Facing rising costs, falling orders, and mounting pressure from global competitors, MSMEs in the State have to now grapple with the tariffs imposed by U.S. President Donald Trump, which are likely to cripple various sectors, particularly the garment industry, finds out Mini Tejaswi. However, trade bodies bat for new markets such as Vietnam, Indonesia, South Korea

The Donald Trump administration’s recent imposition of steep tariffs, 25% in July and another 25% in August, came as a huge trade roadblock and critical threat to Karnataka’s industrial and export ecosystem — from garments to engineering goods — as they have the potential to significantly cripple the productivity and profitability.

Particularly hit will be a host of products made by the State’s Micro, Small and Medium Enterprises (MSMEs), as the landed costs of their exports will be hit by 20% to 35% with immediate effect, lament trade bodies and industry players. They are already facing rising costs, falling orders, and mounting pressure from global competitors.

Karnataka is home to close to 10 lakh MSMEs, employing around 60 lakh people across sectors such as textiles, engineering goods & electronics, auto components, leather and footwear, gems and jewellery, marine/sea products and processed foods, agro products, coffee, silk, spices, chemicals, home furnishing, handicrafts, hardware, toys, to name a few, and a large number of these firms heavily depend on U.S markets.

As per data shared by Visvesvaraya Trade Promotion Centre (VTPC), the State’s nodal agency for promoting international trade, Karnataka’s exports to the U.S have almost doubled in the last four years, from $4,625.05 million in 2021-22 to $7,898.02 million in 2024-25 (Source: DGCIS, Kolkata).

While textiles, apparel and readymade garments, remain the hardest hit in Karnataka, the tariff’s impact is far broader. Gems and jewellery exports (in Bengaluru and Mysuru) are seeing reduced demand in the U.S., while leather goods (around Bengaluru) face substitution from low-cost producers elsewhere. Engineering goods and auto components exporters are grappling with shrinking demand and higher component costs. In electronics and precision engineering, tariffs combined with elevated supply chain expenses are further squeezing margins.

Garment worker tailors clothes on sewing machines at an apparel manufacturing unit in Bengaluru. | Photo Credit: ALLEN EGENUSE J

Recently, Jitendra Chopra, president, Aluminium Extrusion Manufacturers Association of India (ALEMAI) expressed concern over Karnataka’s aluminium extrusion industry being hit by global headwinds, including volatility in raw material prices, high energy costs and mainly the 50% tariff.

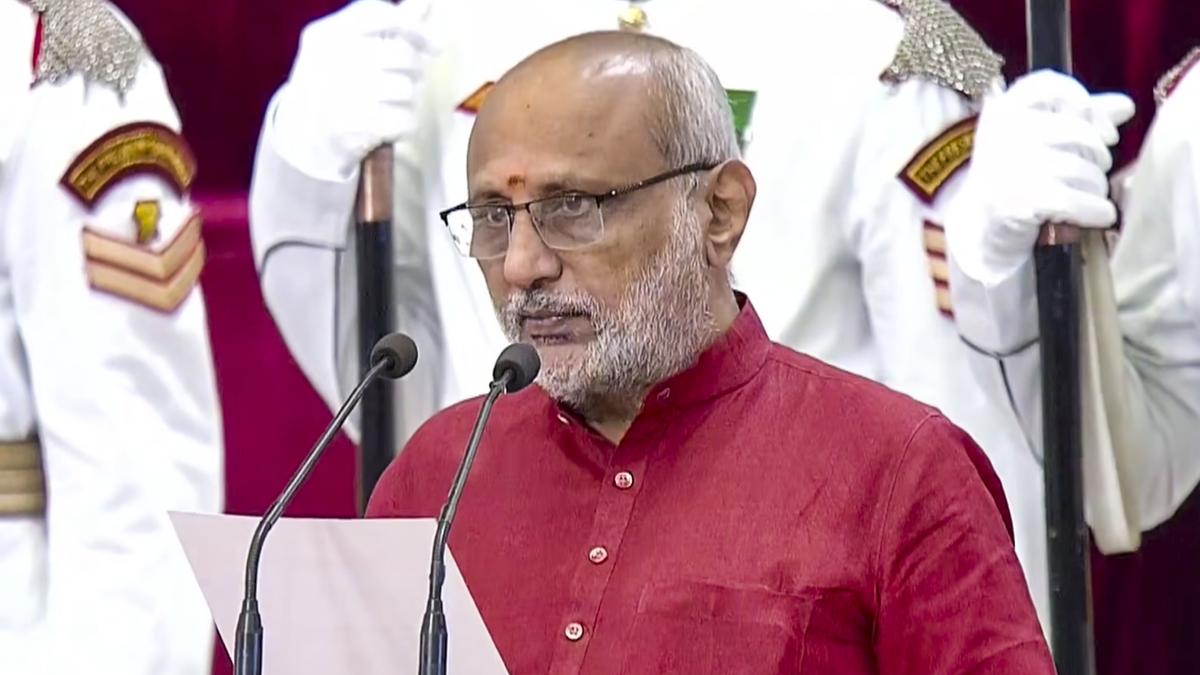

Karnataka’s Minister for Small Scale Industries and Public Enterprises Sharanabasappa Darshanapur admitted that U.S. tariffs would impact export-oriented units across multiple sectors, including garments, automobile components, aerospace products, food, etc,.

