ARTICLE AD BOX

MUMBAI: Paving the way for banks to fund mergers and acquisitions (M&A) in India, Reserve Bank of India (RBI) has issued draft guidelines that tighten the parameters of acquisition finance while aiming to safeguard financial stability.

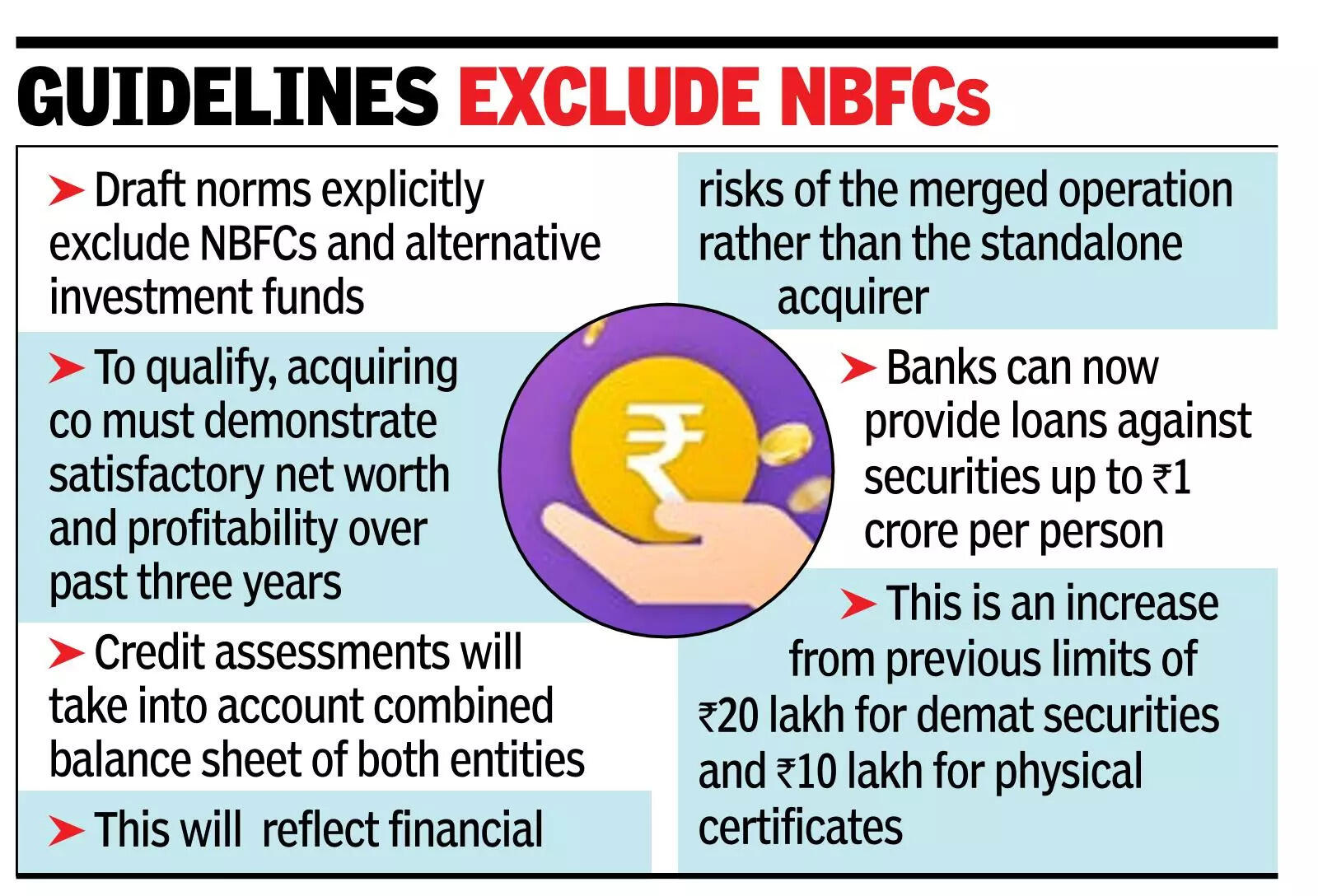

Under the proposed framework, banks would be permitted to lend only to listed acquiring companies or their step-down special purpose vehicles (SPVs), explicitly excluding non-banking financial companies (NBFCs) and alternative investment funds. This marks a significant step in formalising acquisition lending, which has previously operated under looser norms.

Issues Draft Norms, Banks Permitted To Lend To Listed Acquiring Cos, Their SPVs

To qualify, the acquiring company must demonstrate a satisfactory net worth and a track record of profitability over the past three years.

The target company, in turn, must provide three years of financial statements, and neither the acquirer nor the target can be related parties under the Companies Act, 2013. Importantly, credit assessments must take into account the combined balance sheet of both entities, reflecting the financial risks of the merged operation rather than the standalone acquirer.The draft guidelines consolidate and clarify existing regulations on capital market exposure (CME).

Banks can now provide loans against securities up to Rs 1 crore per person, a substantial increase from the previous limits of Rs. 20 lakh for dematerialised securities and Rs 10 lakh for physical certificates. Secondary market acquisitions carry a sub-limit of Rs 25 lakh, while financing for initial public offerings, follow-on offers, or employee stock option plans is capped similarly.

Loans must maintain a maximum loan-to-value (LTV) ratio of 75%, with borrowers contributing at least 25% in cash.

For individuals, loans against listed shares or convertible debt securities have an LTV ceiling of 60%, whereas commercial market intermediaries face a steeper 40% haircut, formalising a differentiation that did not exist under earlier norms.The guidelines impose strict prudential limits on banks' overall exposure. Total CME cannot exceed 40% of a bank's Tier 1 capital, while direct CME-covering both investment exposures and acquisition finance-is capped at 20%.

Within this, acquisition finance is limited to 10% of Tier 1 capital, and banks may finance up to 70% of an acquisition's value, with the remainder contributed by the acquirer. Eligible targets must be listed entities with a strong net worth and three years of profitability, and post-acquisition debt-to-equity ratios must not exceed 3:1.Certain exposures are excluded from CME calculations, including investments in a bank's own subsidiaries, Tier I or II debt of other banks, and loans against non-convertible debentures or debt mutual fund units. Collateral for loans against listed shares or units is valued at the lower of the six-month average closing price or the previous trading day's closing price. Shares of the target company must serve as primary security, supplemented by collateral from the acquirer or target assets as appropriate.To ensure ongoing prudence, banks are required to implement robust monitoring frameworks, including early warning mechanisms and stress tests.

2 hours ago

4

2 hours ago

4

English (US) ·

English (US) ·