ARTICLE AD BOX

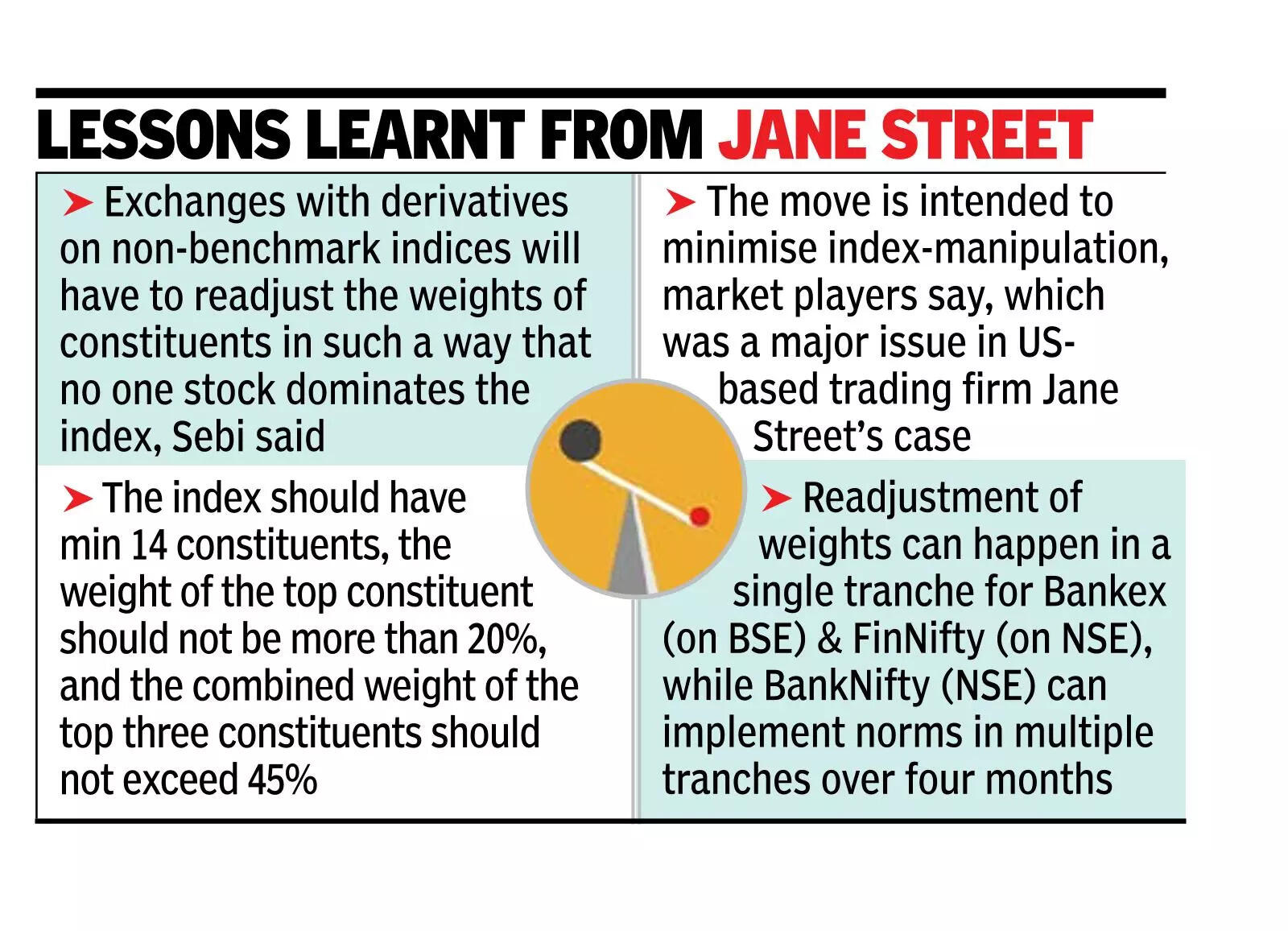

MUMBAI: Markets regulator Sebi on Thursday said that exchanges that have derivative products on non-benchmark indices will have to readjust the weights of their constituents in such a way that no one stock dominates the index.

As of now there are derivative products on BankNifty, Bankex and FinNifty.In addition to the existing rules for constructing indices, stock exchanges shall follow some additional norms for non-benchmark indices on which derivative (futures & options) products are traded, a Sebi circular said. These norms would have to be followed for launching new derivative products on any other non-benchmark indices in future.Among others, these norms specify that the index should have a minimum of 14 constituents, the weight of the top constituent should not be more than 20%, and the combined weight of the top three constituents should not exceed 45%.Some of the non-benchmark indices include Bankex, Bank Nifty, FinNifty etc. In India, the main benchmark indices are Nifty and sensex.

Readjust An Index To Ensure No One Stock Dominates It: Sebi

Market players said the regulatory intent here is to have indices with less scope for manipulation and also derivative products based on those.

In the Jane Street case, a Sebi analysis had shown how the US-based trading giant had allegedly manipulated the stock prices of some of the index constituents to simultaneously trade in the derivatives products based on those indices in a way that brought in massive profits."The composition of the index will be such that those are not going to be manipulated, with a cap on the weight of each component...this (index manipulation) was a major issue cited in Sebi's Jane Street order," said a market veteran.Sebi in its circular said that the exchanges could adjust the weights of at least two indices-Bankex (on BSE) and FinNifty (on NSE)-in a single tranche. However, for BankNifty, Sebi has given a glide path for making the necessary changes over a four-month period. The glide path has been provided "to ensure orderly rebalancing of assets under management (AUM) tracking the index. Sebi said that the new constituents would be added in tranche 1. "The top three constituents will have a target weight at the end of tranche 4. In each adjustment, the weight of top 3 constituents would be checked and if the weights are beyond the prudential norms, the excess would be targeted for reduction equally over the remaining tranches."The effective dates for implementation of eligibility criteria for derivatives on non-benchmark indices have been extended up to March 31, 2026 for BankNifty and up to December 31, 2025 for Bankex and FinNifty.

4 hours ago

3

4 hours ago

3

English (US) ·

English (US) ·