ARTICLE AD BOX

MUMBAI: FM Nirmala Sitharaman has called on financial regulators to expedite the return of unclaimed assets that have accumulated across banks, insurers, mutual funds, and pension accounts. The FM stressed a coordinated approach to reconnect rightful owners or heirs with dormant funds while chairing the Financial Stability & Development Council (FSDC) meet here on Tuesday.

The plan includes district-level outreach camps involving multiple agencies.

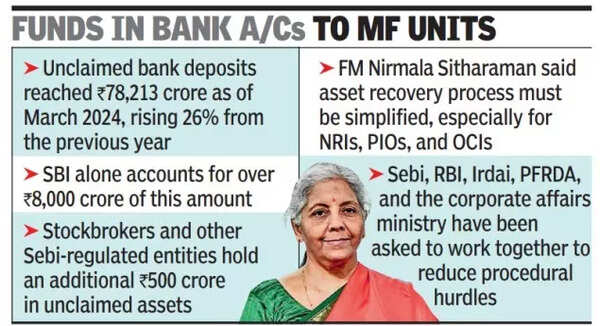

The FSDC functions as the main platform for dialogue between the finance ministry and regulators. Tuesday's meeting was attended by RBI governor Sanjay Malhotra, Sebi chief Tuhin Kanta Pandey and ministry officials. These assets have grown due to outdated contact details, incomplete documentation, or unreported deaths. Unclaimed bank deposits reached Rs 78,213 crore as of March 2024, rising 26% from the previous year.

RBI holds these balances under its Depositor Education and Awareness Fund. SBI alone accounts for over Rs 8,000 crore of this amount. Stockbrokers and other Sebi-regulated entities hold an additional Rs 500 crore in unclaimed assets, spread across idle funds and securities.

Several demat accounts and mutual fund units remain inaccessible because of incomplete nominations or lack of awareness.Based on a review of cybersecurity rules, and suggestions from Financial Sector Assessment Programme 2024-25, the FSDC discussed creating a dedicated cybersecurity plan.

This area has received emphasis in the wake of the surge in cyberattacks following the India-Pakistan conflict.The council also discussed expanding both the access and coverage of factoring services as well as the use of account aggregators which improves financial inclusion and can reduce unclaimed assets. It also discussed creating frameworks to assess and improve the responsiveness of regulations and proposed prescribing common KYC norms to enable digital onboarding, especially for NRIs, PIOs and OCIs in Indian markets.She said the asset recovery process must be simplified, especially for NRIs, PIOs, and OCIs. Sebi, RBI, Irdai, PFRDA, and the corporate affairs ministry have been asked to work together to reduce procedural hurdles. A standardised KYC framework and uniform nomination systems are part of the plan.

.png)

.png)

.png)

1 day ago

8

1 day ago

8

English (US) ·

English (US) ·