ARTICLE AD BOX

India's IT heavyweights dragged down the stock market today, tracking a 2% drop in Wall Street, on concerns that AI is set to disrupt their business model.

The 30-share BSE Sensex fell as much as 1.07%, or 903.17 points, to 82,771.75 points while the broader Nifty 50 slumped 1.13%. All 16 major sectors declined at the open. Here's a look at the movers of the benchmark:

Nifty 50 Top Gainers: Bajaj Finance, HDFC Bank and Bharti Airtel

Nifty 50 Top Losers: Eternal, Hindustan Unilever, Adani Ports, Trent, Tata Steel, Reliance Industries, IndiGo, Larsen & Toubro, UltraTech Cement.

The Nifty IT index, which sends five companies—Tata Consultancy Services (TCS), Infosys, Wipro, HCL Technologies and Tech Mahindra—to the Nifty 50, is on track for the worst week since the pandemic started in March 2020.

To be sure, the unwinding of AI stocks on Wall Street is a positive for Dalal Street for the wider market lacks the outsized exposure to such trade.

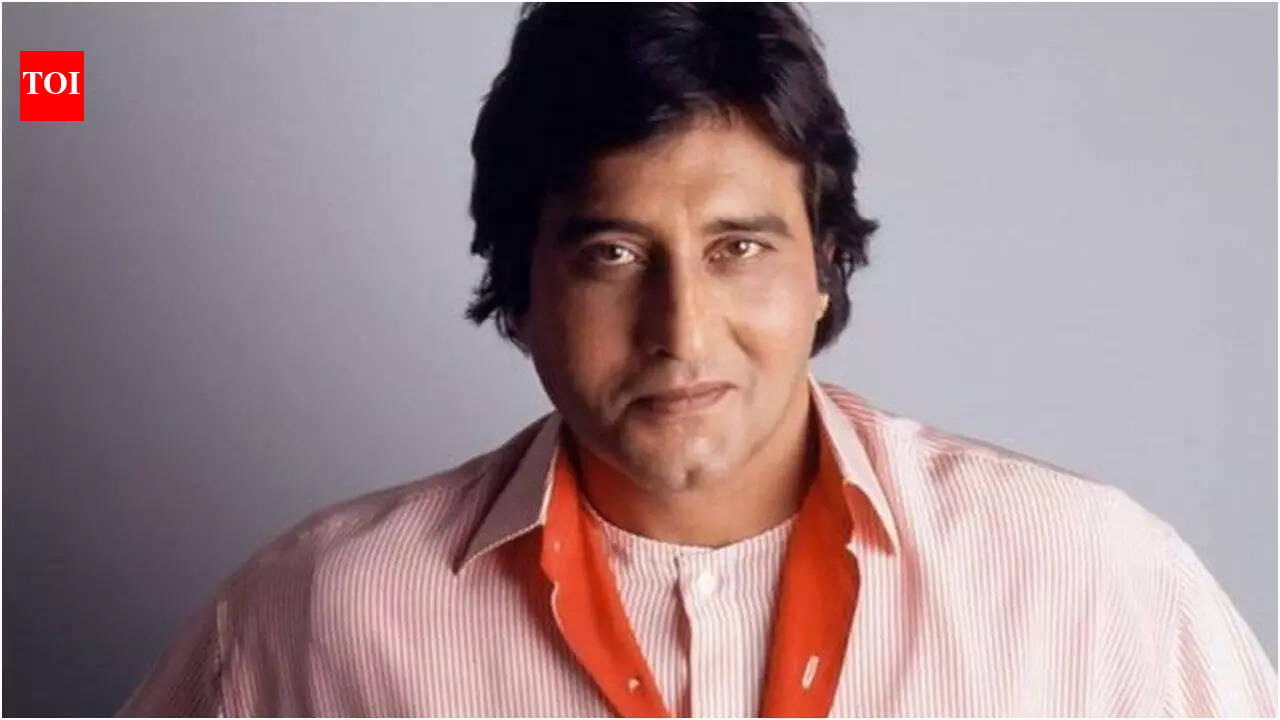

“What is rattling the Indian market now is the massive sell-off in IT stocks, which is the second largest profit pool of India Inc.,” V.K. Vijayakumar, chief investment strategist at Geojit Investments Ltd., told HT Business in an emailed statement. The real impact of the ‘Anthropic shock’ on the IT sector is yet to be ascertained".

Meanwhile on Thursday, foreign institutional investors bought equities worth ₹108.42 crore while domestic institutional investors bought stocks worth ₹276.85 crore, according to exchange data.

1 hour ago

4

1 hour ago

4

English (US) ·

English (US) ·