ARTICLE AD BOX

Third, technical charts indicate a reversal after the recent decline, encouraging fresh buying interest.

23 Dec 2025, 10:00 AM IST i 23 Dec 2025, 10:00 AM IST 23 Dec 2025, 10:00 AM IST

Cholamandalam shares have fallen 43% in the last 12 months. Photo source: Envato)

Summary is AI Generated. Newsroom Reviewed

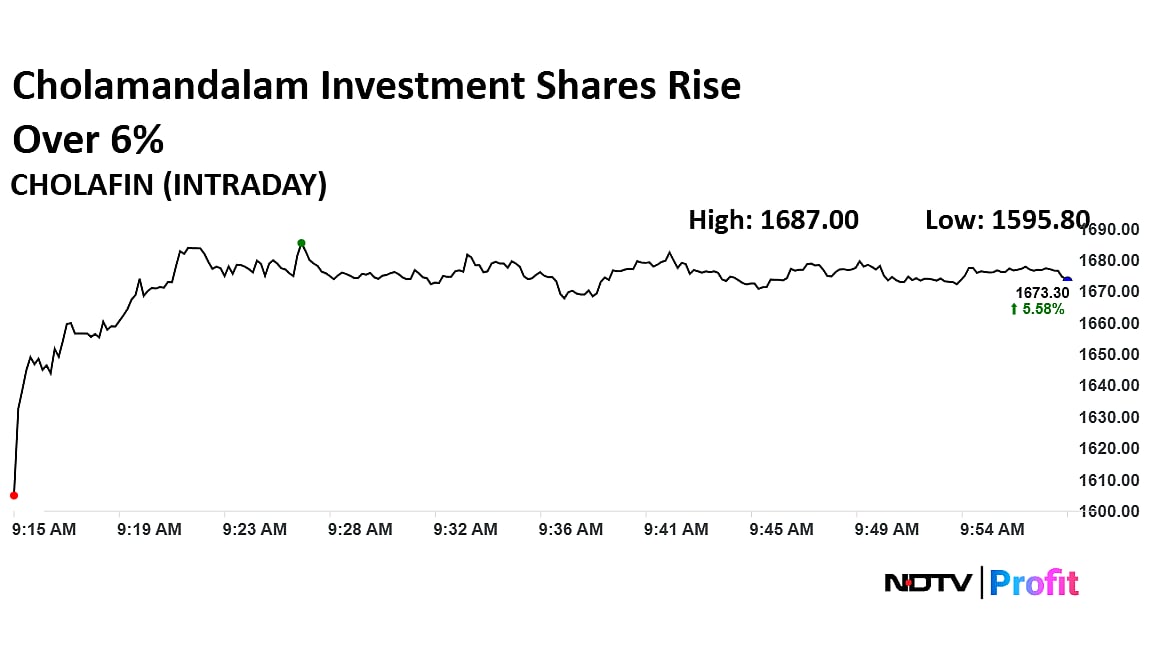

Cholamandalam Investment and Finance Company Ltd. (CIFCL) shares rose over 6% on Tuesday, snapping a two-day losing streak, as investors appeared to look past recent allegations and focused on fundamentals, technical signals and a supportive macro backdrop for non-banking financial companies (NBFCs).

The sharp rebound can be attributed to a combination of factors. First, brokerages and investors have largely viewed the recent IIFL–CobraPost allegations as frivolous or irrelevant at this stage, pending any formal response from the company or the Murugappa Group. A cursory reading of the claims has not materially altered the investment thesis for CIFCL, according to market watchers.

Second, short covering was seen after the market absorbed news related to Shriram Finance, which had earlier weighed on sentiment across the NBFC space. With immediate concerns easing, traders who had built short positions in Chola Investment appear to have rushed to cover, adding to the upward momentum.

Third, technical charts indicate a reversal after the recent decline, encouraging fresh buying interest.

This came against the backdrop of a strong macro environment for NBFCs, supported by stable asset quality trends, resilient credit demand and expectations of a benign interest rate environment. Investors also continue to take comfort from the Murugappa Group’s long-standing pedigree and governance track record, which remains a key pillar of confidence.

What CobraPost Has Alleged?

CobraPost has raised questions around related party transactions and cash movements involving Cholamandalam Investment & Finance Company. According to the allegations, transactions aggregating approximately Rs 10,262 crore were routed through Murugappa Group entities.

It also flagged cash deposits totalling around Rs 25,000 crore made across more than a dozen banks over the past six years, arguing that the routing of such transactions raises questions on monitoring, reporting and regulatory oversight in a listed financial institution handling public, institutional and borrowed capital.

Additionally, CobraPost highlighted transactions worth Rs 4,103 crore between CIFCL and Chola Business Services Ltd. (CBSL), a privately held company owned and controlled by Murugappa Group promoters. It claimed that CIFCL disclosed related party transactions of only around Rs 2,045 crore in its filings.

The report also pointed to professional fee payments of roughly Rs 642 crore to five Murugappa Group companies, as well as Rs 19 crore paid as salary and professional fees to 12 senior Murugappa family members.

Cholamandalam Investment Share Price Today

The scrip rose as much as 6.44% to Rs 1,687 apiece on Tuesday, the highest level since Dec. 19. It pared losses to trade 5.46% higher at Rs 1,671.40 apiece, as of 9:55 a.m. This compares to a 0.10% decline in the NSE Nifty 50 Index.

It has fallen 43% in the last 12 months. Total traded volume so far in the day stood at 1.84 times its 30-day average. The relative strength index was at 37.55.

Out of 42 analysts tracking the company, 20 maintain a 'buy' rating, 15 recommend a 'hold,' and seven suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target stands at Rs 1,746 indicating an upside of 4%.

Stock Market Live: Nifty Above 26,100, Sensex Down Nearly 100 Points; ICICI Bank, Bharti Airtel Lead Decline

2 hours ago

5

2 hours ago

5

English (US) ·

English (US) ·