ARTICLE AD BOX

Sanjay Kumar Agarwal, chairman of the Central Board of Indirect Taxes and Customs (CBIC) explains the overall message of massive GST reforms undertaken by govt. In an interview to TOI, Agarwal says that companies must ensure that benefit of rate reduction is fully passed onto consumers.

Excerpts:What is the overall message behind this GST reforms?This transformational reform could take place because this exercise has been done from the heart. The only thing which was kept in mind was that it should lead to removal of litigation, a simplified GST and that the items used by the common man are subjected to lower tax so that they make savings. We have tried to take care of all segments - mass consumption, mass employment and also ensure certainty and stability to the businesses.

How do you see the implementation of rate cuts and will companies pass on the full benefit to consumers?The companies have to immediately take steps to update their systems so that the new rates are reflected. From Sept 22 the new rates should be picked up by their systems for generating invoices. Secondly, they have to ensure that rate cut benefits are passed on to consumers and they should not hold back any benefit s accrued due to this rate cut, with themselves.

The department is closely monitoring price trends pre-cut and post-cut so that in case any kind of intervention is required, we will be ready to take that to ensure that benefits are ultimately passed on to consumers.

But, we are otherwise confident that industries on their own will pass on the benefits. These kinds of assurances are being given by various chambers to us.

What kind of interventions are possible for sectors which are non-compliant or companies which are not? For any sector which is not compliant, we will take the matter up with the industry body in that sector and point out that we are receiving these complaints against that particular industry and they may look into it.

When they are making representation to us, it becomes their duty to look into it if any concern is flagged by the revenue department. This simplification of GST which has been done to bring only two rates will remove any kind of uncertainty about their liabilities, and they will now be certain that this is the rate which applies to them.

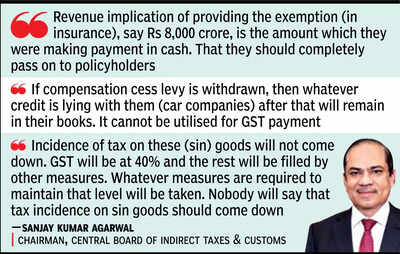

Some sectors like insurance have expressed apprehensions about passing on the full benefits because of ITC being withdrawn... If a policy is exempt, then input tax credit will not be available on inputs and input services, so that cost will get embedded, and to that extent they are right. But the revenue implication of providing the exemption, say Rs 8,000 crore, is the amount with which they were making payment in cash. They should completely pass that on to the policyholders. We understand the input tax credit part, but the relief which they are getting by way of revenue implication - is a huge amount - should be completely passed on to the policyholders.One of the other concerns is with car dealers because of cess and GST now. Your views... Compensation cess which has been paid, say on a car when it was cleared from the factory, can be utilised only for paying compensation cess. It cannot be utilised for payment of GST. If the compensation cess levy is withdrawn, then whatever credit is lying with them after that will remain in their books, and can't be utilised for GST payment.There is some lack of clarity on whether there is still scope for some levy beyond the 40% for certain sin goods like tobacco products?On cigarettes, pan masala, chewing tobacco, and other tobacco products - the current duty structure is continuing till the compensation cess collection is enough to make loan repayments. That may be till Dec. After that, the incidence of tax on these goods will not come down. GST will be at 40% and the rest will be filled by other measures. Whatever measures are required to maintain that level will be taken. Nobody will say that tax incidence on sin goods should come down.

.png)

.png)

.png)

5 days ago

8

5 days ago

8

English (US) ·

English (US) ·