ARTICLE AD BOX

Donald Trump slams tech billionaire Elon Musk on the official launch of his new party called ‘America Party’ amid his ongoing public feud. Donald Trump called the Tesla CEO a ‘train wreck’ for proposing a new third-party movement.

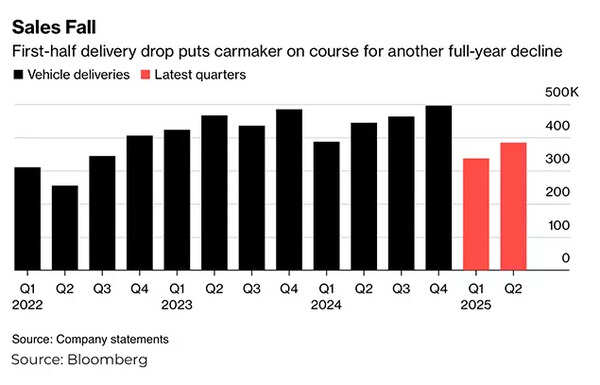

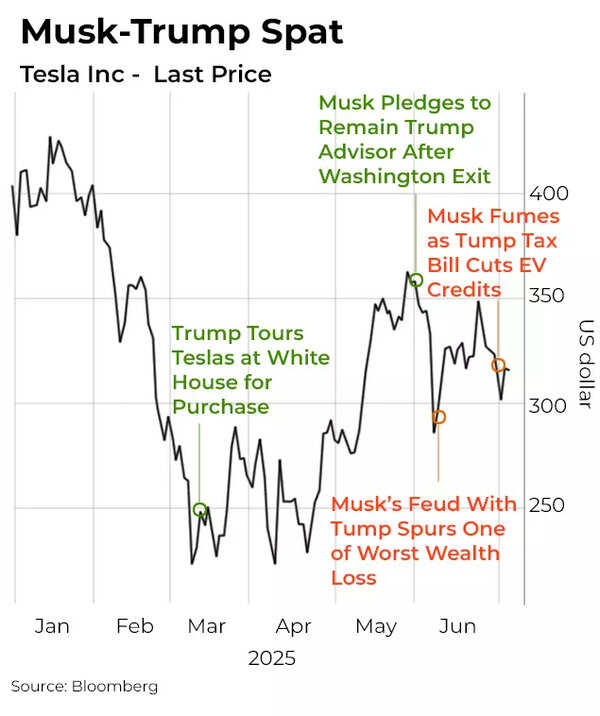

Tesla shares saw a steep decline among S&P 500 stocks on Monday, after tensions between CEO Elon Musk and US President Donald Trump flared up again over the weekend. Once a key Trump ally and major donor, Musk announced plans to launch a third political party in response to the Republican-backed spending bill passed last week.Driving the news Musk introduced the “America Party” on Saturday following an escalating clash with Trump over his tax-cut and spending package.The timing of Musk’s political pivot added to market unease, coming just days after Tesla reported its second consecutive quarterly decline in vehicle deliveries-a sign of mounting pressure from intense competition and an aging product lineup. "Investors are worried about two things – one is more Trump ire affecting subsidies and the other, more importantly, is a distracted Musk," said Neil Wilson, UK investor strategist at Saxo Markets. Tesla stock, which peaked in December after Trump’s re-election win, has since dropped 35%, the steepest decline among the so-called “Magnificent Seven” group of high-growth US tech giants.Why it matters

- As his public feud with President Trump intensifies and his political value to Beijing diminishes, Musk finds himself caught in a geopolitical squeeze with potentially existential stakes for Tesla.

- Since January this year, Musk has been a prized figure in both capitals: a symbol of innovation in China’s booming EV sector and a direct line to the White House under Trump.

- But today, he’s politically isolated in Washington, increasingly outpaced in Shanghai, and facing waning influence in both.

- Tesla’s growth engine is stalling-and the political winds that once pushed it forward are now turning against it. Trump’s tax reforms have stripped billions in subsidies that once boosted Tesla. Meanwhile, China has elevated domestic EV rivals like BYD and Xiaomi, relegating Tesla to the sidelines in a market it once helped ignite.

- Tesla’s future as a global EV leader hinges on how Musk navigates these dual breakdowns. Neither Trump nor Chinese President Xi has publicly written him off, but both are now making moves that sideline Musk’s once-central role.

The big pictureTesla is no longer the darling it once was. In the US, Tesla’s vehicle sales are sliding fast. Deliveries dropped 21% in Q2, according to Cox Automotive, marking the second consecutive year of decline.

Tesla’s market share of US EV sales has plummeted from over 75% in 2022 to under 50% as of 2024. Even in California, a deep-blue stronghold for EV adoption, Tesla registrations dropped for four straight quarters-much of it blamed on Musk’s polarizing politics.In China, the world’s largest EV market, Tesla is being squeezed even harder. May sales dropped 30% year-over-year, and its market share in the EV and plug-in hybrid category fell to just 4%, down from 11% in 2021, per China Passenger Car Association data.

