ARTICLE AD BOX

MarketsEternal Share Price Rises For Fourth Day As Goldman Sachs Hikes Target Price — Know Why

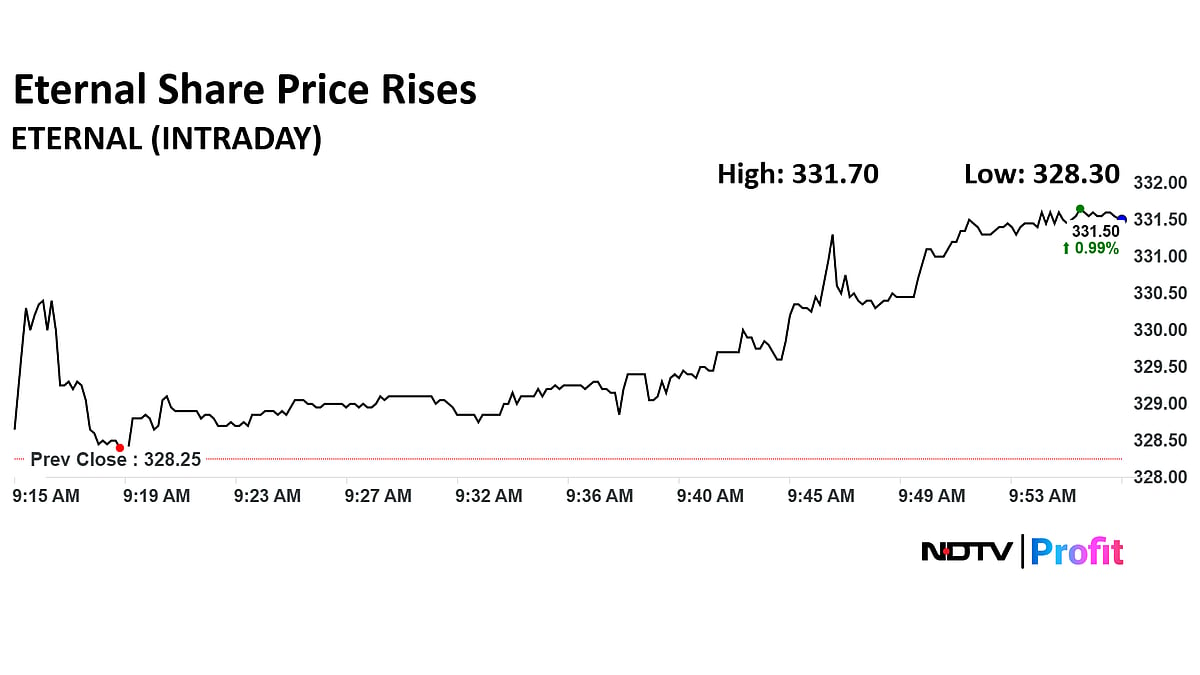

Eternal share price rose 0.99% to Rs 331.5 apiece. The stock has been rising for four sessions.

18 Sep 2025, 10:16 AM IST i 18 Sep 2025, 10:16 AM IST 18 Sep 2025, 10:16 AM IST

The brokerage reiterated a buy rating on the Eternal stock price. It has hiked the target price to Rs 360 from Rs 340 apiece. The current target price implied 6% upside from Wednesday's close price. (Photo source: NDTV Profit)

Summary is AI Generated. Newsroom Reviewed

Formerly known as Zomato, Eternal Ltd. share price extended rally for a fourth session as Goldman Sachs hiked the target price. The growth momentum in the company is accelerating along with improving margins.

The brokerage reiterated a buy rating on Eternal shares. It has hiked the target price to Rs 360 from Rs 340 apiece. The current target price implies 6% upside from Wednesday's close.

Growth momentum in Blinkit, Eternal's quick commerce arm, is strong. Goldman Sachs' estimates for November 2026 are 80% and 260% higher now compared to what the brokerage had expected 12 and 24 months ago.

Blinkit's market share will increase significantly as its store count will double in the next two or three years, Goldman Sachs said. Blinkit's margin will likely expand by 240 basis points over the next two quarters, and its Ebitda will break even by December 2025.

Blinkit's growth is not being fully reflected in Eternal's share price yet. Goldman Sachs believes that the quick commerce business will be a great catalyst for the Eternal shares.

Based on high-frequency data available, Goldman Sachs said that Eternal's year-on-year growth in both quick commerce and food delivery businesses will accelerate in November.

Track live updates on stock markets here.

Eternal Surpasses Titan, DMart in Market Cap; Now Bigger Than Wipro, Tata Motors

Eternal share price rose 0.99% to Rs 331.5 apiece. The stock has been rising for four sessions. Eternal share price was trading 0.93% higher at Rs 331 apiece as of 9:53 a.m. compared to 0.32% advance in the NSE Nifty 50 index.

The stock advanced 20.17% in 12 months, and 19.15% on year-to-date basis. Total traded volume on National Stock Exchange so far in the day stood at 13.4 times its 30-day average. The relative strength index was at 64.74.

Out of 33 analysts tracking the company, 29 maintain a 'buy' rating, and four suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies a downside of 1.4%.

Exciting Days Ahead For India's Consumption Story, Says Goldman Sachs

.png)

.png)

.png)

2 hours ago

3

2 hours ago

3

English (US) ·

English (US) ·