ARTICLE AD BOX

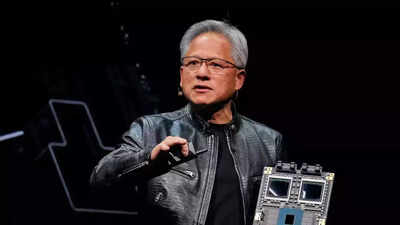

Nvidia CEO Jensen Huang (File photo)

Nvidia CEO Jensen Huang has a 'happy message' for worried and anxious investors of four of the biggest American technology companies -- Google, Microsoft, Meta and Amazon. Taking a question on investors worry about technology companies increasing Capital Expenditure due to spending on artificial intelligence (AI) infrastructure, Jensen Huang said that the level of expenditures is appropriate and sustainable.

Despite posting strong results, Google, Microsoft, Meta and Amazon are facing concerns that they are overspending on data centers.Huang told CNBC that the build-out of artificial intelligence infrastructure will continue for seven to eight years, saying that demand for AI is “just incredibly high.” “AI has become useful and very capable,” Huang said. “The adoption of it has become incredibly high.” Huang argues that artificial intelligence is already paying off for its adopters — and those customers would be doing even better if they had more data centers.Nvidia CEO said that he is not worried that the technology industry will add too much capacity. Unlike with the first build-out of the internet, there’s no infrastructure sitting idle. Companies like Anthropic PBC and OpenAI are generating profitable revenue, he said.

Why Big Tech investors $650 billion 'headache' is making Nvidia 'happy'

Heavy capital spending by the world’s biggest tech companies has alarmed investors in the wake of earnings reports. The market value of Google, Microsoft, Meta and Amazon has declined by close to $1 trillion in total during past few days.

Amazon, along with Google parent Alphabet, Meta Platforms, and Microsoft, are expected to shell out roughly $650 billion for AI tools in 2026, about 60% more than the prior year. In fact the $650 billion number that is spooking the investors of these technology companies is what is surging Nvidia shares. As much of that spending will flow to Nvidia, which makes data center processors that help develop and run AI models. Nvidia shares closed 7.8% higher on February 7, its best day since April 9, adding roughly $325 billion in value. This is the fourth-largest one-day market cap gain for a stock ever. This rise in stock price snapped a five-day losing streak for Nvidia, which erased about $500 billion amid a broader selloff as software and technology shares tumbled past week.

1 hour ago

4

1 hour ago

4

English (US) ·

English (US) ·