By contrast, BYD commands a dominant 29% of the market.

As per a WSJ report, Tesla’s competitive edge is eroding, and fast. Chinese consumers now favor flashier, cheaper, and more tech-savvy cars from domestic brands. Features like in-car refrigerators, multiple screens, selfie cameras, and instant smartphone syncing-once afterthoughts-have become must-haves.Between the linesMusk’s troubles in China go beyond sales figures-they’re rooted in trust, regulatory red tape, and shifting strategic value.For years, Beijing treated Tesla as a catalyst-offering cheap land, tax breaks, and a first-mover advantage in a bid to jumpstart its own EV ecosystem. It worked. Local firms studied Tesla’s playbook and leapfrogged. Now, with the mission accomplished, China no longer needs to elevate Musk as a figurehead.And Musk hasn’t helped his own case. Despite direct meetings with Premier Li Qiang and Vice President Han Zheng, Chinese regulators still haven’t greenlit Tesla’s Full Self-Driving (FSD) software.

Officials say the AI-based system-trained mostly on US road data-poses national security and safety risks. Tesla’s workaround attempts, including limited over-the-air updates, were slapped down. Regulators even accused the company of using Chinese drivers as “guinea pigs” without proper clearance.Tesla’s China team has repeatedly warned headquarters about lagging product appeal and feature gaps. Yet internal pleas to localize more functions-like integrating Chinese voice assistants or building a distinctly Chinese Tesla-were mostly dismissed.

As a result, Musk’s once-iconic cars now appear outdated in China’s fast-evolving market, the WSJ report said.Musk's public spat with Trump has further eroded his utility for the Chinese dispensation. As per the WSJ article, "Because of the Musk-Trump feud, Beijing no longer views the Tesla chief executive as a geopolitical asset and will shy away from publicly courting him, the people said."Zoom in

Musk’s feud with Trump is further complicating Tesla’s path forward.Musk once held rare influence in Trump’s Washington, heading DOGE -a federal efficiency task force - and securing green-energy incentives that became vital to Tesla’s bottom line. But that alliance shattered after Trump’s $5 trillion tax and spending bill, which gutted EV subsidies and regulatory credits. Musk blasted the legislation as “insane,” then retaliated by announcing a third political party-the “America Party”-to challenge Trump’s allies in Congress.Trump hit back, calling Musk’s move “ridiculous,” while threatening Tesla’s government contracts and subsidies. Treasury secretary Scott Bessent warned Musk to “focus on business, not politics.” Investors echoed the concern, with Azoria Partners delaying a Tesla ETF over doubts about Musk’s divided attention.What they’re saying

- “You never want to bet against Elon Musk and the resilience of Tesla,” Michael Dunne, a former GM executive, told the WSJ. “But he knows there’s a shelf life for foreign companies in China. He’s probably closer to sunset than sunup there.”

- Bill Russo, CEO of Shanghai-based Automobility, put it more bluntly: “Musk made the classic mistake foreign automakers make-underestimating China’s ability to out-innovate.”

- Even inside Tesla, some fear that Musk’s refusal to localize more products or cede control is alienating crucial allies. “Tesla remains important to China,” said a China adviser to WSJ. “But for authorities, helping domestic companies still matters more.”

What’s nextAs per the WSJ report, many analysts expect Tesla’s future in China to remain rocky.

US companies often enjoy early success in China, only to be overtaken as domestic competitors gain scale and the state gradually shifts support toward homegrown firms.Motorola offers a cautionary tale: in the early 2000s, the company lost its foothold after Chinese rivals, backed by state policies, pushed it to share proprietary technology and comply with battery standards set by Huawei Technologies.Apple, once the top smartphone seller in China as recently as 2023, has since fallen to third place behind Huawei and another Chinese brand offering more features at lower prices.

Its decline has been made worse by official curbs on iPhone use among government employees and a wave of policies boosting local manufacturers, the WSJ report added.The bottom lineIn the US, Musk faces political headwinds from both parties. With Trump’s administration targeting Tesla’s revenue streams and Democrats disillusioned by Musk’s rhetoric, Tesla is without a natural political champion.Tesla’s dominance is no longer guaranteed-and Musk’s political star is dimming on both ends of the Pacific. Xi doesn’t need Musk anymore. Trump has turned on him. As Tesla bleeds market share and fumbles innovation, the company’s fate may depend less on technology and more on whether Musk can win back favor in two capitals that increasingly view him as a liability, not an asset.(With inputs from agencies)

.png)

.png)

.png)

3 hours ago

5

3 hours ago

5

English (US) ·

English (US) ·