ARTICLE AD BOX

Shares of Vardhman Textile rose as much as 9.38% to Rs 447.80 apiece, closely followed by Welspun Living shares which spiked 6.40%.

19 Aug 2025, 11:03 AM IST i 19 Aug 2025, 09:53 AM IST 19 Aug 2025, 11:03 AM IST

Textile stocks spike. (Stock market. Photo source: Freepik)

Summary is AI Generated. Newsroom Reviewed

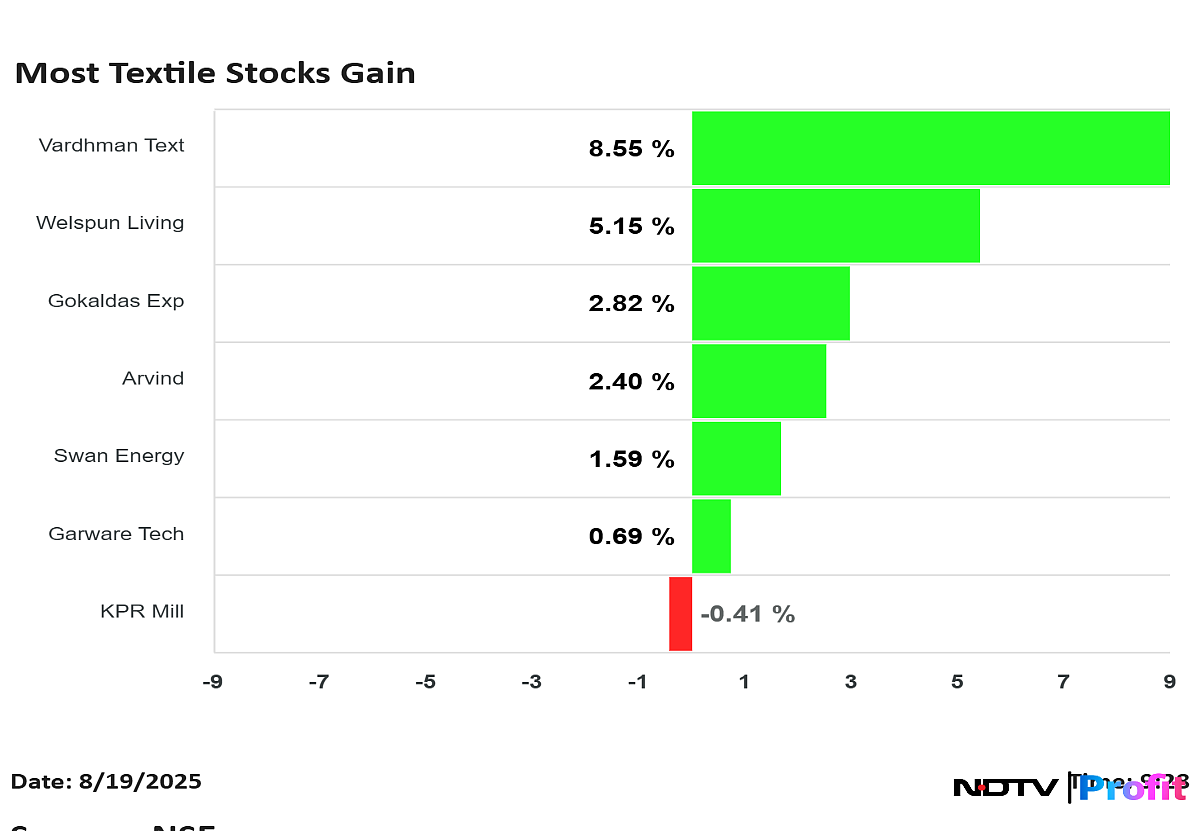

Textile stocks including Vardhman Textile Ltd., Welspun Living Ltd., Gokaldas Exports Ltd. surged on Tuesday following a Gazette notification on removal of 11% duty on raw cotton.

Shares of Vardhman Textile rose as much as 9.38% to Rs 447.80 apiece, closely followed by Welspun Living shares which spiked 6.40% intraday to trade at Rs 124.6 apiece.

Gokaldas Exports Ltd. share price rose 3.57% at day's high to trade at Rs 752 apiece. Arvind Ltd. rose as much as 2.95% to Rs 301.90 apiece.

The notice said that the 11% duty on raw cotton imports will be removed for a period of 42 days till September 30. This exemption is understood to benefit the textile chain including yarn, fabric, garments and made-ups and is also likely to provide temporary relief to the textile industry.

In the Gazette notification the government said the move was "necessary", "in public interest", which is seen as a response to the recent tariffs announced by the US.

The government’s decision to temporarily waive import duties on cotton comes amid mounting pressure from Indian exporters, who are grappling with elevated raw material costs and tariff challenges in the US market.

Industry bodies had raised concerns that high cotton prices, combined with existing duty structures, were undermining the competitiveness of labour-intensive sectors like apparel and home textiles. By suspending the duty, authorities aim to ease raw material supply and support export momentum ahead of the festive season. However, officials clarified that the relief is temporary and will expire on September 30, unless extended.

Stock Market LIVE: Sensex Gains Over 200 Points, Nifty Rises As RIL, Airtel Shares Lead

.png)

.png)

.png)

6 hours ago

2

6 hours ago

2

English (US) ·

English (US) ·