ARTICLE AD BOX

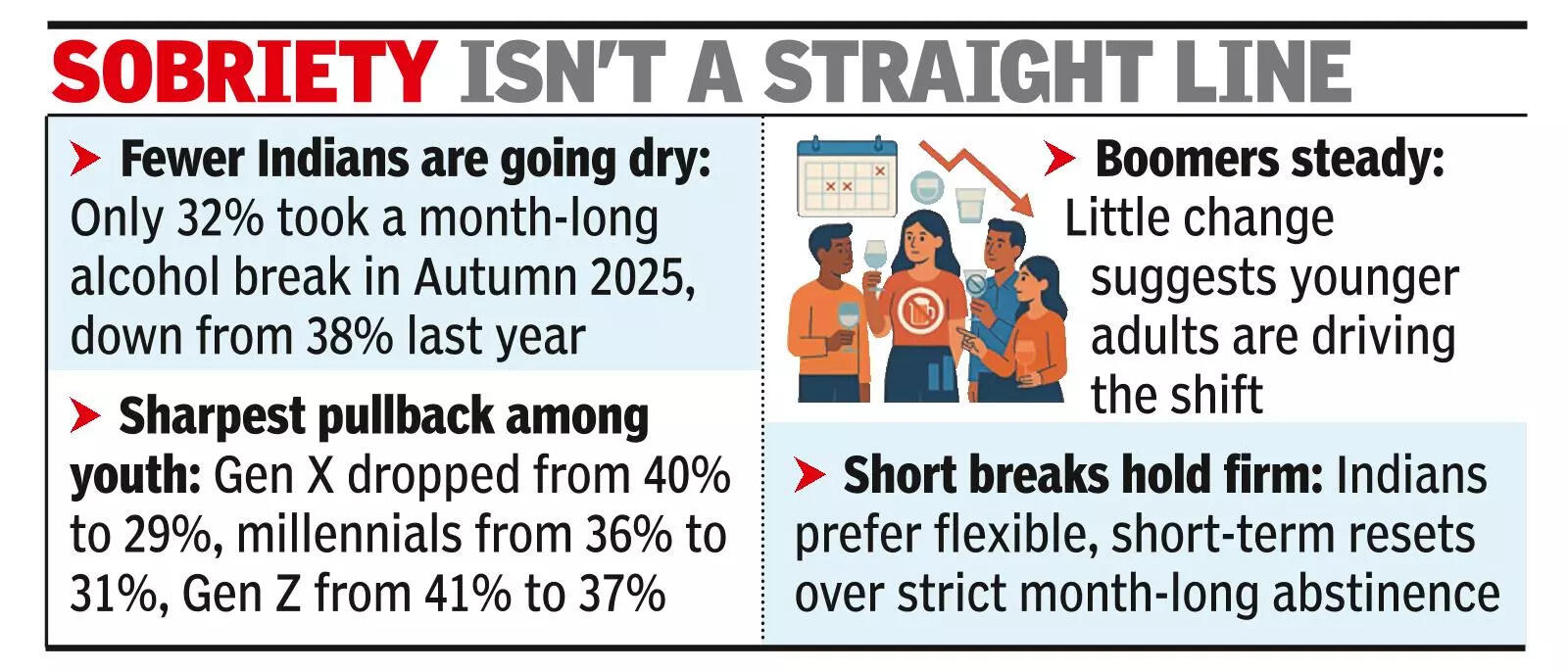

BENGALURU: India's urban drinkers are cooling on month-long alcohol breaks, even as the "sober curious" wave rises in Western markets. About 32% urban drinkers went dry for a month or more in Autumn 2025, down from 38% a year ago, IWSR Bevtrac data shared exclusively with TOI showed.

The pullback is sharpest among younger legal-age consumers. Gen X participation in month-long breaks fell from 40% to 29%. Millennials slipped from 36% to 31%. Gen Z drinkers eased from 41% to 37%. Boomers were largely unchanged, underlining that the shift is being driven by younger adults, not older cohorts. IWSR defined generational cohorts in India as Gen Z for those aged 21-28, millennials aged 29-44, Gen X 45-60, and boomers 61 as of Sept. "Similar declines in month-long abstinence are evident among younger legal-age drinkers in several markets covered in the Bevtrac survey, including the UK and Australia. The results from India are unique, however, because they are observed across multiple generations," IWSR president Marten Lodewijks told TOI.

The findings point to a clear loss of appetite for long abstinence spells among city drinkers. The Bevtrac survey is conducted twice yearly across 15 major markets, including India, with a total sample of over 26,000 qualified respondents.

Respondents from India were adults aged over 21, with a monthly household income of over Rs 30,001 before taxes, and representative of the 11 metro areas. Shorter breaks, however, were holding firm.

Data suggested many Indians are moderating their drinking rather than committing to strict "dry Jan"-style pledges. Consumers appear to prefer shorter, flexible resets that fit around work, festivals, and social events.

India still ranked high on temporary abstinence compared with other major drinking markets tracked by IWSR, followed by Brazil at 31% and Mexico at 29%. But the latest data indicated that the country is carving its own path as global brands talk up low- and no-alcohol launches and wellness-led campaigns. For drinks companies, the message is nuanced. On one hand, Indian drinkers are becoming more selective and more informed.

Premium products, at-home occasions, and experimentation with styles such as craft spirits and ready-to-drink formats continue to shape urban consumption. On the other hand, the fading popularity of month-long breaks shows a limited appetite for rigid sobriety trends imported from the West. "India's drinking population is undoubtedly becoming more sophisticated, and the Indian market is increasingly central to the business plans of the international drinks industry," Lodewijks added.

3 hours ago

3

3 hours ago

3

English (US) ·

English (US) ·