ARTICLE AD BOX

Banking operations at public sector banks across India are facing widespread disruption on Tuesday, as the United Forum of Bank Unions (UFBU) went ahead with a nationwide strike.

The strike comes as unions demand the immediate implementation of a five-day work week, a long-standing request that has yet to be formalised by the government. The move is expected to affect branch-level services for five consecutive days, with banks already closed on January 23 (Basant Panchami), January 24 (FourthSaturday), January 25 (Sunday), and January 26 (Republic Day).The UFBU, an umbrella body of nine unions representing bank officers and employees, had held conciliation meetings with the chief labour commissioner on January 22 and 23.

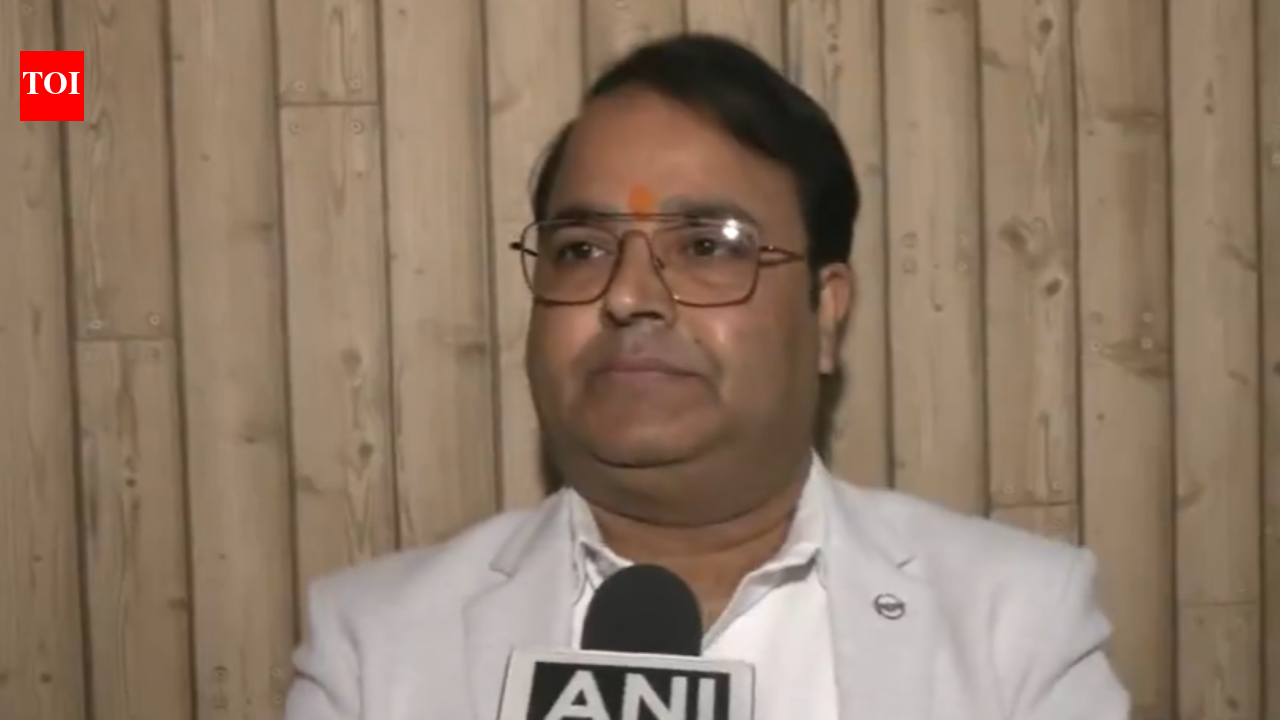

However, union leaders said these talks failed to provide any assurance regarding their demands. “Despite detailed discussions during the conciliation proceedings, there was no assurance on our demand. Hence, we have been compelled to proceed with the strike action,” said C H Venkatachalam, general secretary of the All India Bank Employees Association (AIBEA), a UFBU constituent, to PTI.Union leaders emphasise that the strike is not aimed at inconveniencing customers, but at promoting a humane and sustainable banking system.

10 things to know about the strikeWho is striking? The strike has been called by the United Forum of Bank Unions (UFBU), which includes nine major unions representing officers and employees of public sector banks.Why are they protesting? Unions are demanding the implementation of a five-day work week, which would make all Saturdays holidays in public sector banks.The contention: reportedly the proposal for Saturday holidays was agreed during the 12th Bipartite Settlement with the Indian Banks’ Association (IBA) in March 2024, but the government notification is still pending.Impact on branch services: Branch-level operations like cash deposits, withdrawals, cheque clearances and administrative work will be affected at public sector banks, including SBI, PNB, and Bank of Baroda.Effect on private banks: Major private sector banks such as HDFC Bank, ICICI Bank, and Axis Bank are expected to remain largely unaffected, as their employees are not part of the unions participating in the strike.Digital banking: Digital services, including UPI, internet banking, and mobile banking, will continue to function. However, ATM cash availability may face localised delays due to logistical issues.Union stance on customers: Leaders say the strike is aimed at improving workforce efficiency and financial stability, not disrupting services for customers.“This movement is not against customers, but for a sustainable, humane, and efficient banking system.

A rested banker serves the nation better,” said L Chandrasekhar, general secretary of NCBE.Government and banks’ preparations: An urgent meeting chaired by the secretary, department of financial services, with SBI officials, MDs of nationalised banks, and the IBA CEO, was held to ensure smooth operations, including government transactions and business correspondent services.Precautionary measures: Banks have confirmed that ATMs are loaded with sufficient cash, and timely replenishment arrangements have been made.

While branch work may be affected, digital channels are expected to function normally.Official advisories: Several public sector banks, including SBI, have informed stock exchanges about the strike. SBI in a statement said, “While the bank has made necessary arrangements to ensure normal functioning in its branches and offices on the day of strike, it is likely that work may be impacted.”

3 hours ago

4

3 hours ago

4

English (US) ·

English (US) ·