Garments the hardest hit

Karnataka accounts for nearly 20% of India’s garment exports, with Bengaluru, Ballari, and Mandya being the key hubs. “Being labour-intensive and price-sensitive, even small tariff hikes render exports uncompetitive. Competing nations such as Bangladesh and Vietnam are already gaining orders at India’s expense,’‘ observed Prashant Gokhale, president, Bangalore Chamber of Industry and Commerce (BCIC).

He argued that while importers and retailers/customers in the U.S. may initially absorb the customs tariff burden of the garment industry, eventually they would push back costs on to Indian exporters by renegotiating or demanding discounts. In some cases, part of the tariff may get passed on to American shoppers and that would increase their retail tag prices, he said.

Garment workers at work at an apparel manufacturing unit in Bengaluru. | Photo Credit: ALLEN EGENUSE J

“But in price-sensitive categories (basic T-shirts, jeans), retailers hesitate to increase prices much, so exporters end up absorbing more of the hit,’‘ said Mr. Gokhale, adding that a readymade garment that previously faced an average tariff of around 10% now confronts a total duty of over 60%. “This suggests a more than five-fold rise in landed costs, dramatically eroding the competitiveness of Indian garments in the U.S. This steep cost increase makes our products almost impossible to sell at a competitive price in the U.S market,’‘ he stated.

Some garments and apparel manufacturers in Bengaluru have even halted production amid worsening cost competitiveness and order cancellations, and payment delays have become regular, said Mr. Gokhale. This view was echoed by many industry players, who did not wish to be named when contacted by The Hindu.

“Recent analysis found consumer prices of imported apparel and footwear in the U.S. could rise by 30% to 40% in the short run, indicating significant pass-through to buyers. This said, price-sensitive contracts and wholesale channels often force Indian suppliers to absorb a portion of the shock — a combination that is lethal for low-margin MSMEs,’‘ said M.G. Balakrishna, president, the Federation of Karnataka Chambers of Commerce & Industry (FKCCI), a trade body representing thousands of MSMEs.

Karnataka exported fashion and apparel worth over $1 billion to the U.S. in 2024 as against the country’s total exports to the country at $4.8 billion.

Multiple other sectors

Karnataka is a key hub for aerospace components, auto parts, machinery, and IT hardware. Tariffs on specific product lines increase supply chain and landed costs, hitting MSMEs hardest. East Asian competitors are emerging stronger in this segment.

Karnataka produces over 70% of India’s coffee and exports roughly half of that output. The State accounts for over 50% of India’s silk industry and contributes significantly to exports. Cashew kernels, spices, handicrafts are exported extensively, and also exported are Channapatna toys, a traditional craft export from Ramanagara district, known for lacquered wooden toys. The emerging merchandise segments include semiconductors, aerospace components, and engineering goods are quickly growing in export share.

Garment worker tailors clothes at an apparel manufacturing unit in Bengaluru. | Photo Credit: ALLEN EGENUSE J

Tariffs will bring not just financial, but also operational and existential burdens on MSMEs, who mostly run on thin 5% to 10% net margins. “A tariff shock of even 10% to 25% on the U.S. side obliterates that cushion unless prices are raised or costs are cut,’‘ said Mr. Gokhale. Also, when tariffs climb to 50% range, low-margin MSMEs are also facing contract attrition as buyers try to consolidate to larger vendors who can finance long cycles and compliance. As labour-intensive units see order flight, chances of factory closures and job fears are high, he explained.

Multiple trade bodies that represent small and medium exporters from the State pointed out that MSMEs are critical to employment generation and industrial growth in hubs such as Bengaluru, Mysuru, Dharwad, and Hubballi. As export orders shrink, there’s a visible impact on jobs, women’s workforce participation, and ancillary sectors like logistics, packaging, and freight forwarding.

The Federation of Indian Export Organisations (FIEO) estimated that some 55% of India’s U.S.-bound shipments, including that of Karnataka, valued around $47 billion to $48 billion are now exposed to pricing disadvantages of 30% to 35%.

A worker arranges tailored shirts for sale at an apparel manufacturing unit in Bengaluru. | Photo Credit: ALLEN EGENUSE J

The U.S. tariffs has raised the landed cost of Karnataka’s MSME exports by 20% to 35%, depending on the product. “This has significantly reduced their global competitiveness. Buyers in the U.S. are shifting towards alternative sourcing destinations such as Vietnam, Bangladesh, and Mexico, which either enjoy preferential access or face lower tariff barriers. MSMEs in Karnataka, already operating on tight margins, are struggling to sustain orders under these conditions,’‘ Mr. Gokhale observed.

