced support through interest subvention schemes, loan repayment moratoriums, and increased RoDTEP duty refunds. The government is also contemplating a five-year extension of RoSCTL for the apparel sector to offset embedded state and central taxes on exports, the report says.Also Read | How can India offset impact of Donald Trump’s tariffs? ‘Two broad options’ to absorb shocks - explainedIndia's strategy involves diversifying its export markets beyond US dependency through Free Trade Agreements (FTAs).

Currently, amongst India's top ten export commodities, which constitute 72% of total exports, the US leads in eight categories. China dominates agricultural exports, whilst the Netherlands leads in petroleum products. Given India's higher tariff structure compared to peer economies, market diversification appears crucial. The United Arab Emirates ranks as the second-largest destination for various commodities, including electrical machinery, gems and jewellery, and iron and steel. Similarly, the UK holds the second position for pharmaceuticals and apparel exports. India has established trade agreements with both the UAE and UK, whilst pursuing FTA discussions with several other nations, including the EU, Chile, Peru, New Zealand and Oman.

India-US trade deal outlook

Barclays notes that bilateral discussions are expected to continue, with crucial meetings scheduled during PM Modi's September visit to the UN General Assembly and President Trump's October visit to India for the Quad summit.

These high-level engagements present opportunities for trade negotiations, with hopes of achieving lower tariff rates than the current 50%.

US largest export market for India

The Indian agricultural sector remains a crucial boundary in trade negotiations, primarily due to its cooperative structure and ethical considerations. India's stance on genetically modified products and US dairy items derived from animal feed continues to be clear. However, India has demonstrated commitment to enhancing bilateral trade through alternative means, particularly during Prime Minister Modi's US visit in February 2025, focusing on defence acquisitions and energy imports, says Barclays.

.png)

.png)

.png)

3 hours ago

3

3 hours ago

3

English (US) ·

English (US) ·