ARTICLE AD BOX

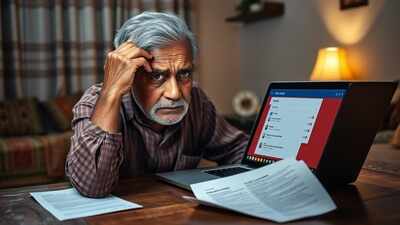

I struggle to understand my online banking. The interface is confusing, and the insurance document is overwhelming.

HYDERABAD: What began as a routine health insurance payment turned into a two-year battle for 69-year-old Vanga Krishna Reddy, involving two banks, an insurance firm, and eventually a consumer court.A single-digit error while transferring Rs 52,659 online for policy renewal in June 2023 led to the amount being transferred into a wrong account - and staying there.Krishna Reddy, a Peerzadiguda resident, used his bank's app to pay for his health insurance renewal three days before the deadline. In haste, he mistyped one digit of the beneficiary account number. The amount didn't reach the insurer.

Realising the mistake, he immediately made a second payment with correct details to keep the policy active.

But the first transaction of Rs 52,659 was lost in digital limbo. Krishna Reddy acted quickly and informed the bank. "They said they'd look into it. But after that, there was complete silence," he stated. His bank initially acknowledged the mistake and raised a chargeback with the receiving bank. But things stalled when the other bank replied: "Customer cannot be contacted for obtaining debit confirmation."Reddy approached the Ranga Reddy District Consumer Disputes Redressal Commission in May 2024.

During hearings, his bank claimed it followed procedure and bore no fault. The other bank failed to appear. The commission ruled both banks guilty of service deficiency. It said even if the customer erred, banks are responsible for verifying mismatches between account numbers and beneficiary names. The two banks will jointly refund the 52,659 with 10% annual interest.

.png)

.png)

.png)

3 hours ago

2

3 hours ago

2

English (US) ·

English (US) ·