ARTICLE AD BOX

Indian mutual fund assets surged past Rs 80 lakh crore in November, fueled by robust equity and hybrid scheme inflows. Despite outflows from debt funds, particularly overnight and liquid categories, investor confidence remains strong. SIP contributions continue to grow, highlighting a commitment to long-term, disciplined investing, now accounting for over a fifth of total assets.

MUMBAI: For the first time ever, the total assets under management crossed the Rs 80-lakh-crore mark in Nov, aided by strong inflows into equity, hybrid and index schemes. Debt schemes on the other hand showed strong outflows, but industry players said there was substantial churn in this segment of the fund industry.

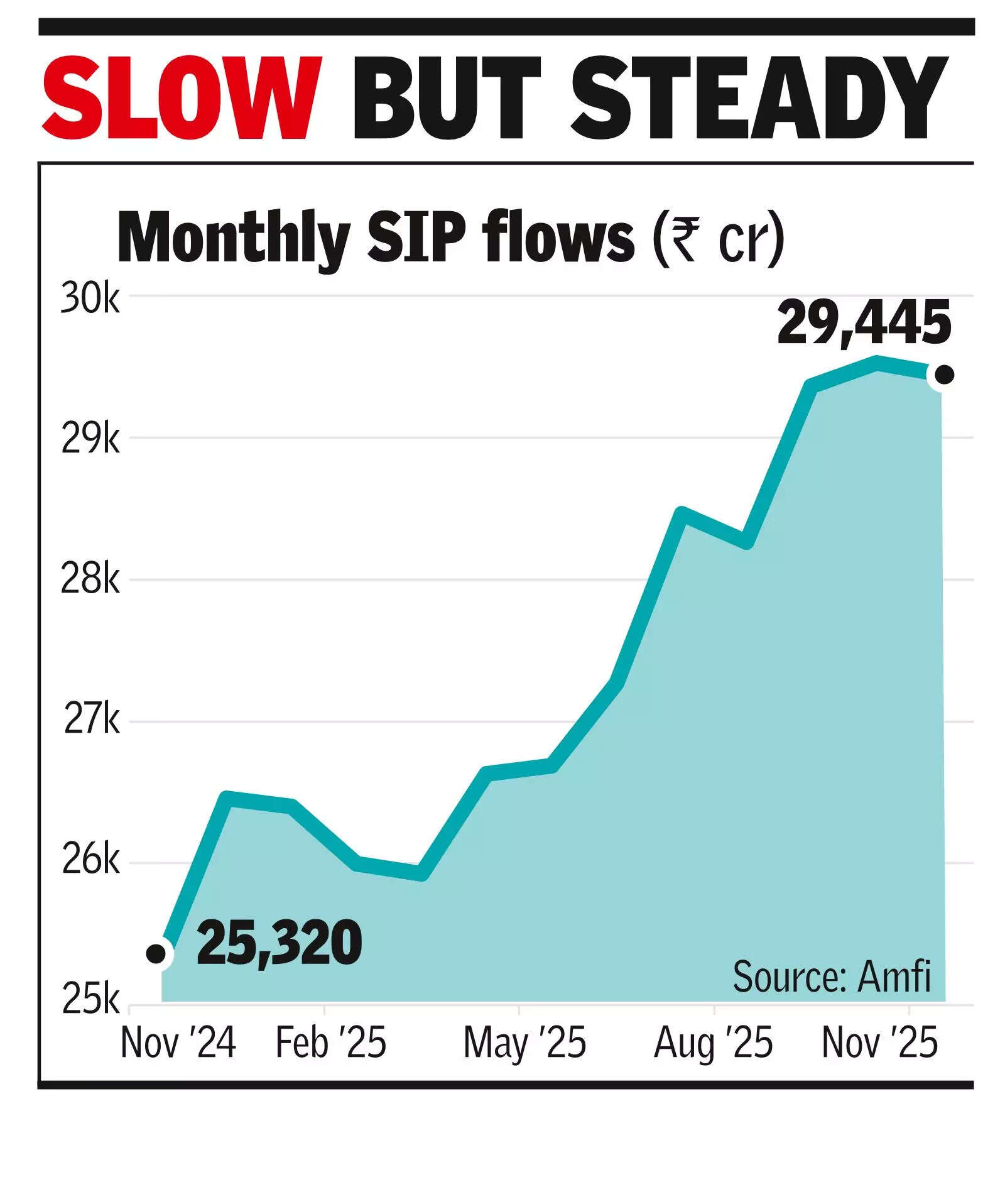

According to data released by fund industry body Amfi, gross inflows through the SIP for the month showed a marginal drop, to Rs 29,445 crore from Rs 29,529 crore in Oct. Industry players, however, said that since a large chunk of SIP flows come in the last week of the month, in Nov the last two days were in the weekend, hence the inflows were hit marginally.The fund industry's total assets were at Rs 80.8 lakh crore at end-Nov, up from Rs 79.9 lakh crore as of end-Oct.

This reflected steady investor confidence in the fund industry, Amfi chief said Venkat Chalasani. Also total assets that came through the SIP route over the years rose to Rs 16.5 lakh crore, now contributing over a fifth of the industry's total AUM. This indicated that investors remain committed to disciplined, long-term investing, Chalasani said.

Amfi data also showed that there was a net outflow of nearly Rs 25,700 crore from fixed income schemes.

According to Umesh Sharma, CIO (debt), The Wealth Company MF, internals showed that within the debt funds, there was some rotation of funds away from the very short end and toward slightly longer carry-oriented categories. "The headline outflow is driven almost entirely by overnight and liquid funds," Sharma said.

1 week ago

8

1 week ago

8

English (US) ·

English (US) ·