ARTICLE AD BOX

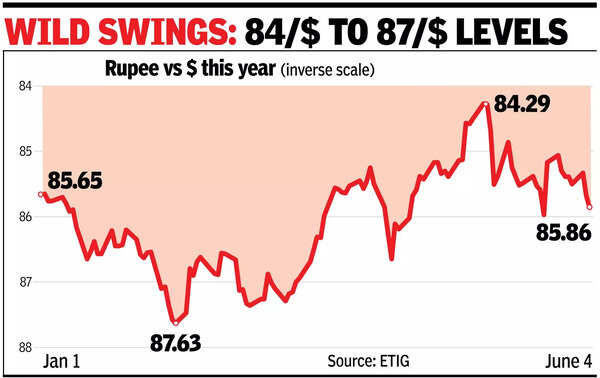

MUMBAI: An imminent trade deal with the US is seen as a positive catalyst for the rupee, which is expected to strengthen to 84 levels by the end of 2025, according to Bank of America. Other positives include soft oil prices, a benign current account deficit, and RBI's growth focus.In an interview with TOI, Adarsh Sinha, co-head of Asia forex & rates strategist at BofA, said the rupee would gain vis-a-vis the greenback partly because of the weaker dollar environment, but it will not appreciate as much as some of the G10 currencies and perhaps some emerging market currencies.

"Generally, we're more constructive on the macro outlook for India... especially if you get this bilateral trade deal done with the US and now you have policy aligned as well.

So not just the central bank cutting rates but govt supporting growth as well," said Sinha.Sinha sees capital flows continuing into India despite rising US interest rates. "FDI is a longer-term story... I wouldn't say it's going to be a near-term swing factor," he said. He added that while foreign debt inflows increased over time, equity flows still dominate. On the dollar, Sinha said he is bearish. "A lot of investors, both in Europe as well as in Asia...

were very long US assets, but they didn't hedge their forex risk or they maintained very low hedge ratios.

.. If we start to see the real money community... hedge their US asset exposure more aggressively, then I think that's the next leg lower in the US dollar."Sinha does not see any rush toward de-dollarisation, although central banks have been diversifying their foreign assets for some time. "Yes, central banks might be moving away from the US dollar, they're probably buying gold, but it's happening at such a gradual pace that it doesn't really affect the short-term dynamics of the dollar.""When you talk about de-dollarisation in terms of the global role of the US dollar, I don't see signs of that changing in a quick way... at least over the next five years, if not a bit longer, the dollar will be the dominant global currency," said Sinha. For him, the real sign of de-dollarisation would be a meaningful decrease in the share of the US dollar in global trade invoicing and payments.

.png)

.png)

.png)

1 day ago

4

1 day ago

4

English (US) ·

English (US) ·