ARTICLE AD BOX

Receiving a festive bonus is exciting and if you wish to invest it for maximum returns, here are some smart financial choices.

27 Aug 2025, 09:02 AM IST i 27 Aug 2025, 09:02 AM IST 27 Aug 2025, 09:02 AM IST

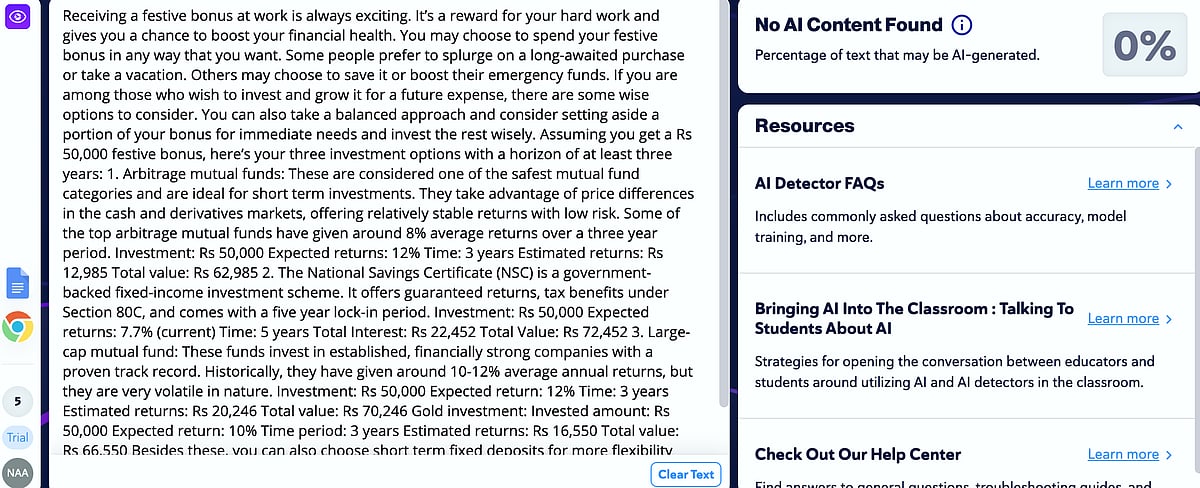

Diversifying your investments could help to minimise risks. (Photo Source: Freepik)

Summary is AI Generated. Newsroom Reviewed

Receiving a festive bonus at work is always exciting. It’s a reward for your hard work and gives you a chance to boost your financial health. It’s quite common for employees to spend their festive bonus on shopping and other lifestyle needs. Many people prefer to splurge on a long-awaited purchase or take a vacation.

However, investing the entire amount of the festive bonus could help in strengthening your financial position or boosting your emergency funds. You can also take a balanced approach and consider setting aside a portion of your bonus for immediate needs and investing the rest wisely.

Assuming you get Rs 50,000 as a festive bonus, here are your potential investment options with a medium-term horizon:

How This Couple In Their 30s Cleared Rs 1.2-Crore Debt And Built Rs 5-Crore Net Worth

1. Arbitrage mutual funds: These are considered one of the safest mutual fund categories and are ideal for short-term investments. They take advantage of price differences in the cash and derivatives markets, offering relatively stable returns with low risk.

Some of the top arbitrage mutual funds have given average returns of around 8% over a three-year period.

Investment: Rs 50,000

Expected returns: 8%

Time: 3 years

Estimated returns: Rs 12,985

Total value: Rs 62,985

2. The National Savings Certificate (NSC) is a government-backed fixed-income investment scheme. It offers guaranteed returns, tax benefits under Section 80C, and comes with a five-year lock-in period.

Investment: Rs 50,000

Expected returns: 7.7% (current interest rate)

Time: 5 years

Total Interest: Rs 22,951

Total Value: Rs 72,951.63

3. Large-cap mutual fund: These funds invest in established, financially strong companies with a proven track record. Historically, they have given an average annualised return of around 10-12%, but they are very volatile in nature.

Investment: Rs 50,000

Expected return: 12%

Time: 3 years

Estimated returns: Rs 20,246

Total value: Rs 70,246

4. Gold investment

Invested amount: Rs 50,000

Expected return: 10%

Time period: 3 years

Estimated returns: Rs 16,550

Total value: Rs 66,550

Besides these, you can also choose short-term fixed deposits for more flexibility. For best returns, you may consider diversifying your bonus in two or more assets to reduce risk, while continuing to benefit from the power of compounding.

India's Economy To Weather US Tariffs, Says Natixis' Trinh Nguyen

.png)

.png)

.png)

1 week ago

4

1 week ago

4

English (US) ·

English (US) ·