ARTICLE AD BOX

August diesel exports to Europe increased 73% from last month. (AI image)

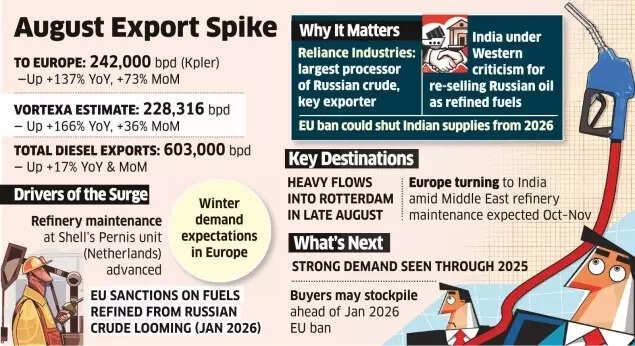

The European Union’s new restrictions on Russia’s crude oil have led to a massive surge in diesel shipments from India. India's diesel shipments to Europe jumped 137% year-on-year, reaching 242,000 barrels per day (bpd) in August, as customers prepared for the European Union's upcoming restrictions on fuels processed from Russian crude starting January 2026.

According to an ET report, the new rules could potentially restrict the market for Reliance Industries, India's primary processor of Russian oil and leading fuel exporter.Industry experts attributed this significant increase to several factors: an unexpected early maintenance schedule at a major refinery, anticipated winter requirements, and forthcoming EU regulations that might restrict Indian supplies.

They anticipate European demand for Indian diesel to maintain strong levels throughout 2025.Also Read | The 50% misfire: How Trump made Russian oil cheaper for India - And Putin a winner

India’s diesel exports to Europe surge

According to Kpler, a global data and analytics service, August diesel exports to Europe increased 73% from last month and surpassed the past year's monthly average by 124%.

August Export Spike

Vortexa, another energy shipment monitoring firm, reported Indian diesel exports to Europe in August at 228,316 bpd, showing a 166% increase year-on-year and 36% growth from July.

Different shipping data monitors often provide varying export figures.The surge in late August shipments, particularly to Rotterdam, seems to be compensating for the shortfall caused by unexpected refinery maintenance, Sumit Ritolia, lead research analyst, refining and modelling at Kpler was quoted as saying by ET. "Exports rose sharply as Shell's Pernis (Netherlands) refinery advanced its planned turnaround from 2026.

This has surprised the market," he said.One industry expert suggested that the early maintenance schedule could be a strategic move anticipating the post-January situation, when European markets may cease accepting Indian petroleum products refined from Russian crude.Also Read | 'One-sided' trade myth: Why Donald Trump is wrong - How US profits big from IndiaUS officials have strongly criticised India, alleging that its refineries are generating excessive profits by purchasing Russian crude at discounted rates and selling the processed products to Western nations, thus indirectly supporting Moscow's military operations.India has dismissed these allegations, stating that Western nations have the option to stop purchasing Indian fuel products if they have concerns.India's exporters anticipate robust demand from Europe throughout this year. "European buyers may accelerate liftings from India given that Middle Eastern refineries will be having a high maintenance in October-November, echoing the stockpiling seen ahead of the February 2023 EU ban on Russian products," Ritola said.Europe relies heavily on Middle Eastern refineries as crucial suppliers.India's diesel exports witnessed a significant increase, reaching 603,000 bpd in August, showing an approximate 17% rise compared to both July and the previous year's figures, as reported by Kpler, primarily due to increased European shipments.The EU's July sanctions announcement stipulated that importers must present proof of crude origin used in refined products from third countries. However, the practical implementation of these import restrictions remains unclear.Also Read | Reality check for Trump! Why blame India for Russian crude trade? US, EU trade with Russia runs in billions

.png)

.png)

.png)

2 days ago

7

2 days ago

7

English (US) ·

English (US) ·