ARTICLE AD BOX

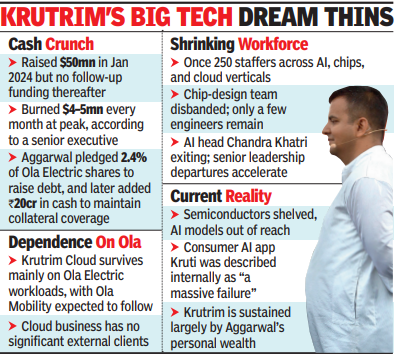

BENGALURU: What was once billed as India's challenger to global giants in artificial intelligence and semiconductors has quietly dwindled into a shadow of those ambitions. Krutrim, the AI venture founded by Ola's Bhavish Aggarwal, is now largely sustained by his personal wealth and loans tied to his Ola Electric stake, with most of its marquee projects abandoned.

"The money that was raised from Z47 (formerly Matrix Partners India) is long gone," said a senior executive familiar with the company's finances. "At its peak, Krutrim was burning through at least $4-5 million every month. None of it is backed by new investors anymore. It's Bhavish's own money that has been going out."

Launched in Dec 2023, Krutrim swiftly reached unicorn status with sweeping ambitions: design semiconductor chips, build an Indian cloud alternative, and develop AI models from scratch.

Aggarwal even acquired Bodhi, a startup founded by former Intel veterans, to turbocharge chip design. Insiders, however, said the simultaneous bets on compute, cloud, and chips proved unsustainable. The company never raised external capital after its $50 million round from Z47 in Jan 2024.

With no new funding, Aggarwal began leveraging his personal holdings in Ola Electric. According to a regulatory filing on Sept 10, he pledged 10.7 crore Ola Electric shares, about 2.4% of the company's equity, to raise debt for Krutrim.

This latest disclosure, as others in recent times, underlines the direct linkage between Aggarwal's Ola Electric stake and Krutrim's survival. As Ola Electric's share price fell, Aggarwal reportedly added Rs 20 crores ($2.3 million) in cash to maintain collateral coverage. Krutrim, however, pushed back. In a statement to TOI, a spokesperson said, "Krutrim remains well funded by the promoter and select investors as we execute on our AI strategy.

In line with our focus on efficient capital deployment, we are building a leaner, more agile team that aligns with our evolving business priorities. "The promoter has leveraged a fraction of his holdings to meet Krutrim's funding needs. Any attempt to link this to Ola Electric's share price is factually incorrect and a plain distortion." Krutrim had about 250 R&D staffers across chip design, AI research, and cloud engineering.

Today, most of that has unravelled.The chip team has been disbanded, with only a handful of engineers retained alongside Bodhi cofounder Sambit Sahu. AI head Chandra Khatri is set to leave this month, marking the exit of one of the last senior leaders. "A few months after Ola Electric's IPO, there was small trimming, about 40-50 layoffs," said another insider. "By the time Kruti launched, most of the trouble resurfaced.

Bhavish realised Krutrim doesn't have either the compute or the money to train AI models." The company's consumer AI app, Kruti, was deemed "a massive failure" internally. With chips shelved and AI models beyond reach, only the cloud division remains, and even that is propped up by Ola.

Ola Electric workloads have been migrated to Krutrim Cloud, with Ola Mobility expected to follow. "The cloud business has no significant external client," one person said.

"It's become more of an ego project than a company." Insiders described Aggarwal's commitment as relentless but increasingly personal. "Money is directly going out of his pocket because there is no investor money at this point," said a former senior member. "It's sad, given the opportunity in AI, that it has come to this." The unravelling of Krutrim is also linked to the rising demands of Ola Electric, which listed in late 2024 in one of India's most closely watched IPOs. The EV business has since consumed Aggarwal's focus. Today, outside of the 150-person cloud team that serves Ola, Krutrim is a shell of its original form with AI research hollowed out, and semiconductors abandoned. For Aggarwal, the gamble to build India's homegrown AI-and-chips giant has collapsed into a cautionary tale of spreading too thin.

.png)

.png)

.png)

2 hours ago

5

2 hours ago

5

English (US) ·

English (US) ·