ARTICLE AD BOX

Tariffs are not cost-free. Prices for tariff-sensitive goods—furniture, clothing, and steel—have started to climb in US.

It's $50 billion and counting: President Donald Trump’s aggressive tariff campaign has, so far, yielded significant financial gains for the US government.TL;DR

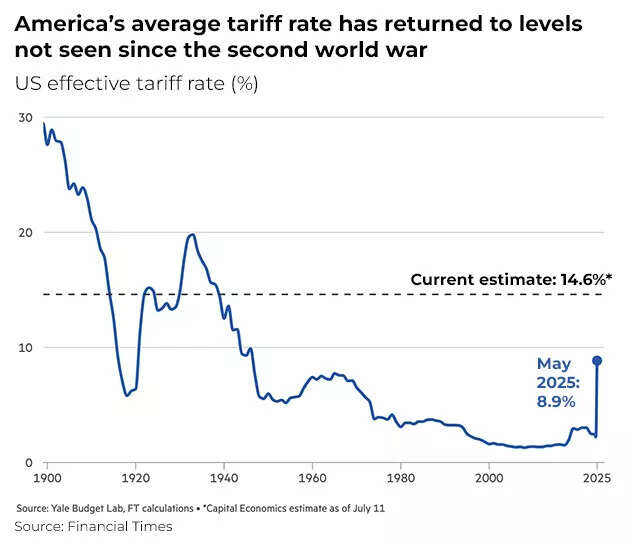

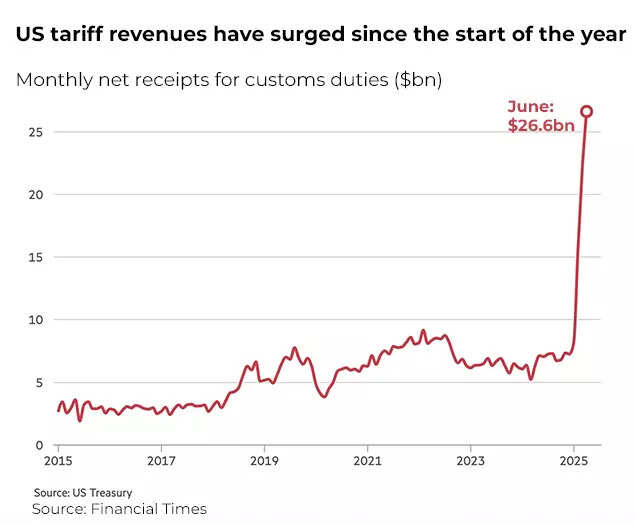

- Trump’s tariffs have brought the US a record surge in customs revenue-$64 billion in Q2 2025.

- The US is effectively using its dominant consumer market position as leverage in trade disputes.

- Global supply chains are absorbing some costs, and many global brands are spreading tariff price hikes across markets, not just US consumers.

- The strategy has led to only modest inflation so far but hints of rising prices in tariff-affected goods are emerging.

- The world is watching what happens as the next tariff deadlines approach, with the risk of escalation always present.

- For now, Trump’s approach is delivering short-term wins, but long-term costs and risks are quietly building beneath the surface.

TACO vs WACO: When tariffs roared and the world whisperedThe summer of 2025 finds America emboldened, its trade war chest swelling as most foreign capitals recoil from Trump’s escalating tariff agenda.

Four months after launching sweeping tariffs-10% on global imports, 50% on steel and aluminum, and 25% on autos-America’s trading partners have, largely, folded rather than fought.

Only China and Canada have dared retaliation, but both have retreated under pressure, wary of a president whose critics once jeered him as "Trump always chickens out (TACO).” Instead, Trump has pocketed nearly $50 billion in extra customs revenues, racking up a record $64 billion in duties during the last quarter alone, according to a Financial Times report. As per the Financial Times reports: “Only China and Canada have dared to hit back at Washington,” with the duties imposed worldwide on American exports representing “a tiny fraction of the US revenue during the same period.” Instead of a global front, most nations opted for negotiation and delay, with the European Union repeatedly deferring countermeasures in hopes of securing a deal by Trump’s self-imposed August deadline.

So far, it seems to be a case of WACO-World always chickens out and not TACO.

Why it matters

- The world’s reluctance to hit back reflects the dominant economic clout of the US as the world’s largest consumer market, the complexity of global supply chains, and the political and security considerations driving some US allies to tread cautiously.

- For now, the US is collecting billions in additional revenue and maintaining leverage as it pushes trade partners toward better terms.

