ARTICLE AD BOX

NEW DELHI/MUMBAI: Aiming to set off a “cracker of a Diwali”, as Prime Minister Narendra Modi put it, the proposed rationalisation of Goods and Services Tax (GST) rates could provide a lift to the struggling packaged foods sector by boosting consumption and reviving urban demand.

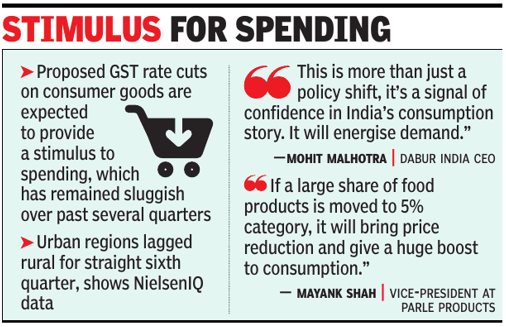

Diwali, traditionally the peak season for household and discretionary spending in India, could see a sharper rebound with potential reforms and lower prices.Under GST reforms, govt plans to scrap existing GST slabs of 12% and 28%, and keep only two rates, 5% and 18%, excluding sin goods. A majority of the goods in the 12% category are expected to move to 5%, while items in the 28% bracket may be taxed at 18%, experts say.The proposed GST rate cuts on consumer goods are expected to provide a stimulus to spending, which has remained sluggish over the past several quarters. A long spell of tepid urban demand coupled with unseasonal showers and early monsoons — which washed out summer sales of consumer goods — weighed on consumption, which is yet to see a broad-based recovery. Recent data by NielsenIQ showed that urban regions lagged behind rural for the straight sixth quarter.

Stimulus For Spending

With consumption accounting for about 60% of GDP and serving as the mainstay of India’s domestic demand, the impact of GST cuts could be significant. Any benefit from GST reduction will have to be passed on to consumers, translating into lower retail prices, experts pointed out. “As the festive season approaches, this move will help improve sentiments and put more purchasing power directly into the hands of millions of Indian families.

This is more than just a policy shift, it’s a signal of confidence in India’s consumption story. It will energise demand, ease the burden on households and catalyse growth for branded FMCG products,’’ Dabur India CEO Mohit Malhotra told TOI .Reforms build on recent pro-growth measures, including income tax cuts for the middle-income group, cut in interest rates, revival in govt capex and others could help cushion the economy against uncertainties stemming from external factors, such as US tariff pressures, analysts from I-Sec say.“In food space, many products are currently taxed at 12% and 18%. If a large share of food products is moved to the 5% category, it will bring price reduction and give a huge boost to consumption,” said Mayank Shah, vice-president at Parle Products, maker of Monaco and Hide & Seek biscuits. Dalal Street cheered the move with consumer stocks ending in the green on the exchanges on Monday.Staples are expected to attract a lower levy, while discretionary products a higher rate of 18%.

.png)

.png)

.png)

6 hours ago

3

6 hours ago

3

English (US) ·

English (US) ·