ARTICLE AD BOX

SIP contributions reached a record monthly figure of ₹26,688 crore in May 2025. (AI image)

I

ndia's mutual fund industry has achieved unprecedented assets under management (AUM) of ₹72.2 lakh crore as of May 2025, showing a 22.5% increase compared to the previous year.

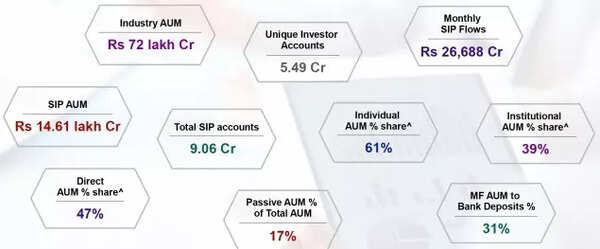

The substantial growth stems from increased investor participation and greater adoption of systematic investment plans (SIPs), demonstrating broader financial participation across the nation, according to a report released by Franklin Templeton.The industry structure shows equity-oriented funds comprising more than 60% of total AUM, whilst debt-oriented funds represent approximately 28%. The passive investment segment has expanded significantly, reaching ₹11.97 lakh crore, representing a 25% increase from the previous year and constituting 17% of the total industry AUM. SIP contributions reached a record monthly figure of ₹26,688 crore in May 2025, with aggregate SIP AUM reaching ₹14.61 lakh crore. The industry now maintains 9.06 crore SIP accounts, the report said.

India Mutual Fund Industry - Vital Stats

The asset management sector has expanded considerably outside metropolitan areas, with B30 cities now contributing 18% of total Assets Under Management. The number of investors has grown to a record 5.49 crore, showing a 19% increase year-on-year.

Individual investors dominate equity fund ownership with an 88% share, indicating strong participation from retail customers.The industry saw substantial capital raising through New Fund Offers (NFOs), collecting ₹1.01 lakh crore in the last 12 months, with equity funds accounting for 97% of the total. The highest net investments were recorded in sectoral and thematic schemes, whilst arbitrage and multi-asset hybrid categories emerged as preferred choices in their respective segments.While equity funds maintained positive net sales for 51 straight months, the equity net sales excluding SIPs and NFOs showed negative trends. Direct investments increased to 47%, driven by the rise of self-investing platforms and professional investment advisors, the report added.At the state level, Telangana recorded remarkable 32% annual AUM growth, followed by strong performances from Haryana and Uttar Pradesh.

The mutual fund sector's expansion outpaced bank deposits, with its proportion to bank deposits rising significantly to 31.2% from 12.6% over ten years.The growth trajectory of India's mutual fund sector remains strong, supported by enhanced financial awareness, favourable regulations and improved digital access. The sector shows promising prospects for continued expansion, particularly through retail participation and passive investment strategies.

.png)

.png)

.png)

6 hours ago

3

6 hours ago

3

English (US) ·

English (US) ·