ARTICLE AD BOX

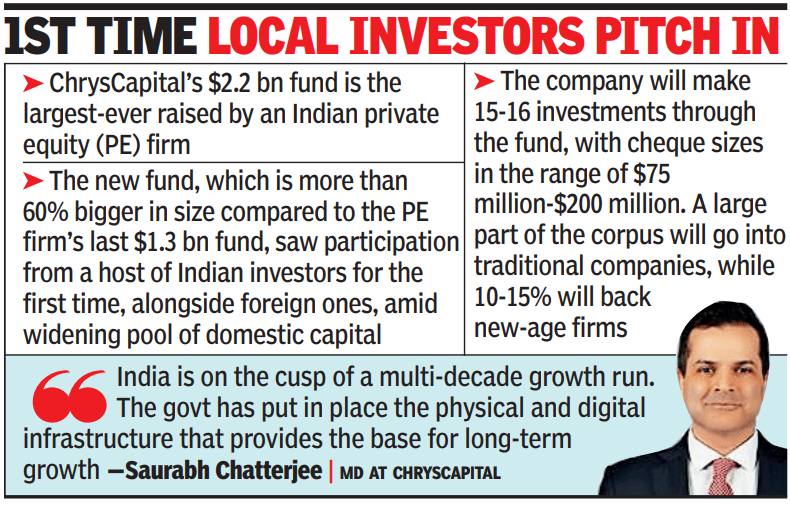

Mumbai: Homegrown private equity (PE) firm ChrysCapital has raised a $2.2 billion fund, the largest ever by a local PE investor to tap into growth opportunities in India even as global fundraising activity has been subdued amid an uncertain macro-environment.

The new fund which is more than 60% bigger in size compared to the company's last $1.3 billion fund closed in 2022 saw participation from a clutch of Indian investors for the first time in the firm's 26 years of operations in the country amid a widening pool of domestic capital. Investors from Japan, Middle East, Southeast Asia, Europe and the US backed the fund alongside a bunch of local insurance companies, financial institutions and large family offices.

"India is where China was two decades ago. We are on the cusp of a multi-decade growth run. The govt has put in place the physical and digital infrastructure that provides the base for long-term growth," Saurabh Chatterjee, MD at ChrysCapital told TOI.

The company has acquired majority stakes in Theobroma and Xoriant and made a slew of investments across a mix of traditional and new-age firms including Lenskart, Hero Fincorp and National Stock Exchange (NSE).

Unlike its venture capital peers, ChrysCapital does not want to rush into the AI race and place bets on disruptive technologies. The PE firm will stick to its strategy of investing in companies that have acquired significant scale, hold leading market share in the segments they operate, are profitable or close to profitability, and can chart out a clear exit strategy for their investors.

"We look at companies after they have gone through the disruptive, cash burn stage and have evolved as a market leader or are among the top two-three players.

That means we will not get a 50x return and that's fine. But we also don't lose money," said Chatterjee. A large part of the fund will go towards making investments in traditional companies while 10%-15% of the fund's corpus will be earmarked for backing new-age firms. ChrysCapital will make 15-16 investments through the fund (higher than its usual 11-13 investments trajectory given the fund size) with cheque sizes in the range of $75 million-$200 million.

One investment has already been closed and it is in the process of finalising a couple more.

The full fund will be deployed in 3-4 years and will largely be used to make new investments across healthcare, manufacturing, new economy, financial services and enterprise technology spaces, said Chatterjee, adding that the deal pipeline is strong. "The global geopolitical environment is tricky. The fact that we managed to raise this fund which is the largest PE fund ever raised in India by a good margin is a testament to the faith that our investors have shown in us," Chatterjee said. Global PE fundraising activity slowed to a decade-low at the end of Sept quarter with annual fundraising value set to be the lowest since 2018 at the current pace, KPMG said in a recent report.

2 hours ago

6

2 hours ago

6

English (US) ·

English (US) ·