ARTICLE AD BOX

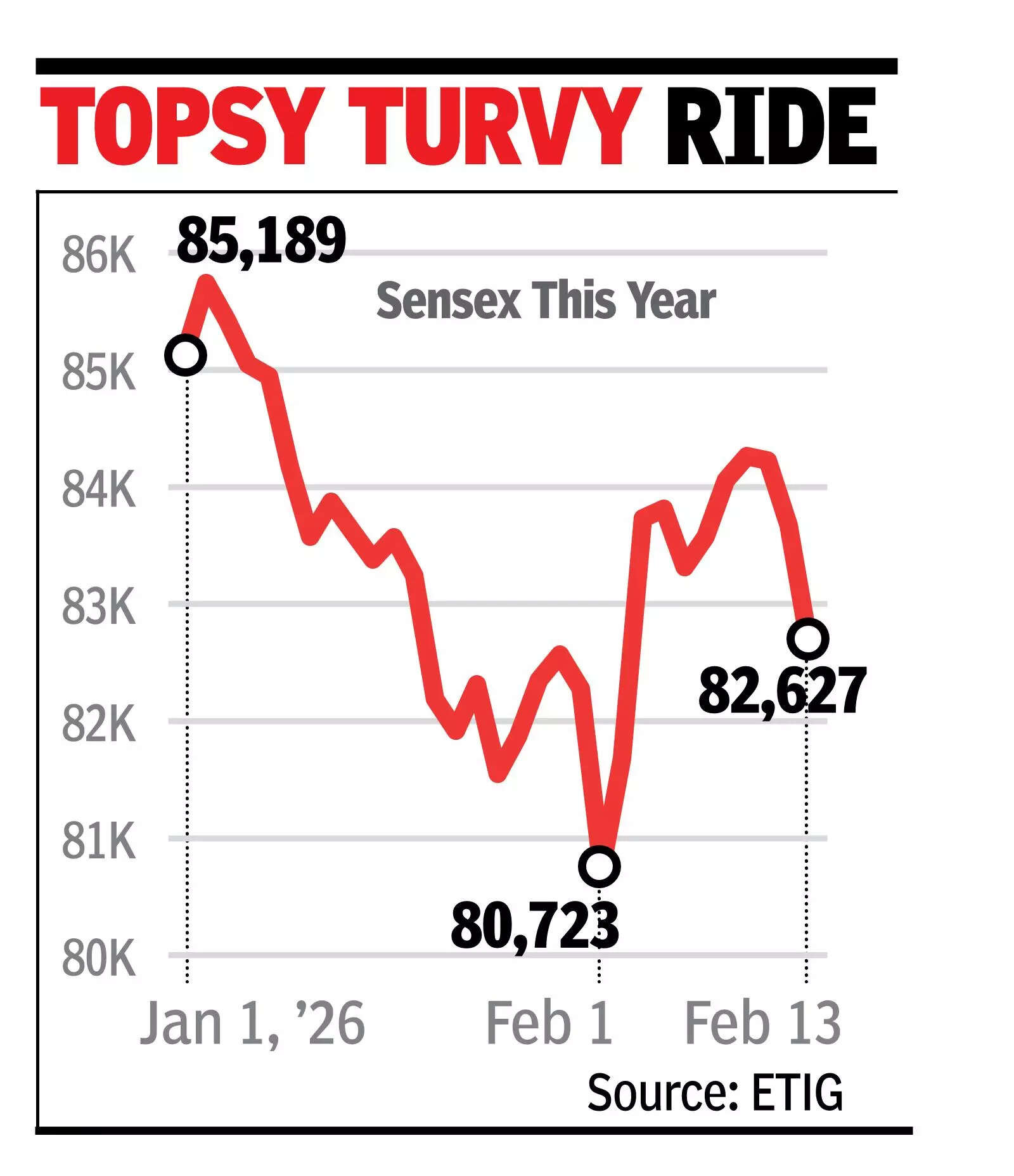

MUMBAI: Across the board selling, compounded by the recent sell-off in technology stocks around the world, pulled sensex down by 1,048 points (1.25%) on Friday. The index closed at 82,627 points.

The offloading, mainly from foreign funds, came on the back of an overnight sell-off on Wall Street for which analysts and market players are using various monikers like AI-unwinding trades, AI-scare trades etc.Following the overnight sell-off in US markets, the day's session on Dalal Street started on a weak note with the sensex down over 750 points. For most of the session, it remained in the red but in a narrow range only to dive sharply near the close of the session.The day's selling was led by foreign funds that net sold stocks worth nearly Rs 7,400 crore, BSE data showed. On the other hand, domestic funds net bought stocks worth Rs 5,554 crore, but that was not enough to arrest the day's slide in the indices.

Among sensex stocks, HDFC Bank and Reliance Industries contributed the most to the day's loss. Among the IT stocks, TCS closed 2.2% lower, Infosys was down 1.3% while HCL Tech closed 1.4%.

The slide in IT stocks pulled BSE's IT index down by 1.7%.The (IT) sector continues to face headwinds amid rising concerns that rapid AI advancements could disrupt traditional service models and weigh on future revenue visibility, said Siddhartha Khemka of Motilal Oswal Financial Services. The day's selling left investors poorer by Rs 7 lakh crore with BSE's market capitalisation now at Rs 465.5 lakh crore, official data showed. Of the 30 sensex stocks, 28 closed in the red with Bajaj Finance and SBI the two gainers. In the broader market, however, the advance-decline ratio was not as skewed: Compared to 2,960 declines, there were 1,253 advances, BSE data showed.

1 hour ago

5

1 hour ago

5

English (US) ·

English (US) ·