- The lack of retaliation offers Trump clear political cover to double down ahead of his August 1 tariff escalation deadline. Countries like the EU and Mexico have opted for diplomatic delay tactics rather than confrontation.

- But economists warn that the costs-rising consumer prices, potential business cutbacks, and slower job growth-may quietly mount over time, sounding a cautionary note on the sustainability of Trump’s tariff strategy.

The reluctant retaliatorsAs per the FT report, even China - the world’s export giant - only managed a 1.9% increase in customs receipts from its counter-tariffs this past year-an anemic haul compared to the US surge. In May, Chinese exports to the US cratered by a third after tariffs soared to 145%, before both countries agreed to a 90-day pause, dialing rates back to 30%. Canada’s bravado proved similarly fleeting: after imposing C$155 billion in retaliatory tariffs, Prime Minister Mark Carney retreated, axing a digital services tax and declining to mirror Trump’s latest tariff hikes. As Dan Nowlan, a Canadian political adviser, put it: “Carney’s ‘elbows up’ rhetoric worked during the election campaign, but we can’t be confrontational with the US. It’s now a much more realist approach.

”For many countries, submission has been less about courage and more about cold calculus. “Unlike the 1930s when countries had more balanced trading relationships, today’s world features a hub-and-spoke system with the US at the centre,” Marta Bengoa of City University of New York told FT. “That makes retaliation economically less desirable for most countries, even when it might be politically satisfying.”The economic case for chickening outWhile the specter of retaliatory spirals haunts the halls of history, today’s global order is different.

“I’d like to think leaders were learning the lessons of history, but I fear that’s optimistic,” Alexander Klein, economic historian at the University of Sussex, told FT. “More likely, the EU, Canada and many other governments fear the hit to global supply linkages and inflation from escalation. Trump cares less about that, so is taking advantage.

”Between the threat of lost access to the world’s largest consumer market and the risk of still higher tariffs, America’s partners have chosen deterrence by deference.

The EU’s latest list of potential counter-tariffs, targeting €72 billion in US goods, notably omitted specific rates-a peace offering to avoid Trump’s ire.In a phrase that captures the nervous uncertainty, an EU official acknowledged that trade talks now “affect the whole spectrum of US relations including those regarding security,” particularly at a time when Europe needs support for Ukraine.Tariffs beginning to bite, but not break

- While inflation remains manageable, early signs show tariffs are quietly pushing prices up on key imported goods like furniture and clothing, per June inflation data.

- UBS reported the fastest price jump in core goods (excluding autos) in three years

- Economists estimate tariffs could eventually shave $2,800/year off US household income

- “Tariffs are beginning to bite,” said Omair Sharif of Inflation Insights.

- “It could become self-reinforcing,” added economist Isabella Weber of UMass Amherst.

- Fed officials acknowledge the impact is just beginning. “It’s still early days for the effects of tariffs,” said New York Fed President John Williams this week. “I expect those effects to increase in coming months.”

- The full burden is not landing at once, as brands and retailers distribute costs globally or absorb them with slimmer margins. “Global brands can try and swallow some of the tariff cost through smart sourcing and cost savings but the majority will have to be distributed across other markets, because US consumers might swallow a 5 per cent increase, but not 20 or even 40,” Simon Geale of supply chain consultancy Proxima told FT.

- Major US banks, flush with profits, note that consumer resilience has so far exceeded expectations, though Citigroup CEO Jane Fraser cautioned, “We have seen pauses in capex and hiring amongst our client base.”

- Wells Fargo CEO Charles Scharf added: “Many have found ways to avoid passing the 10% tariffs on to their customers... they are preparing for the downside and are not growing inventories or hiring aggressively.”

What’s next?Trump is pressing hard for more deals.

In an interview, he claimed deals with India are “very close” and suggested a possible agreement with the EU, though talks with Canada remain uncertain. Meanwhile, the White House is preparing to impose 10% to 15% tariffs on over 150 smaller countries as part of a broader trade shakeup, signaling continuing pressure on global supply chains, a Bloomberg report said.Whether the rest of the world will muster unified resistance remains to be seen. Diplomatic sources note that the August 1 tariff deadline is a critical moment: if Trump raises tariffs to 30% as threatened, the EU and others may feel they “have nothing to lose,” potentially sparking a more intense conflict. For now, the trending strategy has been de-escalation and negotiation, not retaliation.(With inputs from agencies)

.png)

.png)

.png)

5 hours ago

3

5 hours ago

3

English (US) ·

English (US) ·