ARTICLE AD BOX

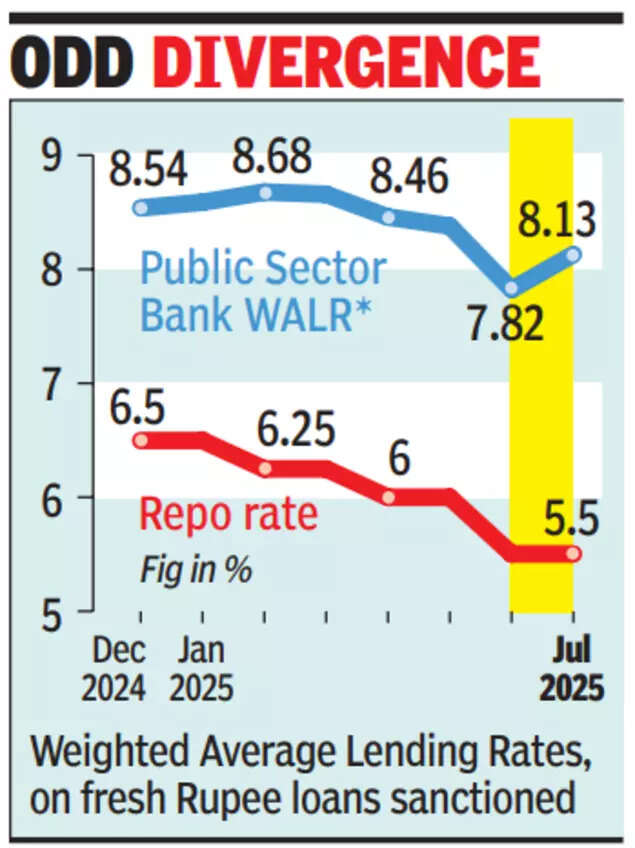

MUMBAI: Banks reported an increase in their weighted average lending rates in July despite a 50-basis point reduction in the repo rate in June. Bankers said this was likely triggered by a rise in the share of high-yielding loans to MSMEs, which typically pick up after the first quarter before the festive season.

According to RBI data, the weighted average lending rate (WALR) for new loans disbursed in July 2025 was 8.8%, 18 basis points higher than 8.62% in June. This was despite the RBI cutting its repo rate by 50 basis points in its June 2025 policy. The weighted average lending rate (WALR) on new loans is the average interest rate charged by banks on fresh loans in a given period, adjusted for the share of each loan category.Bank credit growth in double digits This contrarian behaviour of banks is unusual, considering that in the past their lending rates have moved in line with the repo rate.

For instance, in April 2025, when the RBI cut rates by 25 basis points, the WALR on new loans dipped by six basis points. In Feb 2025, when the rate cut cycle began, the RBI had reduced the repo rate by 25 basis points. In the subsequent month of March, the WALR dipped by six basis points.Earlier, during the rising interest rate cycle when the RBI embarked on a series of hikes in the wake of the Ukraine invasion and global supply disruptions, the WALR rose in the month following every rate hike.

Similarly, rates dipped in the post-Covid cycle.Interestingly banks managed to bring down their interest costs as reflected by the weighted average domestic term deposit rates on fresh deposits which dipped to 5.6% in July from 5.75% in June 2025. RBI data also shows that year-on-year bank credit growth is now firmly in double digits. As of Aug 8, bank credit grew 10.5% year on year.

.png)

.png)

.png)

2 hours ago

3

2 hours ago

3

English (US) ·

English (US) ·