ARTICLE AD BOX

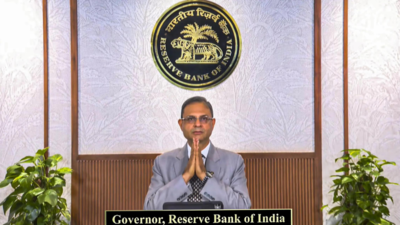

RBI Governor Sanjay Malhotra (PTI)

Small-ticket gold loans up to Rs 2.5 lakh will not require credit appraisal, Reserve Bank of India Governor Sanjay Malhotra clarified on Thursday, adding that final guidelines on the issue would be released within days.Addressing a press conference after the Monetary Policy Committee (MPC) meeting, Malhotra said the draft regulations had merely consolidated existing norms and were aimed at ensuring uniform compliance across lending institutions.“There was nothing new in this (draft) that we have released. We have consolidated and reiterated our old rules,” he said. “Because it was seen that some regulated entities were not following them...

whatever the final regulation is, we will release it if not today, then by Monday.”According to ANI, the statement comes amid heightened concern that the proposed RBI framework might inadvertently disrupt access to small gold loans, which are often used by lower-income borrowers to meet urgent needs.Last month, the Finance Ministry had urged the central bank to ensure that new rules on lending against gold do not adversely affect small-ticket borrowers.

In a post on social media platform X, the ministry stated that the Draft Directions on Lending Against Gold Collateral had been reviewed by the Department of Financial Services (DFS) under the guidance of Union Finance Minister Nirmala Sitharaman.The DFS subsequently submitted its suggestions to the RBI, recommending that rules be tailored to safeguard easy access for small borrowers. It also proposed exempting loans below Rs 2 lakh from new procedural requirements and suggested implementing the changes from January 1, 2026, to allow sufficient time for readiness at the operational level.“These borrowers often depend on small-ticket loans to meet urgent personal or business needs,” the ministry noted, while emphasizing the importance of smooth and timely disbursal of such credit.The central bank’s draft regulations are intended to harmonise rules on gold-backed lending across banks, NBFCs, and cooperative banks. Stakeholder feedback on the draft is currently being evaluated, with the RBI expected to finalise and notify the guidelines shortly.The Finance Ministry said it hopes the RBI will carefully weigh stakeholder input and public suggestions before issuing the final directive.

.png)

.png)

.png)

12 hours ago

3

12 hours ago

3

English (US) ·

English (US) ·