U.S. buyers, especially large retailers, are unwilling to pass on higher costs to the end consumer. As a result, exporters are facing order cancellations, renegotiated contracts, and delayed payments. Smaller MSMEs, with little bargaining power, are particularly vulnerable and unable to safeguard their business relationships, observed Mr. Balakrishna.

Industry insiders said that reduced advance payments from buyers and slower order cycles have worsened liquidity conditions. “Rising domestic input costs — spanning raw materials, energy, and logistics — have added to the burden. To sustain operations, many exporters are resorting to short-term borrowings and overdrafts, which increases their financial risk exposure and weakens long-term sustainability,’‘ said Mr. Gokhale.

Across board surcharge

B.R. Ganesh Rao, president, Karnataka Small Scale Industries Association (KASSIA), said the tariff hike acts like an across-the-board surcharge that immediately raises the landed cost of Indian products in the U.S. market. For Karnataka’s MSMEs, which typically compete on price and run thin margins, steep spike in tariffs means immediate drop in competitiveness versus low-cost Asian rivals like Bangladesh, Vietnam and Indonesia. It will lead to urgent working-capital stress as orders are renegotiated or delayed, and inventory risk where consignments already in transit face unexpected duty increases. Early trade estimates show tens of billions of dollars of Indian exports to the U.S. are affected, indicating a widespread exposure across many MSME value chains, he said.

“Legally, the importer pays the tariff, but in practice the burden is shared: U.S. buyers/retailers face higher landed costs and will often seek price concessions from suppliers or switch sources; where suppliers cannot credibly cut prices, retailers will pass most of the cost to U.S. consumers via higher retail prices,’‘ Mr. Rao explained. Empirical economic work on similar tariff shocks shows consumers do bear a material portion of the increase, but trade diversion and lost volumes are the immediate pain for MSMEs, he explained.

According to Mr. Rao, it comes with a lot more pains such as loss of market share to alternative suppliers and longer time to recover volumes, higher working-capital requirement, as buyers slow payment terms or cancel orders. It means pressure to move up the value chain (which requires capex and time), additional compliance and administrative costs (re-labelling, new HS classifications, testing to seek exemptions) and risk of permanent buyer substitution (once a buyer builds supply relationships elsewhere). These also amplify employment and liquidity stress in labour-intensive MSME clusters, he opined.

Mr. Darshanapur said the State government will assess the severity of the impact and necessary remedial measures will be put in place. “However, the Union government has to intervene to ensure necessary support to domestic exports oriented units,” he added.

Time for swift action

According to the Bangalore Chamber of Industry and Commerce (BCIC), this is a moment for swift and strategic action. The trade body said it was in constant communication with both the Central and State governments to advocate for relief measures pressing for inclusion of key demands such as special financial package for tariff-hit sectors and a review of existing export incentives. Trade bodies are also exploring avenues for technical assistance to help MSMEs streamline their operations and reduce costs, also collaborating with financial institutions to provide easier access to credit for businesses affected by the crisis.

KASSIA said it was advocating for a near-term (30 to 90 days) emergency relief plan which comprised duty-compensation packages, interest-subvention on export credit, and targeted export stimulus for labour-intensive MSMEs. It was also pushing for a medium term (3 to 18 months), which include upgrading supply-chain, training and aggregator models to move MSMEs from commodity-grade goods to higher-value niches where ad-valorem tariffs bite less.

“We will also support and coordinate with government requests for WTO consultations and legal remedies. India has already initiated consultations at the WTO on certain tariff matters and such avenues must be vigorously pursued,’‘ opined Mr. Rao. KASSIA also called for emergency export credit and duty compensation for the most exposed MSMEs, accelerated market-diversification support and urgent diplomacy to remove unjustified tariffs.

Trade bodies said they have been actively encouraging and assisting their members to diversify their export markets. Going away or reducing the dependency on their key export market (America), by focusing more on strengthening ties with the European Union, the U.K., the Middle East, and other high-growth economies, is critical. In fact, the spike in tariff came as a wake up call for MSMEs in Karnataka and it told them to stop being over-dependent on the U.S. market, said many stakeholders.

KASSIA said it would help exporters re-route to non-U.S. markets (EU, Middle East, Africa, Latin America) and ramp up e-commerce B2C channels. It would also promote collective action such as consortium shipping, pooled finance, and shared compliance labs to reduce per-unit cost. Mr. Balakrishna also urged exporters to reduce dependency on the U.S. by diversifying their export markets, meet EU benchmarks through CE certification and sustainability labels, and focus on emerging economies like Vietnam, Indonesia and South Korea.

Policy relief

However, all stakeholders say that unless supported by policy relief, export incentives, and market diversification strategies, Karnataka’s MSMEs risk losing their hard-earned global positioning, threatening both industrial growth and the livelihoods dependent on this sector. Many trade bodies anticipate that the Centre would engage proactively and negotiate with the U.S. administration in the days to come in order to safeguard business, in addition to supporting the exporter community through policy intervention, export incentives, and improved logistics and finance access.

.png)

.png)

.png)

2 hours ago

7

2 hours ago

7

English (US) ·

English (US) ·